-

Community banks in energy-rich North Dakota are having to get regulators' approval to buy houses for their employees, who can no longer afford to live there.

November 21 -

Banks in the Southeast are continuing to shrink their loan portfolios as they grapple with past miscues.

February 19 -

With the price of farmland surging, demand from small farmers for guaranteed mortgages is also way up. Now banks want Congress to raise the cap on those loans.

February 5

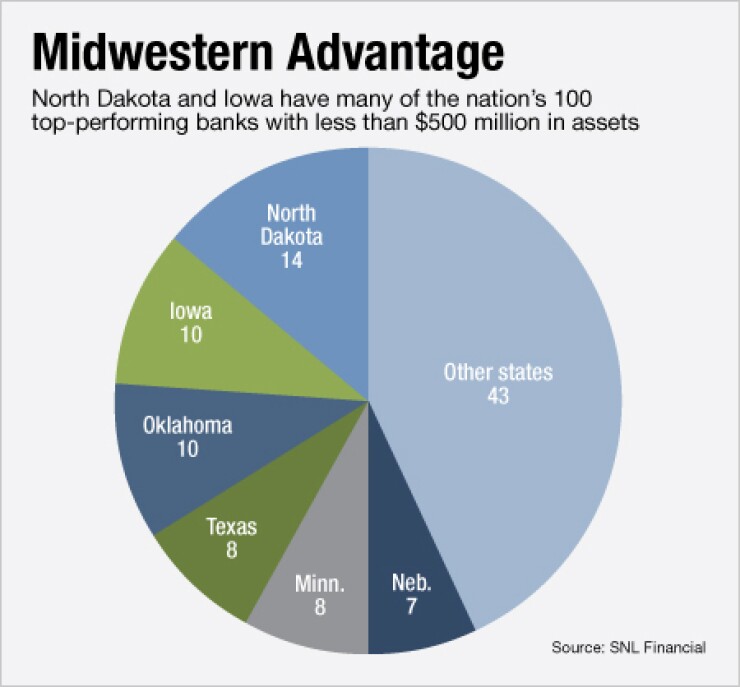

The Midwest, once dismissed by bankers and analysts as a slow growth region, is now home to many of the nation's most admired community banks.

States such as North Dakota and Iowa, along with nearby Oklahoma, were well represented on a recent list of the 100 top performing banks with less than $500 million in assets.

The energy sector, particularly dealings in oil and natural gas, has been a boon to smaller banks in those states. Agriculture has also been a steady business in a number of Midwestern states.

Despite the good fortune, bankers in those states must take precautions to protect their institutions against likely volatility in those industries, experts say.

"I've got clients that can't keep up with the growth that is happening in places like North Dakota," says Jeff Gerrish, chairman of Gerrish McCreary Smith Consultants. "There's just so much money floating around."

North Dakota had 14 banks make SNL Financial's list of top performing community banks. Iowa and Oklahoma each had 10 banks, while Minnesota and Texas rounded out the top five with eight banks apiece.

SNL based its rankings on six criteria: pretax return on tangible assets, net chargeoffs compared to average loans, efficiency ratio, adjusted Texas ratio, net interest margins and loan growth.

Besides Louisiana — another energy-rich state — banks in the Southeast states were largely absent from the list. The region

In contrast, banks in the Midwest continue to benefit from

"There's a lot of drilling in our state," says Bob McCormack, chairman and president of McCormack & Associates, a consulting firm in Duncan, Okla. "This provides jobs, which helps everyone out, including banks."

Few, if any, small banks lend to large energy producers. Instead, they often work with smaller businesses, such as welders, that support the energy sector's biggest players, says Jim Bruce, chairman of American Bank Systems, a consulting firm in Oklahoma City.

Banks in Oklahoma have also benefited from an unemployment rate that has stayed below the national rate through the recent economic downturn. In December, the state's unemployment rate stood at 5.1%, compared with a 7.8% nationally, according to the U.S. Bureau of Labor Statistics. A healthier work force means more demand for products such as mortgages and auto loans.

"The energy sector is obviously extremely important to us," Bruce says. "In Oklahoma City, it's been a real oasis in terms of economic growth and development."

United Community Bank of North Dakota, a unit of Leeds Holding in Leeds, topped SNL's list. Security State Bank, a unit of Old O'Brien Banc Shares in Sutherland, Iowa, was the runner-up. Peoples Community Bank in Greenville, Mo., which is part of Greenville Bancshares, placed third.

Success at Bank 7, the fourth-best bank in SNL's study, is an "indication of the Oklahoma economy and the oil and gas sector really driving things," says Craig Adkins, the Oklahoma City bank's president. SNL ranked the $281 million-asset unit of Haines Financial as its fourth-best bank, with a 49% efficiency ratio, 6.38% net interest margin and 37% loan growth last year.

Bank 7 had to distinguish itself from competitors in its home state by building a reputation for "completing deals in a timely manner," Adkins says. The bank is also willing to be "creative" with the structure of loans to fit individual needs.

"Our loans are tailored to the needs of customers and what their collateral is," Adkins says. "This allows us to generate a good return, but you need a talented staff to do that."

There are concerns that the fickle energy industry could slow down. Banks must control overhead by watching salaries and benefits while making sure they avoid opening too many branches, McCormack says.

Agriculture, which has the potential to ground many high-flying banks, is another common industry in most Midwestern states. For instance, agricultural production in Oklahoma has been stymied by drought conditions in recent years.

The drought finally started to catch up with Iowa last year, putting an end to three good years for crop yields. Still, many rural areas in the state are thriving because of "very strong profitability in agriculture" because there was enough moisture in the soil to produce decent yields, says Kevin Cain, managing partner at Cain Ellsworth in Sheldon, Iowa.

Higher prices for crops have also helped farmers in states were yields are holding up. "We're seeing a tremendous demand for agriculture lenders," Cain says.

Some industry experts are worried about a potential

Examiners in the Office of the Comptroller of the Currency's

Iowa is considered part of the agency's western district, though many of the same risks and concerns exist.

The OCC sent a letter to member banks and thrifts last year outlining what examiners were watching for in terms of the drought, Bert Otto, the agency's deputy comptroller for the central district, said during the conference call.

The OCC is also encouraging banks to make sure that borrowers have crop insurance. Banks should also conduct stress tests that consider variables such as commodities prices, yields, rates and input costs, Meade said.

"We're encouraging our portfolio managers to talk to those banks with significant concentrations to make sure … that the borrowers in those portfolios can withstand fluctuations that may come with the 2013 season," Meade said.