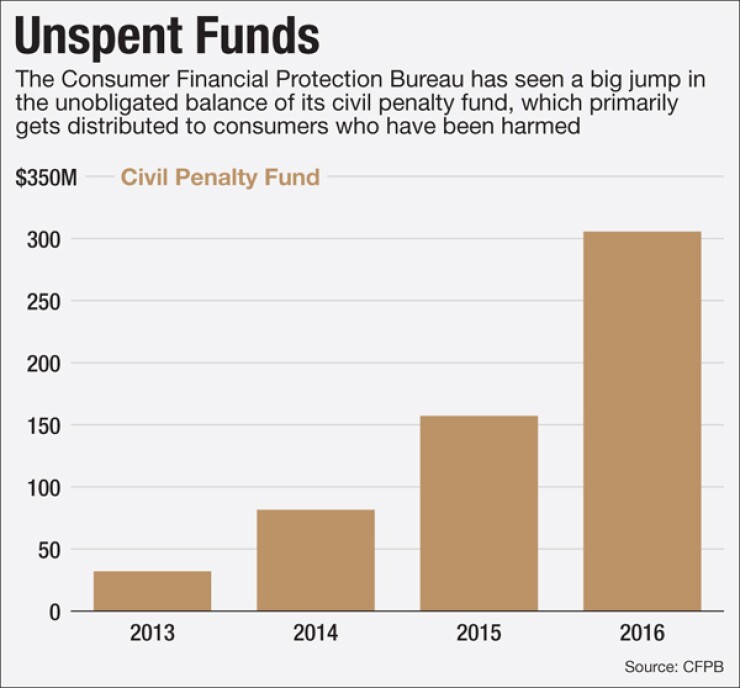

The Consumer Financial Protection Bureau has amassed more than $300 million in its consumer relief fund, nearly double the amount from a year earlier — sparking questions about why the fund is so large.

The agency held $305.6 million in what is known as "unobligated balances" in its civil penalty fund at the start of fiscal 2016, a 94% jump from a year earlier, the bureau said in a budget report issued in February. It expects to have $137.6 million at the start of the next fiscal year, according to Stephen J. Agostini, the agency's chief financial officer, in a recent update.

The sheer size of the fund is stoking concerns that the CFPB is collecting more money than necessary from firms it pursues.

-

The White House and other Democrats have long pushed for banks to offer affordable small-dollar loans as an alternative to payday loans and other costlier credit, but banks have struggled to make them profitable and safe for consumers.

February 8 -

The White House threatened to veto two bills on Tuesday one that would mandate new cost-benefit requirements on the Federal Reserve and the other to allow loans held in portfolio to qualify as a qualified mortgage.

November 17 -

WASHINGTON The House Appropriations Committee approved legislation Wednesday to subject the Consumer Financial Protection Bureau to the federal appropriations process and block the agency from issuing a rule on mandatory arbitration clauses.

June 17

"It begs the question of why they are collecting this money from the industry if they aren't able to use it in order to remediate allegedly harmed consumers or conduct education programs," said Joe Rodriguez, who formerly worked in the CFPB's fair-lending group and is now of counsel at Morrison & Foerster. "It further suggests that perhaps they are overestimating the harm to consumers in their enforcement actions."

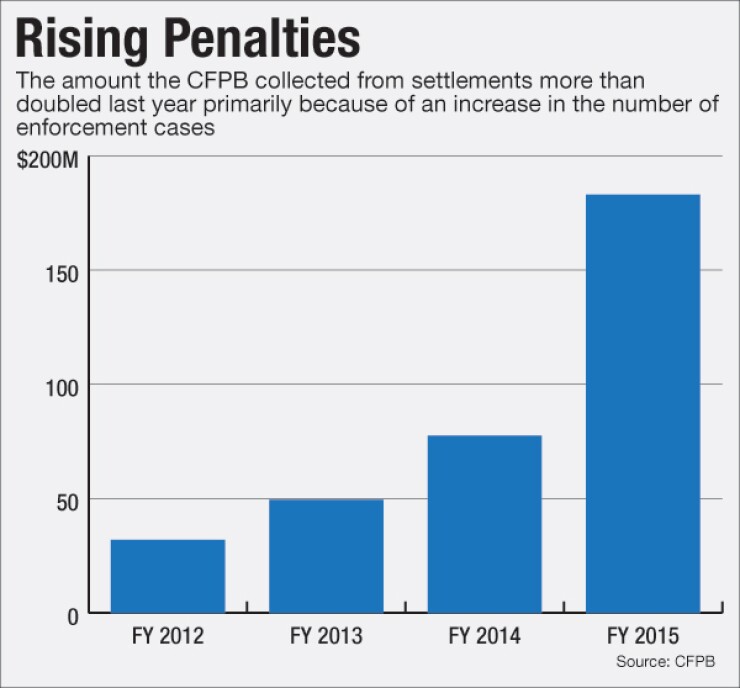

The growth of the fund is mostly a result of a bumper crop in enforcement actions during the past fiscal year.

"They keep settling more and more cases, and now they are fully ramped up and there were a lot of cases in the pipeline so they keep collecting civil money penalties," said Alan Kaplinsky, a partner at Ballard Spahr's Consumer Financial Services Group. "But they really shouldn't be carrying over that large of a balance from year to year."

A CFPB spokesman said the size is a reflection of the length of time it takes between collecting penalties from financial institutions and outlays to consumers. Determining which consumers get paid and at what amounts can involve painstaking forensic work, said the spokesman, Sam Gilford.

For example, in 2014, a Tulsa, Okla., payment processor, Global Client Solutions, settled charges that it illegally collected upfront fees from thousands of consumers on behalf of debt settlement companies. The CFPB determined that thousands of consumers were harmed but had not been compensated.

The bureau has since allocated $108 million from the civil penalty fund to be paid to those harmed consumers this year, which will significantly draw down the unobligated balances of the fund.

But some industry observers said the CFPB's reports on how money is being distributed are confusing and don't allow outsiders to check up on how it's being spent.

"They just say that they made an outlay, but they don't tell you to whom the money was given," Kaplinsky said. "I don't understand why they don't do that, particularly for an agency that demands transparency from everybody else."

The CFPB publishes details of payouts by the fund, including the number of consumers who receive checks, the percentage of checks that get cashed and the total dollar amount allocated and distributed. It does not publish the names of individual consumers, Gilford said.

The Dodd-Frank Act gave the CFPB the authority to collect and retain civil penalties from anyone in a judicial or administrative action. The bureau's civil penalty fund, which is basically a victims' relief fund, is maintained in a separate account at the Federal Reserve Bank of New York.

The bureau collected $183.1 million in civil penalties in fiscal 2015 from a variety of companies that settled allegations of wrongdoing, a 136% jump from a year earlier. The agency settled 37 cases in fiscal 2015, compared with 22 in fiscal 2014, a 68% increase.

Industry lawyers parse the CFPB's actions for clues as to whether the agency is issuing larger penalties over time or even imposing bigger penalties overall. Last year it settled some large investigations with firms for credit card add-on products, cases that had dragged on for a few years.

"I don't perceive that the agency has become more aggressive, rather it's a sign that some investigations tend to drag out longer," said Chris Willis, an attorney at Ballard Spahr, who settled five cases for clients in December 2015 alone and has seen some investigations last two to three years.

"Numerically I believe the bureau simply had more consent orders in 2015, and I don't believe that the penalty amount per consent order has really changed," Willis said. "The bureau's approach to penalties appears to be driven by case-by-case considerations and I don't see any indication that the CFPB's demands for penalties in individual cases are getting larger as time goes forward."

Rodriguez agreed that the increase in fines is driven by the sheer volume of enforcement actions. The bureau appears to be on track to almost match the pace set last year, he said.

"2016 is off to a big start with seven [enforcement] matters already announced," Rodriguez said.

The CFPB's civil penalty fund does not include roughly $6 billion in consumer relief, including $1 billion in restitution, that companies paid to redress consumer harm in 2015, the agency said.