HSBC is playing coy about the future of its U.S. retail banking unit — perhaps a smart negotiating tactic in a hot M&A market.

Instead, executives said Tuesday they are still exploring “organic and inorganic options” for the retail unit and reaffirmed the plan

An HSBC spokesman declined to say if discussions are underway with potential buyers who might be interested in all or part of the company’s far-flung U.S. franchise, which is split between the East and West coasts.

If the unit is on the block as many suspect, it could be in HSBC’s interest to take its time in a seller’s market, according to Chris Marinac, an analyst at Janney Montgomery Scott.

M&T Bank, Huntington Bancshares and PNC Financial Services Group have each announced sizable merger agreements in recent months. Citizens Financial Group says it’s open to a bank deal, and New York Community Bancorp is actively on the hunt.

“Deals beget deals, and the more transactions you have, the better off the pricing will be,” Marinac said. “The more transactions, the higher the price.”

HSBC is undergoing the latest in a series of global overhauls in the past decade to improve profitability. The current cost-cutting effort aims to trim $4.5 billion from expenses, reduce headcount by 35,000 and sell $100 billion of assets in certain markets.

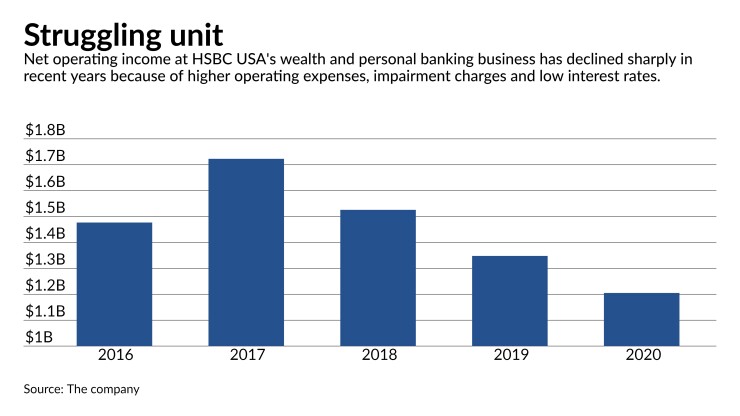

HSBC USA — whose headquarters is in Tysons, Va. — is one of the company’s struggling units. It has been weighed down by provisions for consumer and commercial banking that started rising even before the pandemic recession, back-to-back impairment charges in 2019 and 2020, higher operating expenses and the near-zero interest rate environment.

Last year the U.S. subsidiary closed about 80 branches, or 30% of its network, and shrank its workforce by 14%. In total, it brought costs down in the U.S. by 8% or by $302 million, the HSBC spokesman said.

The branch cuts took place a year after the company set out to

In an annual report on U.S. business operations, the company said it will “continue to explore strategic options” for its retail operations in order to “focus on [its] high net worth client base and wealth management products.” HSBC has said it may add wealth management centers to some branches.

The question of what will happen to the U.S. retail banking franchise coincides with the bank’s review of its retail operations in France. On Tuesday, HSBC Group Chief Executive Noel Quinn said HSBC is “in negotiations in relation to a potential sale” of that business, but “no decisions have yet been taken.”

Regarding

While M&T might no longer be on the list — on Monday, the $142.6 billion-asset company

“I would think New York Community would be more interested now” given the company’s

“We’re going to partner [because] partnerships will get it done a lot quicker and will make rational sense,” Cangemi told investors Jan. 27 during the company’s fourth-quarter earnings call.

One thing is clear about HSBC’s restructuring plans: It doesn’t plan to exit the U.S. in full, according to analyst Maria Rivas of DBRS Morningstar, who follows the company.

“Today HSBC announced that it will continue to maintain a good presence in the U.S. and will focus over the coming years on its international corporate and institutional franchise in the U.S.,” she said in an email. “HSBC aims to leverage its U.S. franchise to connect with Asian businesses and clients, which it hopes will translate into business and revenue growth” for the company.