The trend of shrinking loan books has reached those in charge of them.

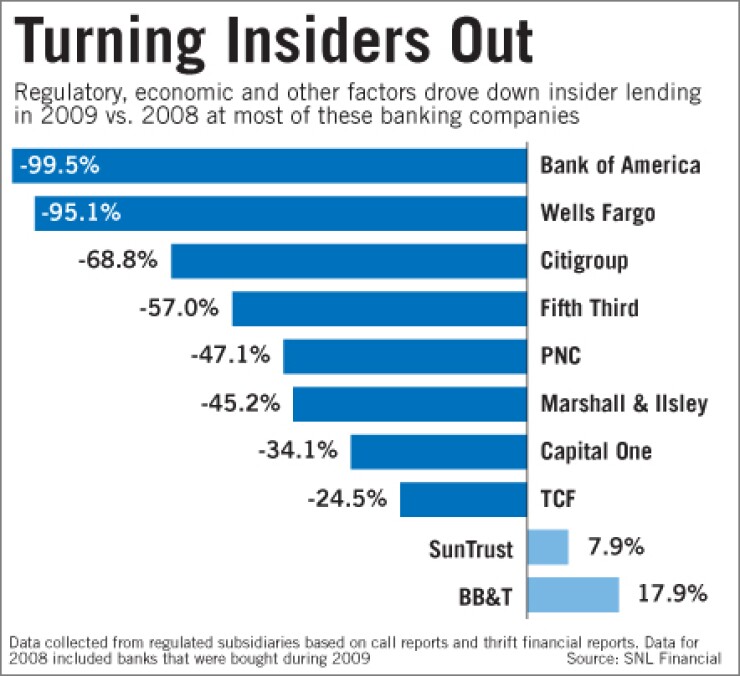

Last year, loans to insiders at the nation's biggest banks fell 31% from a year earlier, to $5.48 billion, according to call report data compiled by SNL Financial. Banks are generally tight-lipped about such loans, often citing customer confidentiality. Observers are wondering if banks are reining in such loans due to regulatory scrutiny or whether insiders, like many other borrowers, are simply deleveraging.

Either way, the issue has never been thornier than in the post-meltdown era. Fail to crack down, and banks could draw the ire of the regulators, investors and media who zero in on potential conflicts of interest at the managerial or board level. Rein insider loans in too much, some say, and outsiders might read the move as more than an impolitical reluctance to lend in general, or, seen from the demand side, perhaps even a lack of board-member confidence in the bank.

"There is a fair amount of sensitivity to this issue," said Ray Groth, a co-founder of Duke University's Directors' Education Institute. "In the current environment, banks are going to try and make their relationship to directors as arms' length as possible."

Synovus Financial Corp. provides an example of the risks of doing business with insiders.

It has drawn attention for troubled loans to the resort developer Sea Island Co. A.W. Jones 3rd sat on the board of the Columbus, Ga., banking company and ran the development company. James Blanchard, Synovus' chairman and CEO when the lending relationship began, was also a member of Sea Island's board. Synovus placed a $220 million loans to Sea Island on nonaccrual status in early 2009, or less than a year after Jones stepped down from the banking company's board.

Synovus spokesman Gregory Hudgison declined to discuss the situation. The company has said in the past that it approaches all loans "in the same prudent fashion."

On the other hand, some observers are concerned about a counterproductive signal the dramatic reduction might send to the borrowers and their communities. Robust borrowing from insiders can be viewed as support for the banking industry and the economy, some observers say.

"As a firm, we encourage our banks to make these loans," said Nicholas Ketcha Jr., a managing director at the bank consulting firm FinPro and a former director of supervision at the Federal Deposit Insurance Corp. "Your board should be your primary sales force," Ketcha said. "How do you encourage others to bring business to you if your own directors aren't doing it?"

Regulation O defines insiders as executive officers, directors or principal shareholders. Banks provide a quarterly assessment of how much credit is available to those individuals and related parties such as companies that they own or work for. Banks are not required to publicly disclose the types of loans or disclose individual loan details.

SNL tallied loans and available lines of credit to insiders, based on call reports and thrift financial reports. If a bank made an acquisition in 2009, SNL included the insider loans of acquisitions in its 2008 totals.

The three biggest banking companies — Bank of America Corp., Citigroup Inc., and JPMorgan Chase & Co. — either declined to comment or did not return calls seeking comment on the insider lending trends. Bank of America had the steepest drop last year, with insider loans falling 99.5%, to $2.8 million. The biggest drop at B of A occurred during the second quarter, according to SNL.

D. Anthony Plath, a financial professor at the University of North Carolina at Charlotte, said the timing makes sense because the $2.4 trillion-asset Charlotte company began retooling its board shortly after its April annual meeting. "The old people had a history of taking out loans with the company and perhaps the replacements have not been lining up for loans," he said.

Plath noted that in many cases the loans still sit on banks' books. "They are just not classified as loans to insiders anymore," he said.

Other banking companies had similar circumstances behind reduced insider loans. A spokesman for TCF Financial Corp. said the Wayzata, Minn., company's tally for such loans fell $2.5 million after a director left the bank. Fifth Third Bancorp's amount declined 57% after the Cincinnati company consolidated into a singe bank and eliminated 11 officers and directors that had loans, a Fifth Third spokeswoman said.

A spokeswoman for Wells Fargo & Co., which saw its insider loans drop 95%, to $39.4 million, said its number fell because several Wachovia Corp. insiders who once contributed to the amount no longer held that status last year. (Wells Fargo bought Wachovia in 2008).

A spokeswoman for Capital One Financial Corp. said the 2008 data showing a 34.1% decline, to $3.6 million, included insiders at Chevy Chase Bank, which the McLean, Va., company bought in February 2009. Excluding former Chevy Chase insiders, 2008 insider loans at Capital One would have totaled just $206,000, with increases last year in newly extended credit, she said.

Still, some observers believe the lower number could reflect caution by banks during a heightened regulatory environment. The FDIC in particular has stated that it would scrutinize such loans, with chairman Sheila Bair telling Bloomberg News in December that she was "deeply skeptical of any kind of insider lending."

"The regulators have turned examinations into a form of colonoscopy for bankers," Plath said. "That type of scrutiny applies to the insider book as well."

Others said the decline is best explained as waning demand from borrowers, noting that someone's status as a director doesn't make them immune from a turbulent economy. Some said that such loans were often used for speculative commercial real estate, which has all but dried up amid declining values and the credit crisis.

"I'd be surprised if banks are deliberately looking to have this number go down," said Donald Mullineaux, a finance professor at the University of Kentucky. "Demand for debt is down generally. If directors typically borrow for business purposes, it is fair to assume that they, too, may have less need."

Not all big banks reduced insider loans. BB&T Corp. reported a 17.7% increase last year. A spokeswoman for the Winston-Salem, N.C., company said "virtually all" of the increase came from a line of credit it already had with Piedmont Natural Gas Co. Thomas Skains, the utility company's president and CEO, joined BB&T's board last year.

Plath stressed that insider loans are not problematic for banks as long as they underwrite them at rates and terms comparable to what they might make to noninsiders. "The big issue is what to do when they get stressed," he said. Banks then must make tough calls on modifying or foreclosing on such loans, he added.

B of A decided to provide significant disclosure for one such loan under pressure. In its preliminary proxy with the Securities and Exchange Commission, the company said a mortgage to the brother of director Monica Lozano was past due at yearend 2009. The filing said the mortgage, which was made three years before Lozano joined the board, was "extended in the ordinary course of business" at similar terms to borrowers "not related to the corporation."