-

Regulators closed $3.5 billion-asset Frontier Bank in Everett, Wash., and three other smaller banks in the Midwest to bring the year’s failure total to 64.

April 30 - Washington

WASHINGTON — TD Bank of Wilmington, Del., purchased three separate failed banks in Florida late Friday, totaling $3.9 billion in assets, on a night that saw a total of eight bank collapses.

April 18

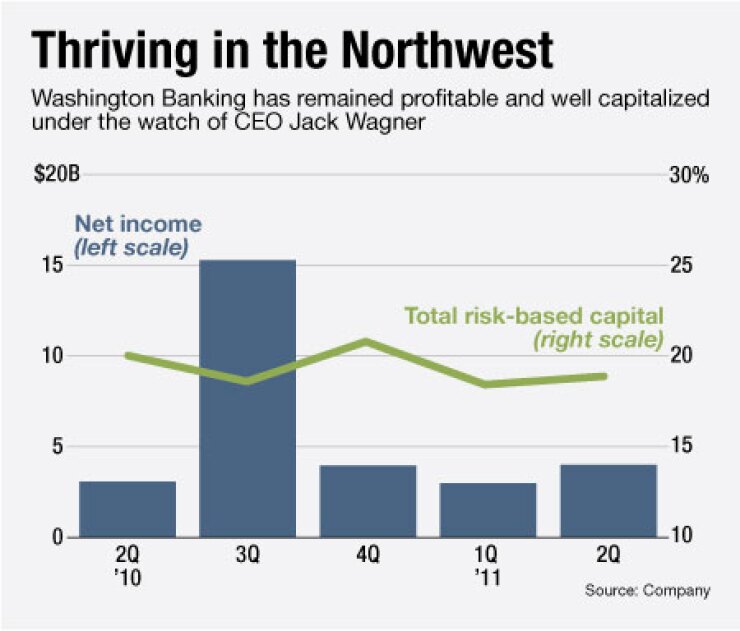

Jack Wagner became the president and CEO of Washington Banking Co. in Oak Harbor, Wash., in October 2008 while financial markets were in a tenuous position. The $1.68 billion-asset company has remained profitable and it exited the Troubled Asset Relief Program earlier this year.

The company also acquired two failed banks last year from the Federal Deposit Insurance Corp. The following is an edited transcript of an wide-ranging interview with Wagner from last week's FIG Partners LLC's banking conference in Atlanta:

Can you discuss the market where the company operates?

JACK WAGNER: We cover an area primarily from northern King County [in Washington state] to the Canadian border, and to the west out to the San Juan Islands. The branches out there [on the Puget Sound] are pretty rural, primarily deposit gatherers. We don't do a lot of lending out there.

The Puget Sound islands are a rural area and the communities that support the islands are very, very small. Throughout the San Juan Islands, you have primarily secondary homes that are extremely expensive. California people will have their second homes up there but they don't tend to do their banking in that area.

We service all the Interstate 5 corridor, especially since we acquired [two failed banks] that provided 12 branches down in northern King County and Snohomish County. Both are in suburban Seattle. That was very important for us, not only to have that demographic area but also to have our executive team established there so we could easily get at the market and service it.

What has been the most significant changes or developments for the bank from those failed-bank deals?

The acquisitions improved our demographics four-fold. It's hard to believe but you're talking about commercial loan teams that were picking bones to get loans up in Whatcom County and Skagit County, especially on the islands. They felt like they've died and gone to heaven down there in Snohomish County. There's business all over the place. A lot of it isn't active right now, but a lot is. The first areas of the state where we'll see a recovery in Washington is Snohomish County and King County. You've got a lot of suppliers for Boeing, vendors, that type of thing; Microsoft and Amazon.

Those two acquisitions got us up to 7.8% [deposit] market share in Snohomish County, so that's a significant move on our part.

What is your outlook for deal activity?

We're still in a growth strategy. We're still emphasizing M&A activity. The FDIC will be back in our state next year and we'll look to see what types of banks are closing, whether they are attractive to us or not. Straight M&A's, we're looking at possibilities there but they're extremely difficult because of the regulatory environment we're in. Plus, people have just not been able to get the profits and capital to get themselves out of a hole.

Most smaller banks can't generate enough capital to solve their problems and those aren't attractive to us. Consolidation will be a big thing for us, but not in 2011. We are currently talking to a lot of other banks, but that's like everyone else. If they just don't have much to offer, there's not much you can do about it. It's a little sad, actually.

Would you look at deals outside the Puget Sound region?

Right now, we'll only be in the Puget Sound market.We'll be concentrating in that area. Most of our assets are centered in that area and we like to feed off of that as much as possible.

Who are your competitors?

U.S. Bancorp, Wells Fargo & Co., Bank of America Corp., KeyCorp and JPMorgan Chase & Co. are the big banks in our area. We primarily make small-business loans. We're known for that. Some of the big banks are doing small-business lending. You used to never see those people come down and do a loan below $1 million or $2 million, but now you see them because they'll take what they can find like the rest of us. So they're competition. As for state-chartered banks, Columbia Banking System Inc. and Washington Federal Inc. are competitors.

Is the economic downturn hurting your company?

We're enjoying very good growth even though the economy is quite slow and causing some difficulties. We just don't think a lot of things, including loan demand and the mortgage market, are going to really settle down until we get some sort of resolution on the economy. It's just creating too much doubt for people.

If we continue in this economic slump, or if it deepens and we aren't able to do much in the expansion area, then we're going to have to start looking at some serious cost savings. We're at about 60% efficiency rate now with a very high level of employment at 64 people. But we've built [up that staffing] over two years and they're very gifted and talented. We're not anxious to give up on what we've created today and I doubt we will.