Transforming a 152-year-old institution is no easy task.

But Dime Community Bank in Brooklyn, N.Y., is hoping that Kenneth Mahon, a longtime veteran of the company poised to take over as CEO on Jan. 1, will be able to move it beyond its historical roots in multifamily lending and into other business lines, such as commercial and industrial loans. Banks' heavy concentrations in multifamily and other commercial real estate lending have drawn scrutiny from investors and regulators lately.

The transition will be slow, said Mahon, who will have to build Dime's expertise in new niches while holding costs down and maintaining credit quality. That tall order, emblematic of the challenges facing many of his peers, makes Mahon one of American Banker's community bankers to watch in 2017.

"The Dime model as it exists today … I just don't think we can run forever because of the regulatory regime, and investors like diverse lines of business," Mahon said. "I don't expect this model to change after a year or two. We see this as a long-term solution."

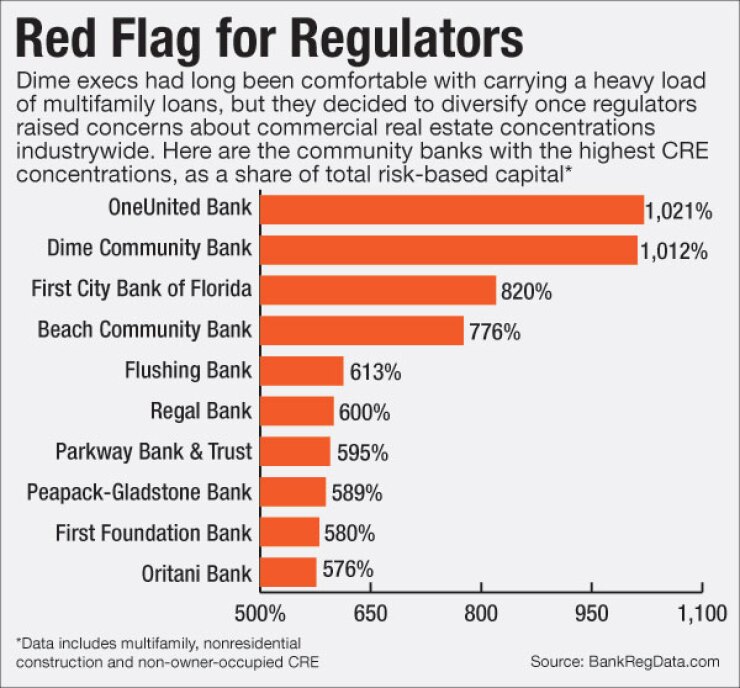

Mahon likes to describe the $5.8 billion-asset bank's focus on multifamily lending in New York City, primarily lending on prewar buildings with rent-controlled units, as more of a "specialization" rather than a concentration. At Sept. 30, its CRE loans were more than 1,000% of total risk-based capital, the second-highest percentage in the country for banks with assets of less than $10 billion, according to BankRegData.com.

He noted that this number has been significantly elevated for more than a decade, and Dime has been comfortable with it because of its deep expertise in the asset class and its historically low losses.

However, the industry is changing, and Dime has to make adjustments. Regulators

"If regulators worry about something, then investors tend to worry about it," said Robert Kafafian, president and CEO of the Kafafian Group. "It's better to diversify your risk and portfolios than it is to be concentrated. I think that's pretty standard for the industry right now. Diversity is good."

In the past, Dime has done much of its lending through mortgage brokers who take bids from banks to find the best loans for landlords throughout the city. Now management wants to move into more of a direct-lending model, though "it won't be a big part of our business for the next few years," Mahon said.

The switch will require a broader suite of products offerings, such as commercial or home loans for business owners, Mahon said. To ramp up this effort, the company has hired executives who are more familiar with retail and small-business banking from larger competitors.

"These customers will see you as their primary banker when they have a credit need, so that is the buildout that will happen," Mahon said. "It will be a slowly evolving part of our business here, but we felt like it was something we had to start down the road on."

Dime's recent

Mahon, who is currently the president and chief operating officer, was seen as a good choice to take over for

"It's like pushing a big rock up a hill," Fitzgibbon said. "The company recognizes that. They are not going to try to be all things to all people. They will pick a few things to do in a reasonable time period without abandoning multifamily lending."

For one, Mahon will work to ensure the company keeps its operating expenses low, traditionally a hallmark of Dime. Its efficiency ratio was just under 49%, according to Dime's third-quarter earnings report.

Secondly, he also wants to keep credit quality strong, another factor that has set the company apart from some of its peers. The company's ratio of nonperforming loans was 0.07% in the third quarter.

There is sometimes a risk in branching out into new areas of loans, Kafafian said.

To gain expertise, Dime is working to recruit new lending teams in addition to enhancing the company's technology infrastructure, Mahon said. Bringing on lending teams can be tricky, Kafafian said. It's a matter of finding quality lenders and then allowing them the space to build their book, he added. Unfortunately, Kafafian has seen some banks give free rein to the wrong employees.

"It does take time to establish a reputation with commercial borrowers," Fitzgibbon said. "You have to go out and find capable, qualified people to help grow that business, and those folks are hard to find and hard to convince to come to an institution that hasn't done any commercial lending."

The company is also becoming more visible in the community by devoting more of its marketing budget to things like sponsoring Little League teams. Employees are being asked to become more involved in organizations outside of the bank, Mahon said.

"It is all about execution," Mahon said. "It's about having smart people who understand that we need to keep credit and operating expenses low if we want to continue to be a top performer."