-

The Fed appears to have looked at Bitcoin as a means for real-time payments in the banking system but shelved the concept for now.

January 26 -

Earlier opposition to the idea appears to have eased in the wake of a new proposal that would use interbank fees to cover the cost of technological upgrades.

December 10 -

The payments company and big-bank trade group plans to create a ubiquitous, real-time payment system over the coming years, supplementing the push for same-day settlement of ACH transactions.

October 22 -

The central bank is making clear it has doubts about the private sector's ability to implement a faster electronic payments system on its own.

November 15

The Federal Reserve System on Monday threw its weight behind a host of standards, goals and timelines that are likely to shape the quest to build a faster U.S. payment system.

The new details many of which are arcane, but also critically important were contained in a

The report has been eagerly anticipated by payment industry insiders. It comes at a time when the country has fallen far behind many nations that have adopted real-time systems.

"High-speed data networks are becoming ubiquitous, computing devices are becoming more sophisticated and mobile, and information is increasingly processed in real time," the Fed's report states. "These capabilities are changing the nature of commerce and end-user expectations for payment services."

Over the last few years, the Fed has been trying to walk a tightrope with respect to payment system improvements. Fed officials want to kindle a centralized effort, but they are also wary about being seen as overstepping their authority to bring change in the private sector.

During a conference call with reporters Monday, Fed staffers said that they see the new report as representing an increase in the central bank's role as a leader or catalyst for change. But at the same time they said that the Fed will not step in and build its own new payment service unless the private sector cannot meet the need and certain other criteria are met.

Fed officials pushed back against the notion that there's a lack of urgency in the U.S. payment industry about developing a faster system. They noted that The Clearing House, a group that is owned by many of the nation's largest banks, laid out its own vision for building a faster payment system late last year.

The same officials also said that inside the Fed system, there is a strong sense of urgency on the issue of payment speed. The Fed plans early this year to establish a task force on faster payments, which will get input from stakeholders. By 2016 the group is supposed to identify one or more approaches for implementation.

The Fed's new paper did not lay out a timeline for completing the upgraded system, but an earlier Fed report called for the changes to be finished by 2023.

The Fed's decision to defer to the private sector, at least for now, may not sit well with many community bankers, who worry about being left behind if a faster payments system is built and controlled by the nation's largest banks.

"We would like to see the Fed focus not only on the making of maps, but the building of roads," said Cary Whaley, vice president of payments and technology policy for the Independent Community Bankers of America.

"While we commend them for organizing lots of work groups, the question of ubiquity will be theirs to solve," Whaley said, referring to the goal of ensuring that a faster payment system links every U.S. bank. "That role has traditionally been served by the Federal Reserve."

Meanwhile, the Clearing House released a statement suggesting that the Fed's report is compatible with its own announcement about plans for a faster system.

"The Federal Reserve has played a leading role in promoting the need for payment systems improvement, and we are committed to continue to work with them and others in the industry on this effort," Steve Ledford, senior vice president for product and strategy at the Clearing House, said in the statement. "Our plans announced late last year to build a ubiquitous, national, feature-rich, secure real-time payment service will help fulfill the Fed's objectives as stated in the paper."

Four Possible Routes

The Fed's report, which also discusses payment security, lays out four different options for building a faster payment system. Each of them will be studied further.

One option involves evolving the existing PIN debit infrastructure, which is currently used in retail stores and at automated teller machines, to enable real-time payments.

A second option involves using common protocols and standards to facilitate the clearing of transactions over the Internet. The Fed's report does not say this, but the

A third choice is to create a new payments infrastructure that would build on existing technology and only have certain targeted uses. The sender and recipient would receive messages confirming the transaction in close to real time, but the transactions might not actually be settled until hours later.

The final option is building a new payments infrastructure that would process a wider range of transactions, eventually eliminating the need for checks, wire transfers and automated clearinghouse transactions.

Rejected and Unsettled

The Fed rejected other possibilities, including the idea of building a real-time payment system on top of the existing infrastructures for checks, wire transfers or ACH transactions.

Janet Estep, the president of Nacha, the bank-industry group that sets the rules for ACH transactions, said that she sees the Fed's vision as "complementary" to the ACH network. Nacha is planning a vote later this year on a proposal to move from next-day transactions to same-day ones, and the Fed's report expressed support for that idea.

"I truly don't see it as an either/or," Estep said, referring to the two organizations' visions.

Also rejected by the Fed was the idea of using digital currency, such as Bitcoin, to build a near real-time payment system. Indeed, digital currencies are notable for their near-absence from the Fed's paper. The word "Bitcoin" never appears in the report.

Fed officials said they plan to monitor developments with digital currencies, and that later, as those technologies emerge, they will possibly have a different strategy.

One key issue in the design of any payment system is whether it will enable senders to "push" money to recipients, or allow recipients to "pull" money from the accounts of the senders, or both. The Fed's paper did not explicitly endorse either approach, but it does seem to favor the "push" approach, noting that "pull" transactions expand possibilities for fraud.

The Fed also threw its support behind U.S. adoption of a global payment standard known as ISO 20022, which is seen as offering increased flexibility, and called for the development of technologies and rules that foster greater interoperability between payment systems.

Elizabeth McQuerry, a payments consultant, said in an email that those two details "may still sound geeky to many people, but both are foundational to changing how things work today."

New Settlement Schedule

Also in the report, the Fed vowed to phase in upgrades to its settlement services, which currently open at 8 a.m. and close at 5 p.m. Eastern time Monday-Friday. By the end of this year, the opening time would be 9 p.m. Eastern time on the previous day, and the closing time would be pushed back to 5:30 p.m.

By 2016 or later, the Fed committed to considering, but not necessarily implementing, a 24-hour, seven-day-per-week schedule.

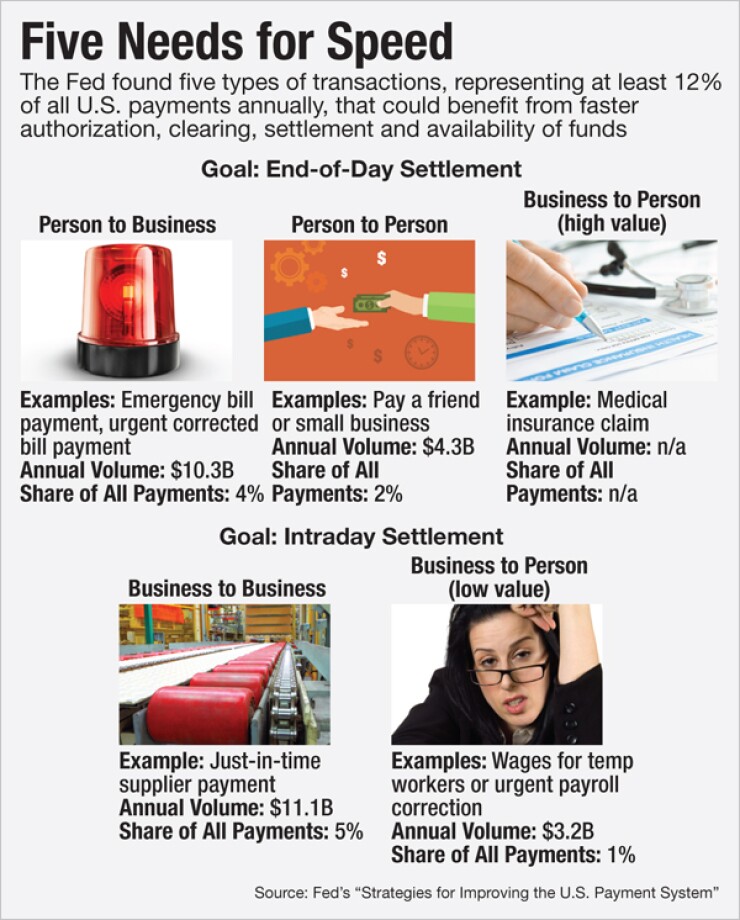

The report lays out five specific types of payments that the Fed believes could benefit from a real-time, or near-real-time, clearing system.

The first example is person-to-person payments, which might be used by friends who want to split their restaurant tab. Another application is urgent person-to-business payments, such as a consumer's last-minute bill payment to the utility company.

The third use involves certain business-to-person payments, such as a paycheck to an employee who failed to fill out his time sheet. Next are payments involving higher-value payments from business to people, such as the proceeds of a legal settlement.

Finally, there are certain business-to-business payments, including payments for the just-in-time delivery of supplies.

Combined, those five payment types comprise only about 12 percent of the total U.S. payments volume, according to the Fed. As of 2012, payments involving debit cards, credit cards and prepaid cards made up 66% of all non-cash payments in the U.S., according to

A Fed staffer said Monday that retail point-of-sale transactions are already well served by existing payment systems, including the debit-card network, so they would benefit less from a new real-time system.

Payment industry watchers who were rapidly digesting the Fed's report on Monday offered some preliminary thoughts.

What to Watch For

Ben Milne, chief executive officer of the payments firm Dwolla, said that the composition of the Fed's task force will be important in terms of what happens next.

"They're saying real-time is coming, and if you don't make it happen, we'll make it happen," Milne said, referring to the Fed. "But they're taking a measured approach without throwing down the gauntlet."

"This is a hands-off approach that's empowering the market to make the solution," he added. "The question is how to handle that; you run the risk of fragmentation."

Peter Gordon, a payments executive at the bank technology vendor FIS, said that the next big question is who's going to pay for upgrades. Questions about the economics of a modernized ACH network were a key sticking point in a failed upgrade effort from 2012.

"What is the business model for these payments systems?" Gordon asked. "What's the fee structure? Who's going to pay what to who?"

Stephen Kenneally, vice president of payments and cybersecurity at the American Bankers Association, noted that the Fed must now figure out how to prompt the private sector into taking cohesive action.

"The challenge the Fed has is they have no absolute authority to mandate these decisions into practice, so they have to shepherd all of the different sheep in the payments world to get them to come to an agreement," he said. "That's a challenge, especially if you want them to come to agreement quickly."

"The Fed is using its bully pulpit to be the convener-in-chief of meetings. Which is essential. But it's going to be hard to get from those meetings to action."