Want unlimited access to top ideas and insights?

With the end of the third quarter bearing down, the economic pain from the coronavirus pandemic lingering, and margins looking tight for the long haul, expense cutting naturally became a hot topic of debate this week in banking industry circles.

At first glance, the ax-wielding appeared to be underway and widespread. Wells Fargo and Citigroup have divulged layoff plans, KeyCorp and others said branch closings would be accelerated, and Fifth Third Bancorp and Associated Banc-Corp announced aggressive cost-reduction efforts.

Yet others, including JPMorgan Chase, Bank of America and some big regionals, were more circumspect. That group either said they had done enough already, talked down the need to announce big cost-control programs or emphasized the importance of investing in the future.

William Demchak, the chairman and CEO of PNC Financial Services Group in Pittsburgh, warned that the tough decisions banks are making now will have long-term consequences that must be thought out.

“People are in an environment today where they're going to announce expense plans and basically cut off their forward-growth opportunities right at a time when to, in my view, compete in the future … you should be investing,” Demchak said Tuesday in a virtual conference hosted by Barclays Capital. “We'll stay focused on [expenses], but we're not going to shortchange the growth trajectory of this company.”

The $185.8 billion-asset PNC seemed to be trying to find a solid middle ground. Though it announced

Making cuts now

Still, two megabanks are among those moving ahead with cost cuts.

Wells Fargo, which is still trying to overcome business and regulatory challenges brought on by its fake-accounts scandal, reiterated that it

Citigroup, too, plans

Meanwhile, some regionals are being assertive on the cost side.

Executives at Fifth Third Bancorp in Cincinnati outlined a major cost-cutting plan on Monday. The $203 billion-asset Fifth Third intends to reduce expenses by $200 million in the first quarter of 2021, President and CEO Greg Carmichael said.

The company expects to find the majority of those savings through initiatives including a 20% reduction in corporate real estate, renegotiation of vendor contracts and staff reductions.

Through 2022, Fifth Third plans to reduce expenses by another $100 million to $150 million with the help of process automation. The company will also continue its plan to reduce branches in some legacy markets while adding branches in new markets in the Southeast, Carmichael said.

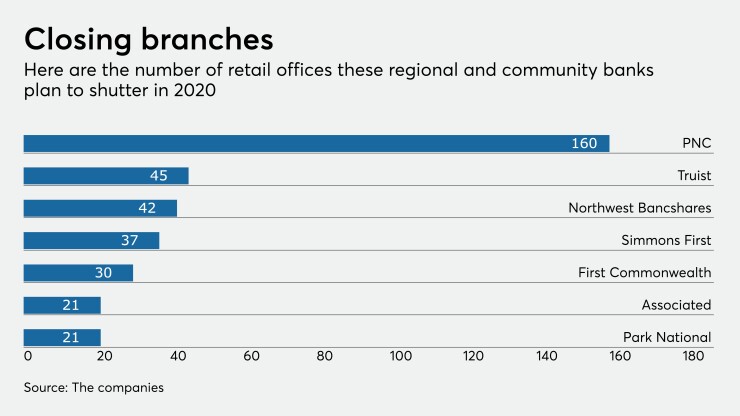

Associated Banc-Corp in Green Bay, Wis., is planning to cut at least $30 million in annual expenses, according to a regulatory filing this week. The $36 billion-asset company will close or sell 21 branches, equal to 8% of its network, that employ about 100 full-time workers. About $264 million in deposits were identified for sale.

The company plans to eliminate about 200 corporate, managerial and back-office positions by the end of this year. It will also restructure Federal Home Loan bank liabilities to add $20 million in net interest income and generate a $40 million net income tax benefit in the third quarter by reorganizing its securities and real estate lending units.

Associated noted that teller transactions in its branches were down 20% in August from a year earlier, while active mobile users had increased by 16% since January.

More cautious approaches

Other large regional banks are seeking to avoid aggressive maneuvers on expenses and have turned toward reducing branch counts as a way to hold their bottom lines steady.

Executives with the $547 billion-asset U.S. Bancorp in Minneapolis said at the Barclays conference Tuesday that they expect third-quarter expenses to be flat compared with the second quarter. In the longer term, U.S. Bancorp will be able to reduce both its branch count and its office space because of changing consumer behavior and greater numbers of employees working remotely.

Chairman and CEO Andy Cecere said the company had not yet finalized exactly how much it would reduce branches and corporate real estate.

“Consumer behavior before COVID was already migrating to digital channels. That has only accelerated in the last six months,” he said.

Regions Financial in Birmingham, Ala., is “[holding] expenses flat while making investments for the future,” especially in digital banking as more customers shift online, CEO John Turner said during the Barclays conference.

That’s come in the form of accelerating some investments in mobile and online digital origination capabilities for the $144.1 billion-asset company, shifting dollars and people from longer-term projects to quick-turnaround items that will “have a real impact in the short run,” he said.

“We are committed to positive operating leverage over time, recognizing that 2021 may be a very challenging year to accomplish that,” Turner said. “We haven’t made that commitment and we may not, given that it would just be mathematically very challenging. But we are committed over time.”

Truist Financial is also holding steady with its expense-management plans. The Charlotte, N.C., company — which

In addition to recent branch divestitures, the $504.3 billion-asset Truist continues to wring out savings by renegotiating third-party vendor contracts; trimming personnel, mostly through attrition; and closing back-office spaces, according to Chairman and CEO Kelly King, who also presented at the Barclays conference.

The bank wants to close 300 offices with a combined 5 million in square feet and an average cost of $30 per square foot, King said. At the same time, it keeps spending on technology, introducing more digital capabilities for clients.

“We are all about making sure we seamlessly deliver technology at the most advanced stages,” King said.

Pushback on pressure to cut

JPMorgan has raised its full-year guidance on expenses to $66 billion from $65 billion, Chief Financial Officer Jennifer Piepszak said during the Barclays conference. The company attributed some of that increase to expenses associated with increased activity in mortgages, capital markets and other lines in the third quarter.

“There hasn’t been a significant change,” Piepszak said in reference to expenses. “We’re obviously looking at things very, very closely as we always do, and we continue to realize structural expense efficiencies as we have been for many years now. So, broadly speaking, I would say no, no big changes” in expense management.

Nor has JPMorgan announced any sweeping changes to its branch network. Piepszak said the bank is “learning a lot and there’s still a lot more to learn” when it comes to customers' branch preferences and behaviors.

The bank

“It is possible that we de-densify in certain markets while we continue to expand into new markets,” Piepszak said.

Bank of America is still spending $700 million to $800 million per quarter in technology investments, CEO Brian Moynihan said during the Barclays conference. He said the company is working to keep expenses “relatively flat” going forward while still continuing some market expansion and building out its branch network.

“We said we wouldn't lay off this year, and we haven't,” Moynihan said. “We can invest heavily in growing the franchise.”