U.S. banks are increasingly fixing their gaze on an industry that offers attractive customer demographics, rapid growth and a reputation for being recession-proof: health care.

KeyCorp, Zions Bancorp. and Capital One Financial are among the banks that have made big moves in the sector this year. Key and Zions are targeting medical professionals as customers, while Capital One is focusing on investment banking services for health care providers.

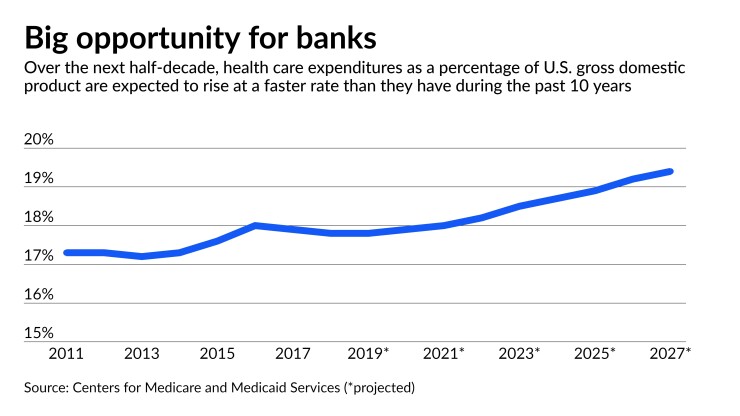

The lean-in has an obvious logic. Health care spending in the United States rose to $3.8 trillion in 2019, accounting for 17.7% of the nation’s gross domestic product, according to the Centers for Medicare and Medicaid Services, which provides the official estimates of total U.S. health care expenditures. Spending is expected to keep rising, reaching a projected $6 trillion, or 19.4% of GDP, by 2027.

“It’s an industry that’s poised for outsized growth, and banks are positioning themselves to take advantage of that growth,” said Terry McEvoy, an analyst at Stevens.

Specifically, McEvoy sees a chance for banks to sell products and services to doctors and others who work in the health care sector, which can cement long-term customer relationships. “If you can be their one financial institution, that’s a big opportunity,” he said.

Banks have long targeted the health care business, which is largely immune to the ups and downs of economic cycles and generally involves low-risk, high-quality borrowers with solid credit and desirable future wealth prospects.

Their past efforts have largely centered on commercial banking, with some banks creating specialized teams to help health care professionals buy or start practices and manage payments.

That approach continues to be popular. On Tuesday, Umpqua Holdings

Banks’ focus on targeting individual medical professionals as customers is somewhat newer. In recent years, challenger banks have sought to fill what they consider to be gaps in providing financial services to such individuals.

Panacea Financial, a division of Primis Financial in Tappahannock, Virginia, was

Banks have recently shown more interest in doing business with doctors, said Dr. Michael Jerkins, president and co-founder of Panacea.

“I see that a lot of folks are starting to recognize that doctors are somewhat underbanked and not uniquely catered for,” Jerkins said. “I think everyone wants doctors as customers, but they haven’t been willing to make unique products for them.”

Banks’ interest in the health care sector ramped up noticeably during the pandemic, said John Pancari, an analyst at Evercore. Increasingly, their efforts have included a digital component, he noted.

KeyCorp’s digital bank, Laurel Road for Doctors, is a prime example. The parent company of KeyBank acquired Laurel Road, a digital lending platform, in 2019 and began providing school loans to medical students, plus student loan refinancing, personal loans and mortgages to physicians and dentists.

Key’s national digital bank for doctors and dentists, Laurel Road for Doctors,

At an industry conference last week, KeyBank’s head of digital banking, Jamie Warder, said the $187 billion-asset company has originated more than $5.5 billion in consumer loans through Laurel Road and plans to open the digital bank not only to nurses, but also to specialists such as occupational therapists.

Fifth Third Bancorp made a similar play over the summer. The Cincinnati company

The deal marked the latest health care-related investment by Fifth Third, which operates a health care investment bank through Fifth Third Securities and a separate mergers-and-acquisitions and real estate advisory and investment banking firm with an emphasis on the health care sector.

Zions, too, is looking to sign up medical professionals as customers.

The Salt Lake City company, which last spring broadened its medical practice lending program to all 50 states, is developing a digital mortgage product for dentists, veterinarians, optometrists, physicians and pharmacists who have already taken out business loans.

Since 2015, when Zions rolled out its Practice Pathways program, it has funded more than 2,000 loans to medical professionals, including more than 400 this year, said David Kirby, the program’s director.

The forthcoming mortgage product for medical professionals — and, perhaps someday, a student loan refinancing option — will be another step in tapping into a highly attractive client base, Kirby said.

“Health care is getting bigger and bigger and bigger in the U.S., and we as banks need to look at it holistically,” Kirby said.

Other banks are focusing more on providing commercial banking, payments and investment banking services to the health care industry.

In April, Bank of America

In May, JPMorgan Chase introduced Morgan Health, a new unit that initially got $250 million to invest in what the nation’s largest bank by assets called “promising health care solutions.”

Last month, Capital One announced it had agreed to

Not only will Capital One add health care advisory services, it also plans to cross-sell commercial banking products to Triple Tree’s clients.

“Banks are realizing an opportunity that you can tailor your banking to this exact industry, and that the industry is big enough and growing fast enough that it makes it compelling to do so,” Pancari said.