What's Driving the Recent Surge in Loan Demand?

Bankers feel overwhelmed by new regulations and are frustrated that interest rates have stayed near zero for six years now, but at least one thing has them smiling: customers are borrowing again.

In nearly every category the exception being home equity lending banks reported modest to strong loan growth through the first half of this year as consumer spending increased and businesses accelerated expansion plans.

There are pockets of distress but, overall, senior bank executives are optimistic that the momentum will continue through the remainder of 2014 and into 2015. Dennis Klaeser, the chief financial officer at Talmer Bancorp in Troy, Mich., says that loan demand in the company's Midwestern markets is "as strong as it's ever been," thanks primarily to a rebounding manufacturing sector. Talmer, founded in 2010 to roll up troubled banks, has seen demand pick up noticeably in such Rust Belt cities as Cleveland and Youngstown, Ohio, and it's even hiring lenders in Detroit, Klaeser said at RBC Capital Markets' financial institutions conference in Boston this fall.

Lending is strong enough in some areas that regulators are raising concerns about concentration risk. Oil and gas exploration is booming right now, but in its most recent quarterly report on lending trends, the Office of the Comptroller of the Currency cautioned banks against loading up on loans in the energy sector.

Another worry is that there are still too many lenders chasing too few quality loans, resulting in some banks loosening loan terms to win business. And there are some high-quality business borrowers that simply don't need loans. Scott Kisting, the chairman and chief executive of AmericanWest Bank in Spokane, Wash., said he knows of one company that recently built a $54 million factory without borrowing a penny. "A lot of people aren't borrowing money because they hoarded cash" in the years following the financial crisis, Kisting said at the RBC conference.

Still, loan data from the Federal Deposit Insurance Corp. shows good reason for optimism. In recent years, much of the loan growth banks were reporting came from stealing market share from competitors that had scaled back lending or exited certain sectors entirely. This year may well go down as the turning point when total loan demand finally rebounded.

Between June 30, 2010 and June 30, 2013, banks' net loans increased by an average of just 2% a year, according to the FDIC data. Between June 30, 2013 and June 30, 2014, net loans climbed 5.3%, to $8 trillion the largest year-over-year increase since 2007.

Commercial and industrial lending has been a bright spot for banks in recent years and continues to drive overall loan growth. In the second quarter, C&I loans on banks' books increased 10% year over year, to $1.66 trillion, in part because of increased demand in such industries as energy and health care. Dan Rollins, the CEO at BancorpSouth in Gulfport, Miss., said his company posted the strongest loan growth numbers in its history during the second quarter.

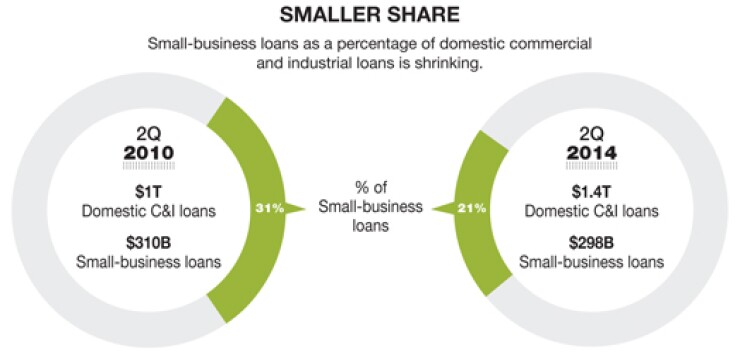

Small-business lending accelerated noticeably in the second quarter. According to FDIC data, total small-business loans increased by 3.4% year over year, to $298 billion the highest total in four years.

But even though the dollar volume is up, small-business loans defined as those under $1 million as a percentage of total loans has been shrinking. Since mid-2010, the percentage of small-business loans to total domestic commercial and industrial loans has fallen from 31% to 21% at June 30, according to FDIC data. This suggests that banks are focusing on larger credits.

In commercial real estate, multifamily lending continues to be the key driver of growth, but construction lending is making a modest comeback. Total construction and development loans for the second quarter increased 10% from a year earlier, to $223 billion, marking the first year-over-year increase since 2008.