One of the flames that ignited the Great Recession may be weakening.

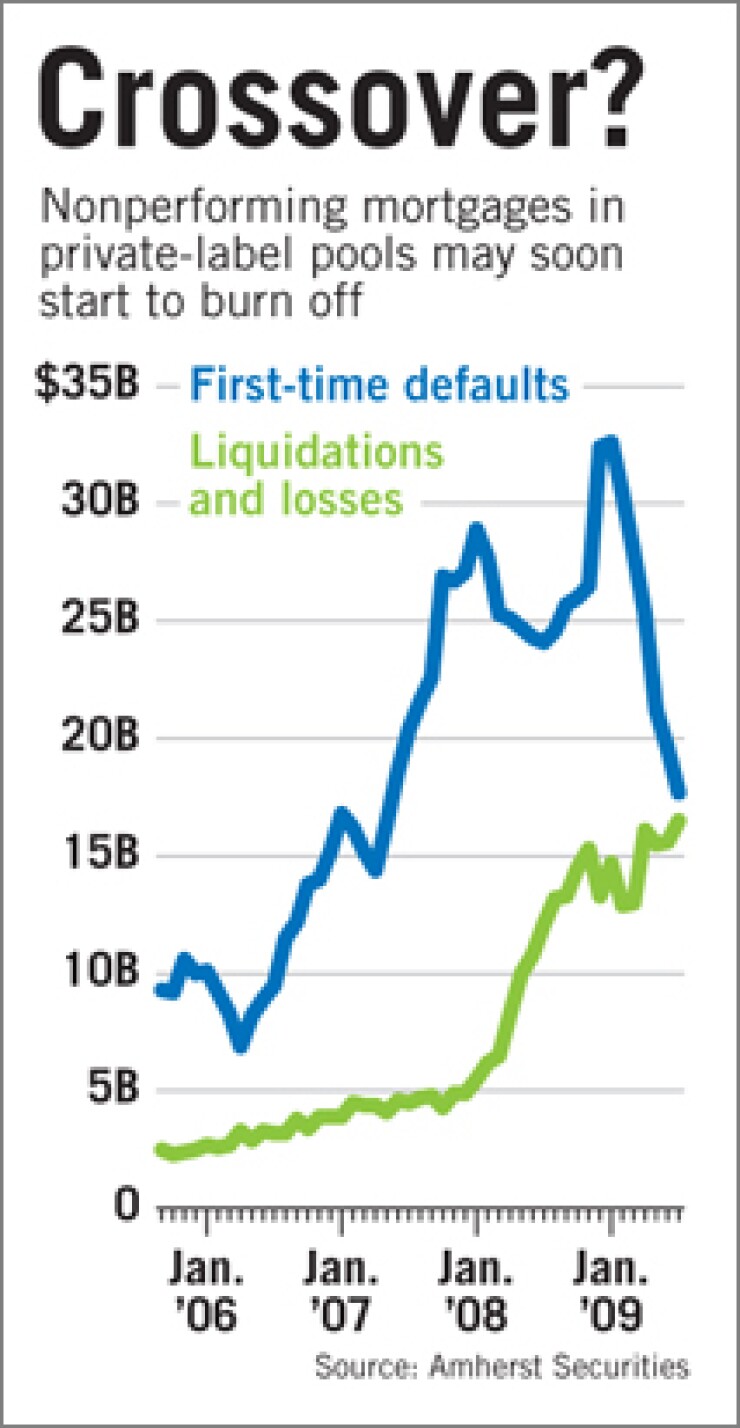

Last month, the volume of private-label securitized mortgages that were liquidated through foreclosure was nearly as high as the amount that defaulted for the first time, according to Amherst Securities Group LP. The pace of first-time defaults in this sector has been falling since January, Amherst's data showed. If the trend persists, liquidations could soon be outpacing new defaults.

Private-label mortgage securities — defined as those without government guarantees — are among the original "toxic" assets. They are stuffed with subprime, alternative-A and other nontraditional mortgages that helped start the global financial crisis more than two years ago. Reducing the stock of nonperformers in these pools would ease the strains on the housing market and economy.

Joseph Mason, a finance professor at Louisiana State University, said the shift would be equivalent to "shutting off the spigot that's filling the bucket of distressed properties for sale."

Chandrajit Bhattacharya, the head of asset-backed securities research at Credit Suisse Group AG, said seasonal factors helped reduce new delinquencies recently. It is unclear whether the stock of nonperforming mortgages underlying private-label bonds will soon begin to shrink, he said.

But with a great deal of uncertainty surrounding ultimate losses, such a turn would "have a pretty significant impact on bond valuations," Bhattacharya said. "People would have an understanding of really what the higher limit is in terms of losses and expected defaults."

The total principal amount of mortgages backing private-label bonds has declined about 12% since October, to about $1.6 trillion in July, according to the Amherst data. (Overall, burn-off from liquidations of bad loans and payments have cut balances from a peak of about $2.2 trillion in July 2007. Issuance of the bonds entered free fall that year as the storm of credit losses in the pipeline came into focus.)

A contraction in the inventory of bad loans means that "the market can at least ring-fence the problem assets and start the clean-up process," Amherst analysts wrote in a report published this month.

Mason said that, though a "triage" of sorts is happening through sale of the most desirable seized properties, foreclosure losses are poised to become even more severe as lenders seek to unload the rest.

"The good properties have been selling in this crisis literally right after foreclosure," he said. "It's the worse-condition properties that will be problematic, and, therefore, we can point to the loss rates that have been occurring to date as only kind of a minimum benchmark."

The stockpile of less-desirable homes will be "tailing off for quite some period of time," Mason said. "And that is what's going to, in fact, drag out the recession right now."

In the private-label pools, first-time defaults as a proportion of loans that had always been on time the previous month hit 2.5% in January (an annual rate of 34.3%), according to Amherst data. The figure fell to 1.6% in July, or a still-blistering annual rate of 21.6%. Though an increase in the pace of liquidations helped keep the amount of nonperformers level from June, at $467.9 billion, delinquent loans accounted for 28.4% — a high point — of the face value of a diminishing overall pool.

To be sure, the conflagration has long since consumed a variety of other paper, and shoddy mortgage bonds are no longer at the center of financial institutions' instability.

According to a

The government's

In the mortgage industry credit problems have moved

New Cleanup Crew

Yet another team of Wall Street and

Their Tampa company, National Real Estate Ventures, has raised $1.5 billion to buy real estate owned from banks, investors and government agencies, including the Federal Deposit Insurance Corp. and Fannie Mae. National Real Estate will operate in seven states — Arizona, California, Colorado, Nevada, New Jersey, New York and Texas.

Monroe started buying such properties last year in the Southeast and in Detroit, which he called "REO boot camp."

"If you can make it in REO in Detroit, you can make it anywhere," he said.

Quotable …

"FHA was 5% of the market, and overnight it became 30%, and it didn't have one dime more for staff or IT systems. Everybody said FHA couldn't handle the volume, and guess what? We did. Can you imagine what would happen right now if we didn't have FHA?"

Brian Montgomery, the former FHA commissioner, who