For years, bankers have said that they would happily return more capital to shareholders if only the Federal Reserve would let them.

But a number of regional banks may soon be free to do so, if a bill to roll back post-crisis regulations is signed into law this year.

The bill, backed by the Senate in mid-March, would raise the asset threshold for systemically important financial institutions to $250 billion from $50 billion, exempting roughly 20 banks from the Fed’s annual capital review. If the bill passes the House in similar form, these regional banks — many of which are sitting on piles of excess capital — would be able to boost dividend payouts and buy back more of their shares without having to ask the Fed for permission.

On first-quarter earnings calls set to begin next week, investors and analysts will be listening closely to CEO comments for any hints of how banks might deploy excess capital in the coming years if the asset threshold is raised to $250 billion.

While some banks looking to gradually reduce their capital cushions might opt to buy back more shares or pursue acquisitions, analysts said that they expect most to respond by boosting dividend payouts to shareholders. The Fed has discouraged banks from paying out more than 30% of their earnings through dividends.

“If I had to guess, you will see total capital returns increase, but the predominant lever is going to be dividends,” said Scott Siefers, an analyst with Sandler O’Neill & Partners.

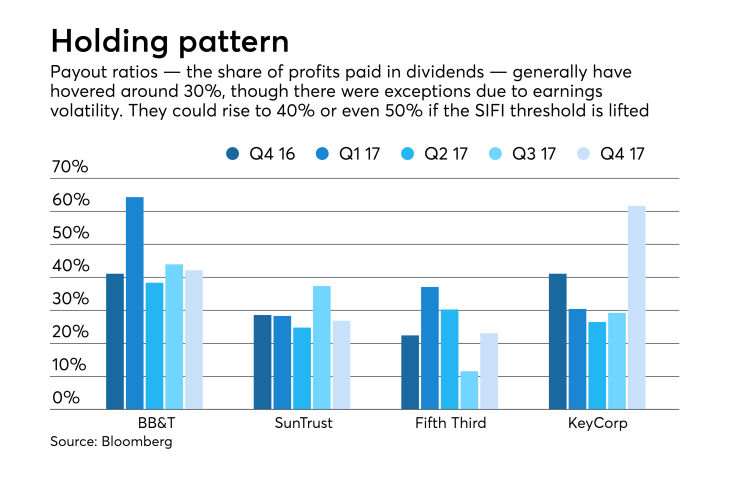

Payout ratios — the share of profits given back to investors through dividends — have hovered around 30% in recent years. Before the financial crisis, and the creation of the Fed’s Comprehensive Capital Analysis and Review, most banks paid out about 40% of their profits as dividends.

As of Dec.31, SunTrust Banks in Atlanta and Huntington Bancshares in Columbus, Ohio, had ratios in the high 20% range. Winston-Salem, N.C.-based-BB&T, meanwhile, has been an outlier among its peers, reporting a ratio of around 40%.

If the regulatory rollback bill is signed into law, expect payout ratios for midsize banks to climb in the coming years — perhaps even approaching as high as 50%, analysts said.

Of course, there is no guarantee that the regulatory relief bill that passed the Senate in mid-March will have the same support in the House. Jeb Hensarling, a Texas Republican who chairs the House Financial Services Committee,

Bankers can expect to field lots of questions about their long-term capital plans during first-quarter earnings calls, though analysts acknowledged that they are unlikely to provide much detail given the uncertain fate of the legislation.

Similarly, bankers will likely stay mum about their most recent submissions to the Fed, analysts said.

By the time earnings season kicks off next week, most banks will have submitted their 2017 capital plans to the Fed. For this year’s CCAR process, the central bank

The test examines a bank’s projected performance over nine future quarters. The results will be announced by the end of June.

Given the severity of this year’s exams, bank executives may signal during first-quarter calls that, while they plan to return more capital than in previous years, they still need to stay cautious.

“They’re trying to rein in expectations,” said Brian Klock, an analyst with Keefe, Bruyette & Woods.

Over the longer term, though, analysts expect capital returns to move up meaningfully, as banks look for ways to boost profitability. If the SIFI threshold is lifted, regionals could start returning capital faster and in larger quantities than they have at any time since before the crisis.

Many midsize banks — a group that mostly focused on the basic business of lending and deposit-taking — have capital cushions that are simply too large when weighed against the credit risks they take, according to industry analysts. That imbalance is acting on a drag on overall profitability.

Most regionals have a common equity Tier 1 capital ratio of around 10%; they need a ratio of at least 7% to pass muster with regulators.

While no banks are expected to drastically shrink their capital ratios, some have indicated that they see an opportunity to safely scale back on reserves they view as excessive.

SunTrust, for instance, has provided some insight about its long-term target.

As of Dec. 31, SunTrust had a CET1 ratio of 9.8%. The $202 billion-asset company has indicated that it would like to lower its capital ratio to the “high end of 8%,” according to Klock.

“There’s probably a percentage point or two that [regional banks] could redeploy or give back to shareholders,” said Marty Mosby, an analyst with Vining Sparks.

Mosby noted that, in addition to dragging down results, an “overabundance of capital” can also encourage banks to take on too much credit risk as they search for yield.

In addition to raising dividends, another option banks have for deploying excess capital is to repurchase shares. But given the run-up in stock prices over the past 18 months, most analysts view buybacks as less attractive and less efficient.

Banks would most prefer to deploy capital by booking more loans, though they are unlikely to meaningfully expand their portfolios until commercial loan demand, which has been lackluster in recent quarters, picks up.

Acquisitions are an option, too, but many would-be buyers have said they are reluctant to pull the trigger on deals until sellers lower their asking prices.

Mosby, for his part, said that increasing dividend payouts would, in some ways, signal that the industry has fully recovered from last decade’s financial crisis.

In the immediate aftermath of the mortgage meltdown, the banking industry focused on recovering from bad credit. Then, since late 2015, banks have adjusted their strategies to account for rising interest rates, Mosby pointed out.

The industry’s focus over the next three years, from now through 2020, is going to be deregulation and the deployment of excess capital, he said.

“This is the third leg of a stool that’s going to be the longest recovery period that banks have ever had to go through,” Mosby said.