-

American Banker's 2025 Small Business Banking conference yielded lessons about the need for speed, simplicity and safety in small-business lending. Other key takeaways included the significance of digital payment options and the importance of continuing to process SBA loan requests during the government shutdown.

October 29 -

Brian McEvoy, chief retail banking officer at Webster Five in Central Massachusetts, says community banks are in a unique position to serve more small businesses. He was a speaker Tuesday at American Banker's 2025 Small Business Banking conference.

October 28 -

In an environment of persistent economic unease, banks have a unique opportunity to help small businesses, Sekou Kaalund, U.S. Bank's head of branch and small business banking, said at American Banker's 2025 Small Business Banking conference.

October 28 -

Triad Business Bank in North Carolina, which opened in March, has made $106 million in Paycheck Protection loans.

May 17 -

The agencies produced an application process that includes favorable interpretation of qualifying expenses.

May 15 -

Oxygen helps customers obtain business licenses and separate their personal and business lives. Its says its services will be in demand as the pandemic accelerates a shift away from traditional jobs.

May 15 -

Up to 12% of loans under the $660 billion small-business rescue program could be tied to misleading or completely phony applications, fueling concerns about lenders' potential liability.

May 7 -

StreetShares, started as a peer-to-peer service for veterans, has added a platform intended to connect small financial institutions and underbanked companies.

September 22 -

The acquisition of Radius Intelligence fits with the online lender's existing focus on small commercial borrowers.

September 3 -

Entrepreneurship among veterans has been declining over the past 20 years, according to a report by the SBA and the New York Fed.

November 12 -

Entrepreneurship among veterans has been declining over the past 20 years, according to a report by the SBA and the New York Fed.

November 9 -

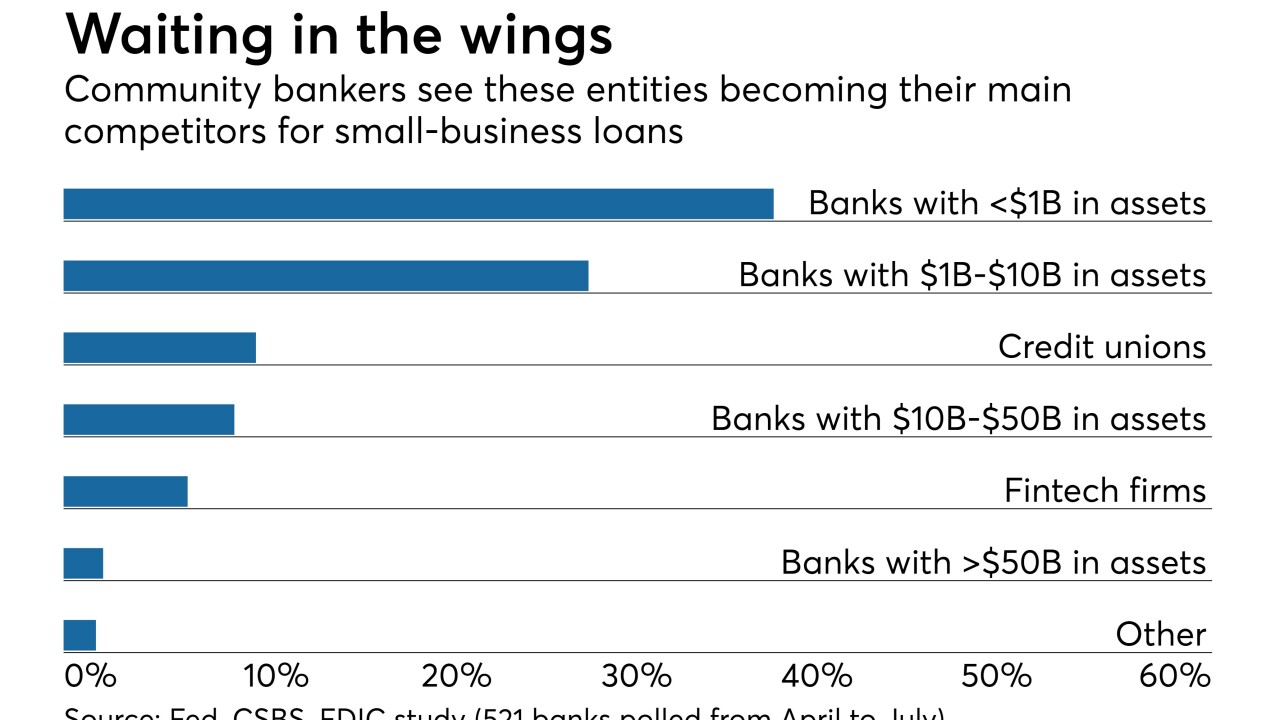

Big banks and fintechs are aggressively adding digital capabilities to process applications quickly, creating a sense of urgency for community banks.

November 6 -

Azlo, Bento, Bank Novo and other neobanks argue they are better at helping small businesses, giving them extra attention, technology and advice.

October 31 -

Traditional financial institutions still have an advantage over challenger banks when it comes to building relationships with small merchants, despite scandals that have befallen megabanks.

October 30 -

The New York unit of Popular has contracted with Biz2Credit to automate commercial loan approvals and handle the underwriting for applications under $100,000.

October 30 -

-

The agency says lenders lacked the risk appetite, while bankers point to concerns over turnaround times and strict loan terms.

October 25 -

The $380-billion asset company will soon join the parade of big banks and tech companies that are migrating online to meet the demands of business owners.

October 22 -

Bigger banks appear to be losing C&I share to small and midsize lenders. That's raising questions about whether community banks — known more for commercial real estate lending — have enough expertise to underwrite deals that larger banks avoid.

October 17 -

The San Antonio bank will refer customers seeking small-business loans to StreetShares, a financial startup that is similarly focused on serving veterans of the U.S. military.

October 16