Several de novo efforts have stalled in recent months, reflecting the challenges organizers still face in forming new banks.

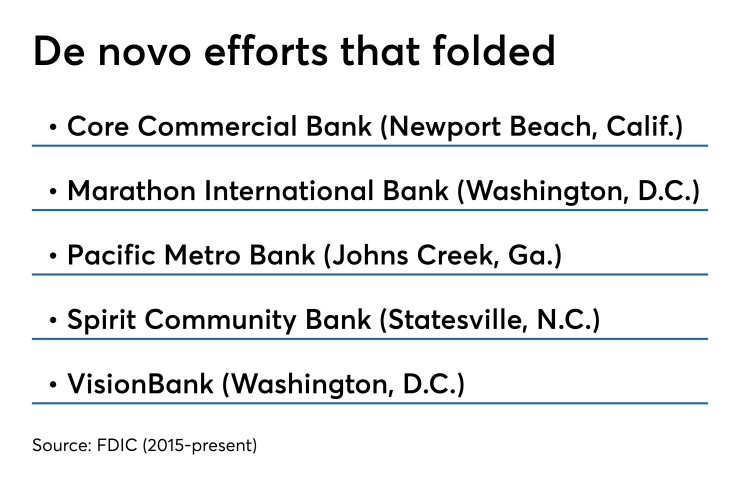

Over the last 12 months, 33 groups have filed applications with the Federal Deposit Insurance Corp. for deposit insurance. Of those, 17 were approved, five were withdrawn and 11 are still pending. A number of the approved efforts — including Spirit Community Bank, Community Bank of the Carolinas and Marathon International Bank — fizzled out.

While regulators were faulted for a post-crisis dearth of de novo activity, struggles in raising capital lead the list of impediments today, industry experts said.

The organizers for Spirit, which was required to raise $20 million, and Community Bank of the Carolinas, which was ordered to bring in $25 million, were unable to hit their targets.

Economic hurdles and inexperienced founders are another factor. At the same time, there are other ways to enter banking.

Buying a bank is one option, particularly given the large number of institutions with aging executives and directors, said Dan Hudson, CEO of NuBank, which helps groups form banks.

"I see the attraction" of buying an existing bank, said Jacob Thompson, a managing director of investment banking at SAMCO Capital Markets. "You’re acquiring an existing bank with an earnings stream, and those legacy earnings can at least somewhat offset the higher operational costs associated with expanding into new markets."

Community Bank of the Carolinas, for instance, shifted gears and now has a letter of intent to buy an unnamed bank. The proposed founders of Dogwood State Bank in Raleigh, N.C., abandoned the de novo route, instead

There are also instances of bankers giving up on a de novo initiative to accept jobs elsewhere.

Mindi McClure, proposed CEO of VisionBank in Washington, and Richard Horn, who was going to be the de novo's chief operating officer and general counsel,

Casey Mauldin, who was going to lead

MOXY only has four months to open under the conditional approval it received in January from the FDIC.

Hudson said MOXY has suffered from its organizers' lack of understanding about de novo formation.

"All of these individuals had no funds at risk or invested," said Hudson, who has not been involved with the effort. "There was a lot of goodwill, but it was very poorly executed."

MOXY's founder, Keith Walters, did not respond to a request for comment. Mauldin declined to discuss the proposed bank's status.

Still, capital seems to be the biggest hurdle for the various groups. Here's why: Capital requirements are higher than they were before the financial crisis. There is a lot of competition from proposed and existing banks for investor funds. Volatility in bank stocks, immediate concerns over the interest rate environment and long-term worries over credit quality also are making it harder to drum up support.

Hudson said some organizers suffer from the delusion that simply filing to open a bank will bring in investors. Another common error has been the assumption that a bank can open with a select handful of investors.

"This is not a 'build it and they will come' value proposition," Hudson said. "You need an army to launch a de novo today."

Organizers in states such as Florida, which was hit hard by the last recession, have dealt with the added challenge of convincing shareholders that things will be better this time around.

That being said, several new groups have recently filed the paperwork to open banks.

A group this week applied to form

There are still compelling arguments for de novos, including market opportunities created by consolidation. Organizers just have to realize that the challenges are real and that not all efforts will fly, industry experts said.

"We think it's a good time for them with all the mergers that have taken place the last few years," said Joey Warmenhoven, CEO of the investment bank JWTT. "We're rooting for de novos."