Regional banks not named SunTrust or BB&T must be mulling what the new merger partners have clearly concluded: In an era where technology is king, size is necessary to compete with the nation’s largest banks.

But whether more big mergers will follow in the wake of

In the case of BB&T and SunTrust, the stars aligned. BB&T CEO Kelly King is 70 years old. He plans to serve as chief executive of the combined bank until September 2021, at which time he will hand the reins to SunTrust CEO William Rogers, who is more than a decade his junior.

The two Southeast-based companies have branch footprints with substantial overlap, which offers certain advantages that would be unavailable in many other potential mergers of large regional banks.

The combined firm is expected to cut costs by closing redundant branches, and to

“That means you should be able to have pricing power,” said Brian Klock, an analyst at Keefe, Bruyette & Woods.

The industry’s first megamerger in at least a decade sparked chatter Thursday about whether combinations of other large regional banks will follow suit.

“You’re going to see more similar transactions,” predicted John Allison, a former BB&T chairman and CEO, who said that the opportunities for large regional banks to gobble up smaller competitors in their markets have waned.

“There are a lot of bankers who are going to sit down and think, ‘I’m beating my head against a wall, they’re beating their heads against the wall, maybe it’s time for us to stop fighting over who’s going to run the Kiwanis Club and get together,’ ” said Walter Moeling, a longtime banking attorney in Atlanta, who is now retired.

Christopher Wolfe, managing director and head of North American banks at Fitch Ratings, agreed the deal “could be a catalyst for further consolidation amongst large regional banks that are looking to take on the big national players” and speculated that regulators would be open to such combinations.

"Washington D.C. appears to be warming up to large bank M&A after a 10-year slump since the crisis,” Wolfe said in an emailed statement.

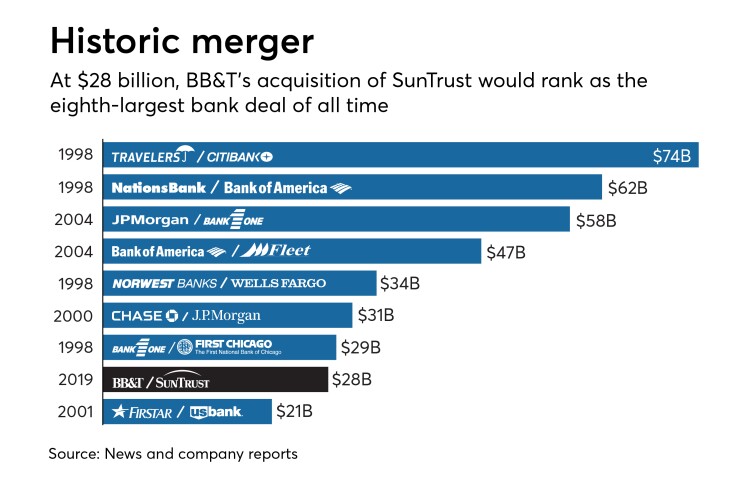

The industry hasn’t seen a combination of healthy banks of this size since a wave of mergers in the late 1990s and early 2000s.

In a span of weeks in 1998, the insurance giant Travelers struck a deal for Citigroup, NationsBank merged with Bank of America, Bank One acquired First Chicago Bank, and Norwest bought Wells Fargo.

Those deals started a wave of combinations of smaller regionals over the next several years, including Firstar’s acquisition of U.S. Bank, Chase Manhattan Bank’s purchase of J.P. Morgan and First Union Bank’s acquisition of regional rival Wachovia Bank. (In many of those examples, the buyer wound up taking the seller’s name.)

But some observers are skeptical that another wave of large mergers is coming.

“I think anybody who says that is engaged in stargazing or wishful thinking or both,” said H. Rodgin Cohen, a partner at Sullivan & Cromwell, which advised SunTrust on the merger with BB&T.

Cohen noted that in a so-called merger of equals, which is how the BB&T-SunTrust deal is being billed, both banks must make compromises on big issues. Those matters include the location of the headquarters, the composition of the leadership team and the membership of the combined company’s board of directors.

“These transactions are difficult to negotiate,” Cohen said.

Executives at numerous large regional banks declined to comment on whether the deal puts pressure on similarly sized banks to join forces to remain competitive.

But the stock prices of several large regional banks rose Thursday following the announcement of the BB&T-SunTrust deal. By late afternoon, shares in Huntington Bancshares, KeyCorp, Citizens Financial Group and M&T Bank were all up by more than 2% even as broad stock-market indexes slid.

The rising prices of regional bank stocks could create an incentive for executives at various banks to think about the possibility of a merger, said Stephen Scouten, managing director at Sandler O’Neill. But he argued that there is a dearth of potential buyers.

The nation’s four largest commercial banks — JPMorgan Chase, Bank of America, Wells Fargo and Citigroup — are widely seen as unlikely to buy a large regional bank.

Scouten argued that mergers between smaller regional banks, such as the recent deal between TCF Financial in Wayzata, Minn., and Chemical Financial in Detroit, may still be more likely than bigger deals.

“BB&T and SunTrust are telling you that scale is more important than it ever has been, and I think that’s going to be even more true as you move down the spectrum,” he said.

Todd Baker, a former banker turned consultant, said that regional institutions face a choice in an era when the largest banks are making massive investments in technology.

Regional banks can either pursue a niche strategy — focusing on a particular lending segment, for example — or they can join forces, as BB&T and SunTrust are doing.

“The theory here is combine the companies, cut a lot of costs and plow that cost-cutting into technology investment,” said Baker, managing principal at Broadmoor Consulting and a senior fellow at Columbia University’s Richman Center. “They can’t keep up with the technology spend of the megabanks.”

Paul Davis, Alan Kline and John Reosti contributed to this story.