U.S. Bancorp expressed confidence Wednesday that its pending acquisition of MUFG Union Bank will be completed during the first half of this year, which is in line with the deal’s original timeline.

Chairman and CEO Andy Cecere told analysts that the $8 billion cash-and-stock purchase might close “later in the first half,” followed by a systems conversion late in the third quarter or early in the fourth quarter.

There’s “nothing to have us believe that it would be any different from that, and we're preparing for that time frame,” Cecere said during U.S. Bancorp’s fourth-quarter earnings call.

His comments come one day after the Federal Trade Commission and the Department of Justice's antitrust division

In an interview with American Banker, U.S. Bancorp Chief Financial Officer Terry Dolan said the Minneapolis company isn’t overly concerned that the joint FTC-DOJ review will impact the Union Bank deal. “It takes a lot of time for that process to occur,” he said.

One reason the $573 billion-asset U.S. Bancorp feels comfortable maintaining its original anticipated timeline: The renomination and confirmation of Jerome Powell as Fed chairman, Dolan said. Powell, who was first appointed to the post in 2017, was selected by President Biden in November and

“That helps move this forward,” Dolan said.

For the fourth quarter, U.S. Bancorp reported net income of $1.7 billion, an increase of 10% from the same quarter in 2020. The company’s earnings per share were $1.07, falling short of the average estimate of $1.10 among analysts polled by FactSet Research Systems.

U.S. Bancorp’s net interest margin decreased from 2.53% in the third quarter to 2.4%, mainly as a result of a reduction in loan fees related to the Paycheck Protection Program, as well as increasing deposits and yields related to the bank’s investment portfolio.

In afternoon trading on Wednesday, shares of U.S. Bancorp were down 7.4% to $57.62.

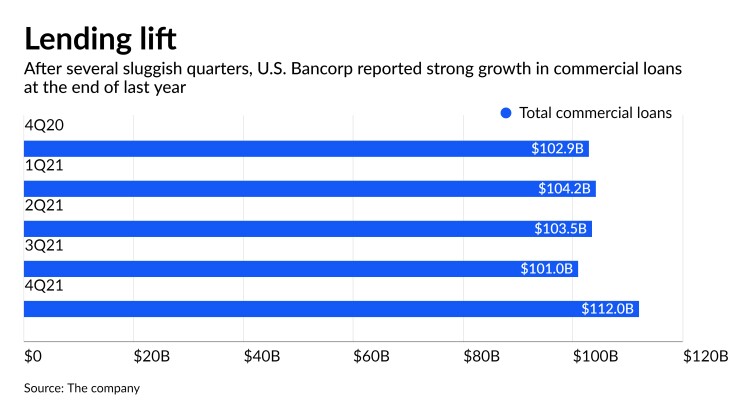

Commercial loans were a bright spot during the fourth quarter. End-of-period commercial loans totaled $112 billion, up 8.9% year over year, the company said.

The uptick is a reflection of how companies are thinking about supply chain issues, according to Dolan. “It’s moving away from ‘just in time’ to ‘just in case’ inventory management approach,” he said.

The parent company of U.S. Bank said that it expects revenues to grow by 3% to 4% in 2022. At the same time, the firm is projecting a 2% to 3% increase in expenses, in part because of inflation and continued investments in the business, Dolan said.

On Wednesday, U.S. Bancorp also announced changes to its overdraft fee policies, joining a raft of large and midsize banks that have done so in recent months.

U.S. Bancorp disclosed that it recently eliminated fees for nonsufficient funds on consumer checking accounts. By the end of the second quarter, the company plans to increase the amount that an account can be overdrawn before incurring fees, bumping the current $5 limit up to $50. The firm will also give customers a full day to deposit funds into an account that has a negative balance of more than $50.

The changes will result in a $160 million to $170 million decline in annual fee revenue, the bank said. Approximately 75% of that reduction will be realized in 2022, Dolan noted.

U.S. Bancorp’s moves come amid pressure on banks from Biden-era regulators to reduce their reliance on overdraft fees. On Wednesday, Regions Bank in Birmingham, Alabama,