Their lips are sealed.

The Bancorp in Wilmington, Del., which has been dealing with a plethora of issues for more than a year, disclosed in a short press release last week that it cut jobs as part of a sweeping expense reduction plan.

The problem is that the $4.4 billion-asset company is refusing to disclose how many jobs it cut or what types of positions it eliminated. The release provided no details, and efforts to coax a number from the company were unsuccessful.

"I do not have specific numbers to share regarding the reduction," Rob Tacey, a company spokesman, wrote in an email to American Banker. Tacey, in a separate email to the News Journal in Wilmington, would only confirm that cuts took place across all of the company's U.S. operations.

Helene Keeley with Delaware's Department of Labor said that she has not received a WARN Act notice from the company. Such notices are required when an employer is planning a large-scale layoff.

The Bancorp had 762 full-time employees at Dec. 31, an 11% increase from a year earlier, according to its annual reports. In addition to its corporate office in Wilmington, the company has loan production offices in cities such as Philadelphia, New York and Chicago; prepaid card operations in Minneapolis and Sioux Falls, S.D.; a sales office in San Francisco; and Bank Secrecy Act compliance staff in Tampa, Fla.

Salaries and employee benefits rose by 23% in the first half of this year compared to a year earlier, to $40.1 million, according to the company's quarterly filing with the Securities and Exchange Commission.

The Bancorp is hardly the only bank to lay off employees in recent months. Comerica also

The Bancorp, by omitting key details, left analysts guessing.

"I found the release a bit vague," said Frank Schiraldi, an analyst at Sandler O'Neill.

Investors would probably welcome any plan that resulted in profit for The Bancorp, Schiraldi added. The company in July reported its

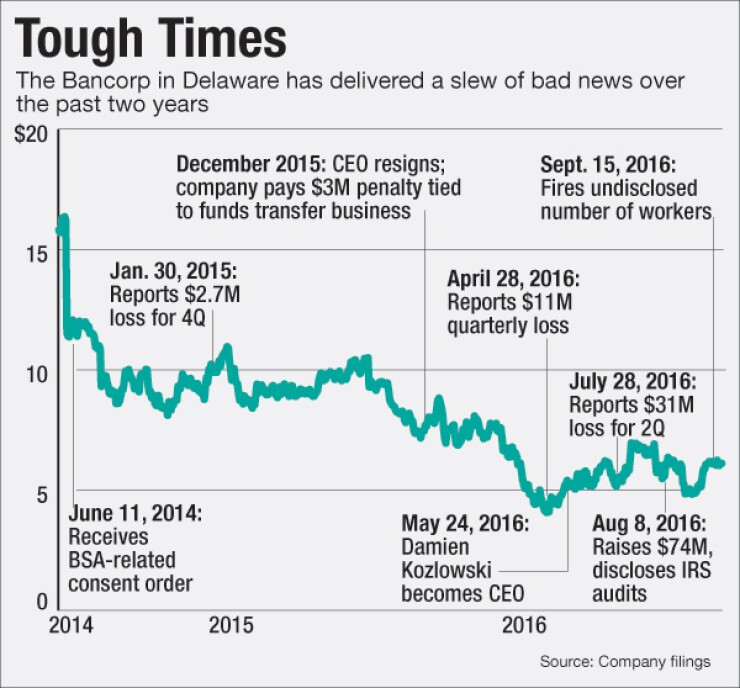

The Bancorp, which has been struggling to regain its footing since signing a consent order in mid-2014 to address weaknesses in its anti-money-laundering compliance procedures, isn't done cutting costs. Management is also looking to reduce expenses within its supply chain network, though Thursday's release was short on details.

"We believe we can substantially lower our operating run rate by 20% to 25% without significantly affecting revenue and, ultimately, have a healthy operating leverage with double-digit business revenue and single-digit expense growth," Damien Kozlowski, a former Citigroup executive who

While short on details, analysts did the best they could with the information provided.

William Wallace, an analyst at Raymond James, wrote in a Friday note to the clients that the announcement — though limited — was "a source of continued positive momentum." He noted that the company had recently agreed to sell

The restructuring, meanwhile, could add as much as 39 cents to the company's 2017 earnings, Wallace added.

"Based in part on previous commentary from management we had already baked in a 25% decrease in expenses, year over year," Schiraldi said. In fact, Kozlowski had discussed a restructuring plan during a July 21 conference call that promised to have "a significant impact" on next year's earnings.

Regardless, it would have been nice to have more clarity on exactly how The Bancorp plans to achieve those savings.

Schiraldi and Wallace, for their part, said they expect the company to release more details about its restructuring after it reports third-quarter results next month.