Commerce Union in Brentwood, Tenn., had no plans to enter a new market 120 miles away.

The $912 million-asset parent of Reliant Bank called an audible last week, opting to move into Chattanooga when an opportunity arose to hire Terry Todd, a lender with considerable experience in the market.

Todd, who is now Commerce Union’s Chattanooga market president, recently left FSGBank, a division of Atlantic Capital Bancshares. Before that, he was a business banker for SunTrust’s Chattanooga region.

The move highlights the continued importance of relationships in banking, even at a time when many institutions are turning more toward technology and closing branches. For Commerce Union, the hiring shows a willingness to take advantage of an opportunity that goes beyond an established strategic plan.

“We weren’t really looking at” Chattanooga, said DeVan Ard, Commerce Union’s president, though he now believes the city can help his company more than double in size to $2 billion in assets. “Our focus has been on middle Tennessee mainly because that’s where our banks were located and because it’s a growth market.”

To that point, a presentation the company made at an investor conference in September dedicated nine slides to expanding around Nashville, Tenn.; none of the slides mentioned Chattanooga.

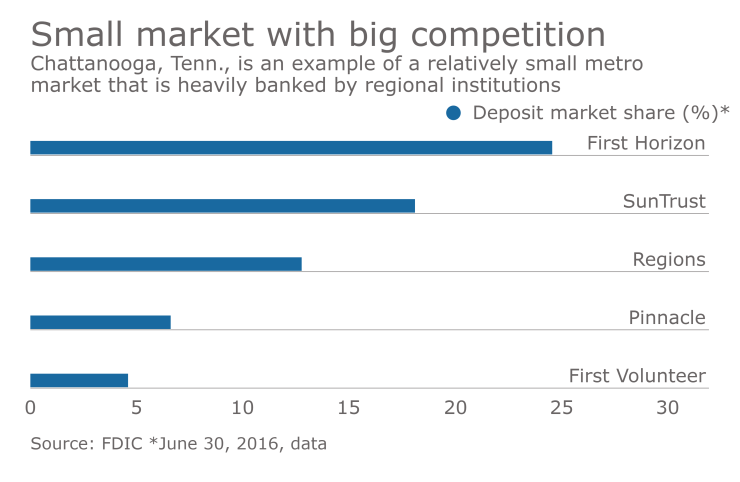

Hiring a well-known banker is critical for a newcomer entering a market like Chattanooga, where five banks control about two-third of the $9.4 billion in local deposits, based on June 30 data from the Federal Deposit Insurance Corp.

The local economy is surging, said Kim White, president of the River City Company, a nonprofit dedicated to promoting development in downtown Chattanooga. Companies have recently invested about $1 billion to develop downtown, including 2,600 apartments and 1,000 hotel rooms.

“That is amazing for a city the size of Chattanooga,” White said. “Being a small, nimble bank can work in [Commerce Union’s] favor. … Chattanooga is still small enough that a community bank can come in and be a big player.”

The city’s population increased by more than 5% from 2010 to 2015, to 177,000, based on Census Bureau data.

Much of Chattanooga’s recent growth can be traced back to Volkswagen’s 2011 decision to build a large assembly plant in the area. In recent years, downtown has been filling up with startups and small firms that serve as bread-and-butter clients for small, commercially oriented community banks, White said.

The sale of several local banks has created potential opportunities.

Atlantic Capital bought First Security Group, Todd’s former employer, in late 2015. In addition, Smart Financial in Knoxville, Tenn., bought

It also helps to know something about the executive being hired.

William DeBerry, Commerce Union’s CEO, tapped Todd to join a Small Business Administration group at a Bank of America predecessor in the early 1980s. In fact, it was DeBerry who asked Todd to relocate to Chattanooga a couple of years later.

“We’ve stayed friends all these years,” said DeBerry, who

Now Commerce Union is relying on Todd to leverage his contacts to tap into Chattanooga’s growth. He will initially work with a single assistant in a sixth-floor office downtown, though he will be responsible for filling out his staff and opening a branch over time.

“I like to do what I call hiring the mayor” when entering a new market, Ard said. “In this case, the mayor is Terry Todd. He knows everybody.”