Online-only banks have thrived during the coronavirus pandemic as consumers became increasingly comfortable using digital channels, but they still have room to improve when it comes to communicating — particularly during a crisis.

Overall customer satisfaction with direct banks declined in 2020, according to a recent J.D. Power study, and the drop was the sharpest among consumers who also said they were worse off financially than they were a year ago. That’s most likely because those customers were navigating fee waivers, loan forbearances and other hardship situations and often didn't feel supported by their banks, J.D. Power said in its latest direct banking satisfaction study.

“People who had a financial hardship recently are often exploring or investigating their financial situation, including the different types of accounts they have. They’re trying to understand the impact of fees and terms and other things they may not otherwise be familiar with,” said John Cabell, director of wealth and lending intelligence with J.D. Power.

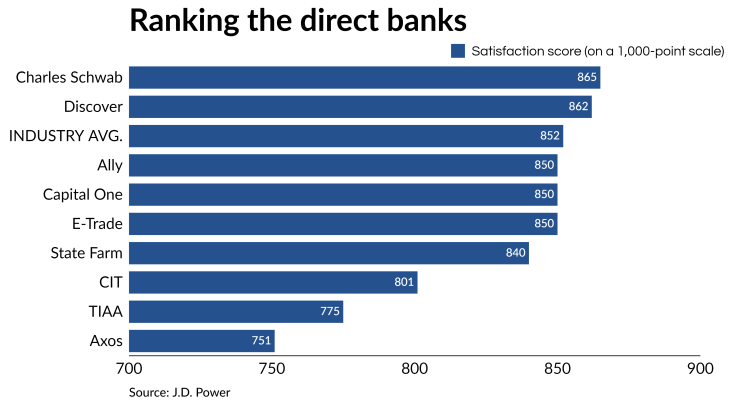

For the third consecutive year, Charles Schwab Bank earned the highest overall satisfaction score, 865 on a scale of 1,000. Discover Bank, a unit of Discover Financial Services, earned the second-highest score, 862, and Ally Financial earned the third-highest score, 850. The average score among the nine online-only banks included in the study was 852, down 12 points from last year.

J.D. Power looked at the largest direct banks in the U.S., meaning branchless banks that offer a checking account. It did not look at the digital brands of traditional banks, like Citizens Financial Group’s Citizens Access or MUFG Union Bank’s PurePoint. And while it assessed USAA Federal Savings Bank in San Antonio, it excluded that bank from the rankings because it only serves military members and their families.

Digital banks

To be sure, some of the factors driving down customer satisfaction were largely beyond bankers’ control. For example, direct banks had to lower the interest they pay on consumer accounts after the Federal Reserve cut interest rates to near zero in early 2020, and that affected customers’ satisfaction levels. Cabell also described a “general sentiment decline” with financial services in general last year, perhaps because so many households faced financial difficulties.

However, direct banks that communicated frequently and actively with their customers ranked higher in overall satisfaction scores. Among customers who felt their bank had “completely support[ed]” them — say, by waiving fees — overall satisfaction scores were 201 points higher than for those who said they received no support, J.D. Power said.

“Brands that have been more successful in this have really increased their perception of communication around the pandemic and the response to the pandemic,” Cabell said. “That proactive communication is really important for all financial services brands and that seems to resonate well with customers.”

While traffic to digital banking channels rose last year, overall satisfaction with those channels also declined, J.D. Power said. In particular, customers in this year’s study gave direct banks lower marks on ease of navigation, mobile appearance and on clarity of information provided on websites and apps.