A New Jersey community bank that made national headlines when an employee resigned after she was targeted by a prominent GOP congressman has exposed itself to significant reputational damage and possible legal liability, according to experts.

Lakeland Bank in Oak Ridge is still caught in a social media furor two weeks after the situation came to light, in which an employee accused the bank of pressing her about her political activities after a congressman complained about her to a board member.

The incident has raised questions about the difficulties of managing a bank in the current hyperpartisan political climate and made the bank a poster child for how not to respond to a public relations crisis, experts in reputation risk said.

"Injecting politics into a business today is risky," said Dr. Nir Kossovsky, the CEO of Steel City Re, a Pittsburgh insurer of reputational risk. "By politicizing the bank's operations, they put half of the bank's customer base in an adverse position."

The bank, a unit of Lakeland Bancorp., may also have violated the law, some said. The National Labor Relations Act protects employees from discrimination, and some states have enacted statutes that specifically prohibit companies from taking any action against an employee based on her political views.

Ashley S. Kelly, partner at Arnall Golden Gregory, said she is being asked more questions these days about political issues in employment.

"Employers do have potential liability for engaging in this sort of behavior," she said. "Politics and the terms and conditions of employment go hand in hand."

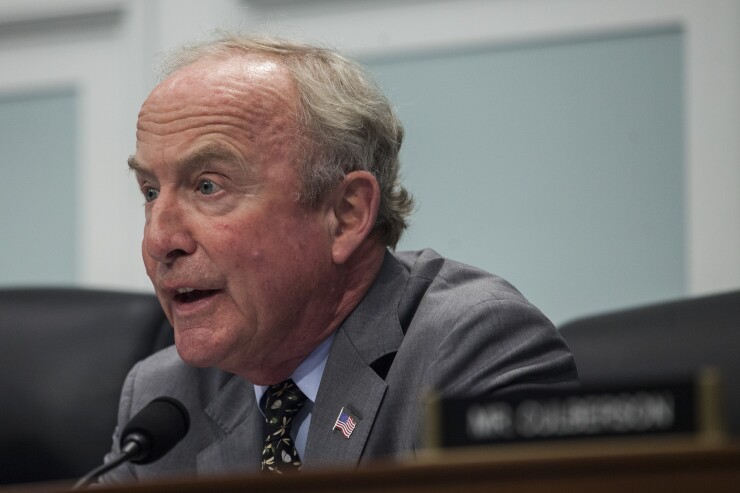

At issue are claims by Saily Avelenda, a former senior vice president and associate general counsel at the $5.2 billion-asset Lakeland Bank, that she was asked to detail her political activity after a letter was sent to a board member by Rep. Rodney Frelinghuysen, R-N.J.

"I was asked repeatedly about my political activity, the nature and extent of my involvement with a local political group, and anything that had my name attached to it," Avelenda said in an interview with American Banker.

In late March, Frelinghuysen sent a fundraising letter to one of the bank's directors describing the need to raise money to combat a newly formed group, NJ11thforChange, opposing him in New Jersey's 11th congressional district.

At the bottom of the letter to Lakeland director Joseph O'Dowd, Frelinghuysen wrote, “P.S. — One of the ringleaders works in your bank!”

Avelenda said she believes she was targeted by Frelinghuysen after her name, with its unusual spelling, appeared

A few weeks later, Avelenda said her boss showed her Frelinghuysen's letter and asked that she write a statement describing her political activity. She objected and asked if another employee, part-time New Jersey State Sen. Robert Singer, also had to write a statement about his politics. (New Jersey's state lawmakers hold office part time.)

Avelenda took a photo of Frelinghuysen's letter and later posted it on social media with a description of how she resigned, in part, due to political pressure.

"I had a letter put in front of me from my congressman, someone I have never met before, who went out of his way to find my name, my employer, and to locate a bank board member that had influence," she said. "There had to have been some reasonable level of comfort that the board member would act, otherwise what was the purpose of calling me out?"

The backlash since then against Lakeland and Frelinghuysen has been swift on social media, with more than 1,000 comments posted on the bank's Facebook page since it issued its only response on May 15.

In the past month, a third-party watchdog has also filed a formal ethics complaint against Frelinghuysen, a 22-year incumbent from a political dynasty. NJ11thforChange has used the incident to circulate a petition and fundraising campaign for a Democratic challenger.

Thomas Shara, Lakeland's president and CEO, did not respond to several requests for comment, nor did Frelinghuysen, who chairs the powerful House Appropriations Committee.

The incident underscores the dangers of appearing to take action against employees for their political views, which can lead to legal liability and reputational damage.

Crisis experts said the incident could have been avoided had O'Dowd, the board member, simply ignored the letter.

"A board member has a duty to protect the assets of the bank," said Kossovsky, the insurance CEO. "Instead, this went from a congressman doing what congressmen do, to the director exposing the bank to reputational risk. The director should have looked at the letter, torn it up and put it in the garbage."

Lakeland still needs to take action, he said. It should take a cue from Wells Fargo and apologize.

"The director needs to come forward and say he made a mistake and that the action he took was inconsistent with his duties as a director and the values of the institution," Kossovsky said. "And then they should institute a policy at the bank and share it with their competitors, that the bank will not be exploited by external political issues. That's how you show everybody that you are sincere about the issue."

But the bank may be afraid to say anything for fears that Avelenda might successfully sue it in court. For her part, Avelenda said she has no intention of suing the bank, but rather wants to raise awareness of how the letter was "a lot more sinister than it looks at first glance."

"I'm just a citizen, I am not a candidate, but I was targeted," she said.