Some community bank CEOs believe the window for smaller institutions to innovative and become more competitive in small-business lending is closing.

Traditional competitors are quickly raising their game, often by partnering with tech firms. And nonbanks are also taking steps to put themselves in better position to compete.

USAA

Bank of Montreal introduced BMO Business Xpress, a small-business lending platform that can reduce approval times from weeks to minutes.

With each announcement, a new sense of urgency should set in.

“All of these announcements have been made in the last 30 days,” said Dana Stonestreet, chairman and CEO of HomeTrust Bancshares in Asheville, N.C. “As community banks, we have to get really good at making loans quickly.”

Stonestreet, along with Laurie Stewart, president and CEO of Sound Financial, and Jim Rieniets Jr., president and CEO of Insbank, is scheduled to discuss the issue on Nov. 30 at American Banker's

A big problem, these CEOs say, is that community bankers are underestimating looming threats, particularly from the tech sector.

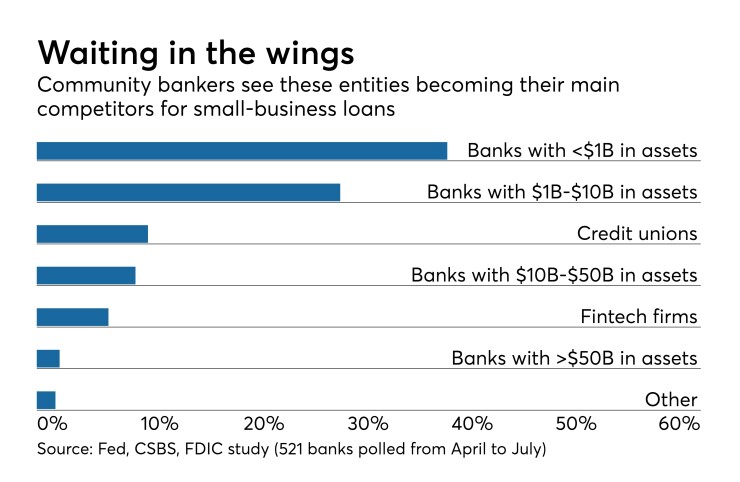

Roughly 7% of community bankers view fintech as their main competitor in the future for small-business loans, according to a survey of 521 banks conducted between April and July by the Federal Reserve, the Conference of State Bank Supervisors and the Federal Deposit Insurance Corp.

Only 0.2% of community bankers currently see fintech as their primary competitor.

“Most bankers don’t realize how tough that competition could be,” Stewart said. “They are oblivious to it.”

Community banks must think of ways to eliminate redundancies and review applications faster than ever. As a result, technology upgrades must go way beyond expanded products and services.

“We often think of technology on the customer-facing side, but to adequately compete banks are well-advised to focus on things that are internal,” Rieniets said.

Insbank hired nCino three years ago to streamline and automate much of its approval process.

“It required a lot of work for a year and a half, but we were able to eliminate duplicate data entry and keystrokes,” Rieniets said. “Now we’re handling things in a more efficient way.”

HomeTrust, which just got into equipment finance, is making improvements largely on its own after hiring someone with tech savvy to update its systems, Stonestreet said. The company has also adopted the PayNet scoring system to help its lenders evaluate potential borrowers.

While HomeTrust is running applicants through an automated scoring process, it is also taking a look at each loan. There will be times where lenders will take a harder look at certain applications before deciding whether to extend credit.

“We’ll be a bit more hands on,” Stonestreet said. “We’re looking to balance speed with risk.”

To be sure, small banks shouldn’t look to compete with fintech for every small-business loan. In many cases, someone who needs a loan approved quickly may not be the best credit risk.

“I am a bit contrarian because I don’t think promoting credit decisions just [based on] speed is good for business,” Rieniets said. “I don’t want to compete if fintechs are doing things that are unsustainable. I can’t compete against largess.”

Insbank’s biggest opportunities are with businesses with less than $25 million in annual revenue and have borrowing needs of more than $250,000, Rieniets said. Anything bigger is the domain of larger banks; those that are smaller seem primed for the “easy button” model of a fintech firm.

“You have to know who you are and what you’re trying to be before you line up your processes,” he said.

Community banks must also remember to value client relationships.

A recent study by J.D. Power found that roughly a third of small-business customers feel their bank appreciates their business. Less than a quarter of the nearly 8,000 businesses surveyed between June and August said their bank anticipates changes in their banking needs.

“Increasingly there is opportunity to bank smaller businesses if we can do it efficiently and remotely,” Stewart said, adding that bankers are in a prime position to help borrowers in areas such as payments and cybersecurity.

Small banks should also be able to bring in lower-cost deposits, but they have to find a way to approve and underwrite loans swiftly.

“There are huge opportunities on both sides of the balance sheet,” Stewart said. “We just have to be nimble.”