Improved margins are helping many banking companies offset loan losses, offering a clear path to profits if lenders can clean up their loan books.

With deposits in ample supply and lending risks seen as acute, bankers have been able to drop rates on liabilities, while charging more for money. In the short term, this equation should mean fatter margins, at least for the rest of this year.

Banks face a bitter irony further out, however: should the very economic improvements they thirst for occur, they could sweep away the factors that have been working in the banking industry's favor. While margins are expected to keep rising this year and level out in 2010, they could contract in the long run as rates on deposits rise to lure depositors away from a resurgent stock market, and credit terms loosen as banks once again compete to lend.

For now, though, even a flicker of good news is welcome to a beleaguered industry.

Take Wells Fargo & Co., whose second-quarter margin expanded 14 basis points from the first quarter, to 4.3%, mainly because its average consumer checking and savings deposits increased 20% from the first quarter on an annualized basis, to $613.3 billion.

"We have a much higher percentage of core deposits in the form of checking and savings accounts than any other bank in the country, which accounts for our wide margin," Howard Atkins, chief financial officer of the $1.3 trillion-asset San Francisco company, said in an interview last week.

James Bradshaw, an analyst at Bridge City Capital LLC in Portland, Ore., said banking companies posting wider margins should be in a better position to post profitability ratios above their peers.

"Everyone's now looking at the pretax, pre-provision revenue line for banks, trying to determine what their earnings power will be when provision expenses return to normal," Bradshaw said. "In about two to four more quarters, we expect to see significant profitability from a lot of these banks, instead of just break-even or losses."

Brett Rabatin, an analyst at Sterne, Agee & Leach Inc. in Nashville, said the industry continued to attract low-cost core deposits for two reasons: retail customers continued to choose banks' deposit products over investing in the stock market; and business customers kept parking their operating income at banks instead of spending it to increase their inventories, build warehouses or expand their service area.

As the economy improves, retail customers are expected to return to the stock market or choose higher-yielding deposit products, and commercial customers will reinvest in their businesses. As a result, growth in low-cost demand deposits one of the biggest drivers of the current margin expansion trend will abate somewhat.

Deposit repricing helped banking companies like First Horizon National Corp. to a great extent, analysts said. In the $28.8 billion-asset Memphis company's conference call July 17, CFO William "B.J." Losche said its net interest margin "was a real bright spot this quarter," improving by 16 basis points compared with the first quarter, to 3.05%.

"We benefited from reduced deposit funding costs as promotional money market savings balances reprised at materially lower rates," Losche said. "We also experienced improved spreads on new and renewed loans, although lack of significant loan demand here muted that benefit so far."

Many banking companies benefited from better spreads on loans because they were able set actual floors on their loans and rely less on pricing based on floating Libor rates, Rabatin said.

One such company was the $63.6 billion-asset Comerica Inc. in Dallas, a big commercial and industrial lender to middle-market companies. Its margin rose 20 basis points from the first quarter, to 2.73%.

However, excess liquidity narrowed Comerica's margin by about 8 basis points, CFO Beth Acton said in the company's conference call last week. Comerica had more cash on hand in the second quarter because of strong deposit growth and weak loan demand, and also because of the sale of mortgage-backed government agency securities.

Comerica chose not to invest its excess liquidity in longer-term securities ahead of possible increases in interest rates, instead depositing $1.8 billion in the Federal Reserve System in very low-yielding overnight funds.

"We believe that the net interest margin will continue to benefit from improved loan pricing and maturities of higher-cost funding," but "excess liquidity is expected to offset those benefits for the near term," Acton said.

As a result, Comerica's margin in the third quarter should be little unchanged from the second quarter, she said. Excess liquidity is expected to diminish during the fourth quarter because of maturities of wholesale borrowings, which should result in margin expansion.

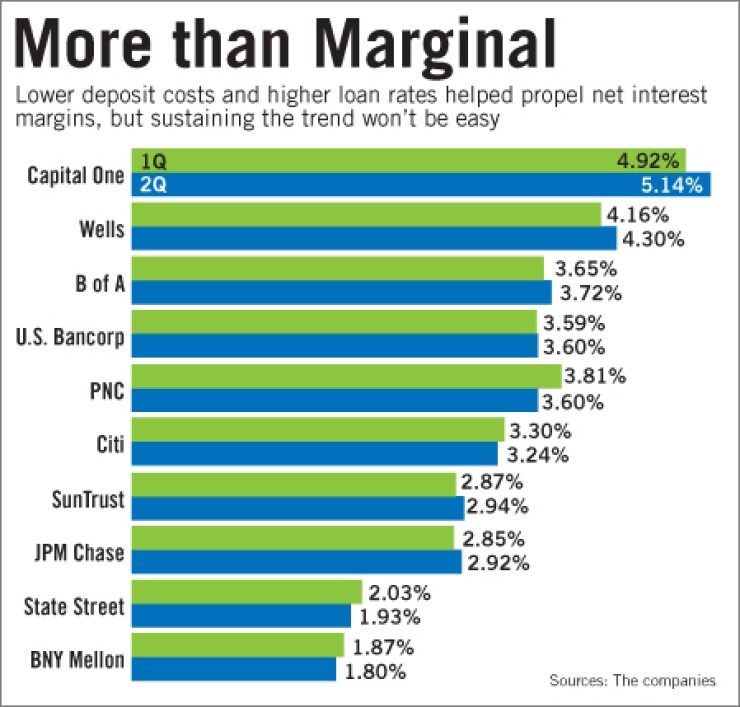

Not all banks experienced margin expansion in the second quarter.

Margins contracted at companies including PNC Financial Services Group Inc. in Pittsburgh and Marshall & Ilsley Corp. in Milwaukee, in part because of higher amounts of nonaccrual loans that resulted in interest rate reversals, analysts said.

Banks did not receive interest income on those nonperforming loans, and they also had to subtract the interest they recorded on the books for those loans in the first quarter, because the loans had actually ceased to perform during the quarter.

PNC's margin, which fell 21 basis points from the first quarter, to 3.6%, was also hurt as the company continued to "de-risk" its balance sheet by reducing loan balances and reinvesting in lower-risk assets, such as U.S. Treasury and government agency securities, and maintaining increased balances in interest-earning accounts with the Federal Reserve.

The "de-risking" will continue to control PNC's margin for the short term, CFO Rick Johnson said in the $280 billion-asset company's conference call last week.

Though certificates of deposit will be repriced lower, PNC will likely sell some of its more risky assets, while commercial customers will likely continue to pull back on their credit lines.

As a result, PNC's margin will likely further contract, Johnson said.