Citizens Financial

Citizens Financial

Citizens Financial Group is a retail bank holding company operating primarily in the New England, Mid-Atlantic, and Midwest regions of the United States. The bank operates through two segments: consumer and commercial banking.

-

The Providence, Rhode Island-based bank has steadily revamped certain parts of its strategy. Now, it will update its systems for serving customers.

January 21 -

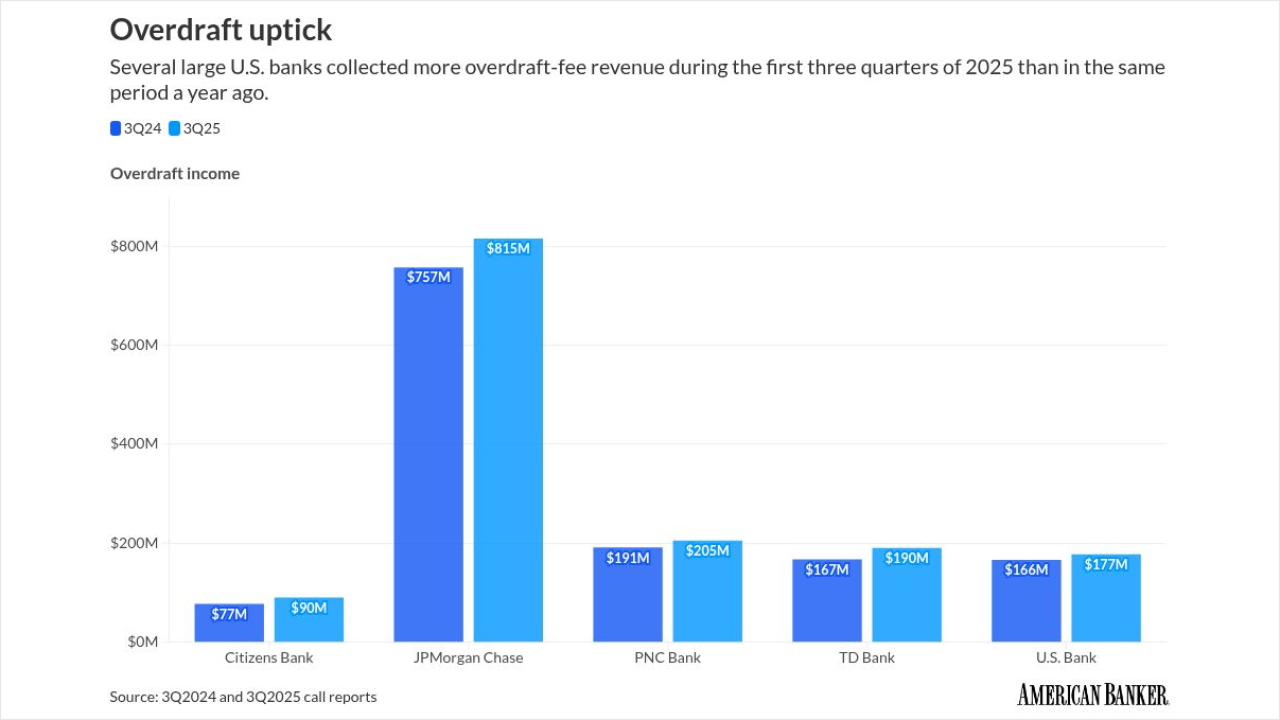

Several large U.S. banks reported an uptick in overdraft-related income for the first three quarters of 2025. Economic pressure on consumers may be to blame, some banks and industry observers say.

January 9 -

After Citizens CEO Bruce Van Saun announced a company-wide AI makeover, Chief Information Officer Michael Ruttledge told American Banker about what's happening under the hood.

December 1 -

Reskilling and giving AI the boring work are two approaches banks take to making agentic AI palatable to workers who may fear that bots will take their jobs.

November 20 -

Amid a surge in bank mergers, Citizens CEO Bruce Van Saun said the Providence, Rhode Island-based bank is largely focused on organic growth. "It would have to be a pretty high bar for us to go down that path," he said.

October 15 -

The regional bank has launched a digital student banking center that's part of a broader strategy to focus on relationship-building.

October 10 -

Don McCree, who has led commercial banking at Citizens since 2015, plans to retire next year. His successor, Ted Swimmer, who was in charge of capital markets, took over on Tuesday.

October 7 -

The Providence, Rhode Island-based bank has hired Aunoy Banerjee as its next CFO, a role that will be vacated by State Street hire John Woods. Banerjee is currently the CFO of Barclays Bank PLC.

August 12 -

The Rhode Island-based bank plans to use artificial intelligence to boost efficiency and improve customer service. "Everything is fair game," said CEO Bruce Van Saun.

July 17 -

Time is running out for the 90-day pause on most of President Trump's tariffs. But at least two bank CEOs are confident there won't be a summer sequel to "Liberation Day."

June 27 -

Truist, Texas Capital and Citizens Financial are among the banks that will be forced to address shareholder dissatisfaction over executive pay.

May 2 -

Citizens Financial Group's promotion of Brendan Coughlin to company president comes at the same time as CFO John Woods prepares to leave for State Street. Both executives have been viewed as potential successors to CEO Bruce Van Saun.

April 30 -

President Donald Trump's tariff policies will strain some banks' business customers, as their supply chains will have to be reconfigured. But uncertainty is the real headwind.

March 12 -

The Providence, Rhode Island-based regional bank plans to create a new senior executive role that will focus on corporate strategy, rather than directly replace Johnson as chief experience officer.

January 31 -

The Providence, Rhode Island-based company launched its private bank in 2023 after a spate of bank failures left holes in the market. "It's not like I'm asking anybody to wait for delayed gratification," CEO Bruce Van Saun said Friday.

January 17 -

The availability and visibility of Bank On-certified accounts, which aim to expand banking access, is contributing to a decrease in the percentage of U.S. households that are unbanked, according to bankers and government officials.

December 4 -

The regional bank's earnings were impacted by challenges in its office loan portfolio, though its overall results were a mixed bag, with its nascent private bank showing momentum.

October 16 -

After the bank's 2014 spinoff from Royal Bank of Scotland, its executives worked to shore up weaknesses. Now they're concentrating on how to close the gap with regional banking peers.

September 24 -

For at least the fifth consecutive quarter, the Providence, Rhode Island, company increased its allowance for credit losses on general office loans, which continue to be a problem area for banks.

July 17 -

The Providence, Rhode Island, company is having discussions with private wealth management teams elsewhere as it seeks to expand its fledgling private bank. In just three months, private banking deposits doubled to $2.4 billion.

April 17