-

FirstMerit's deal for Citizens Republic in Michigan sent a message that acquisition prospects in Chicago are weaker than first thought — and deal forecasters back to the drawing board.

September 18 -

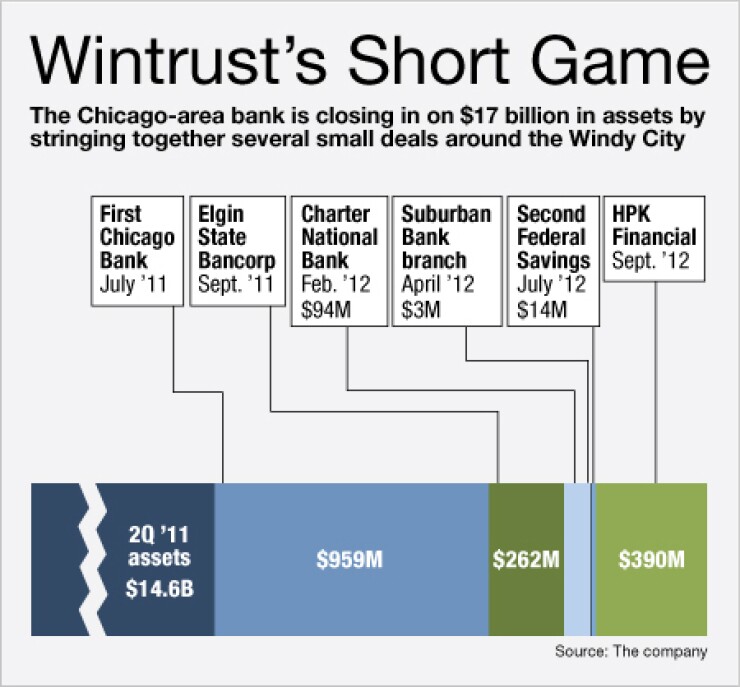

Wintrust Financial (WTFC) has agreed to buy HPK Financial, the parent of Hyde Park Bank and Trust.

September 19

Wintrust Financial (WTFC) continues to find buyout deals where others do not. Maybe because it is looking the hardest.

The latest example is the Rosemont, Ill., company's

Industry observers say Edward Wehmer, Wintrust's president and chief executive, and his team use their connections well.

"M&A is an active business line for them, like deposit gathering and lending," says Peyton Green, an analyst at Sterne Agee & Leach. "They didn't do much for a few years, but during that time they maintained relationships and stayed in touch, and I believe that the two-way dialogue has helped them."

FirstMerit of Akron, Ohio, was

FirstMerit entered Chicago in 2009 and had once been bullish on deals there. Instead, FirstMerit agreed last week to buy Citizens Republic in Flint, Mich.

Analysts say most big banks in Chicago are interested in monumental deals in the city, but they all envision themselves as buyers. The real action involves small banks Wehmer says.

"It is going to be hard for the smaller banks to achieve the same sorts of success going forward, not just because of the regulatory costs and complexities," he says. "It is going to be harder for them to find growth."

Small banks also mesh with Wintrust's goal of strengthening its foothold on Chicago.

"Our plan is to be in every suburb and neighborhood of Chicago," Wehmer says. "We're not out to hit home runs. We're happy with singles and doubles."

The $17 billion-asset Wintrust remains open to larger acquisitions, however.

"Wintrust is unprejudiced as it relates to size," says Chris McGratty, an analyst at KBW's Keefe, Bruyette & Woods. "I think they have an attitude of, 'If it is accretive and adds a couple of branches, we'll consider it.' "

Wintrust's structure might accommodate small acquisitions, too. Other banks dislike such deals because "a conversion is a conversion regardless" of size, Green says.

Wintrust has 15 banks around Chicago. It can either fold a takeover target into an existing bank or it can buy a company and let it operate as a separate unit.

Wintrust, which announced the deal for the $390 million-asset HPK Financial on Tuesday, plans to merge HPK's bank into Beverly Bank and Trust. But HPK's two branches will still operate as Hyde Park Bank.

"The model is appealing to sellers because they can give their shareholders a liquidity event, but continue to operate as they were," says Brad Millsaps, an analyst at Sandler O'Neill.

Small-bank deals give Wintrust a chance to fill in its Chicago market. Wintrust used to focus on the suburbs, but it has been looking more at increasing its coverage across the city in recent years, largely through acquisitions.

"Small community banks are an inexpensive way to extend the footprint," Green says.

Millsaps says that though Hyde Park Bank is well capitalized and profitable, Wintrust is buying it at 82% of tangible book value. Millsaps says Wintrust will likely do more open-bank deals as failed-bank deals without loss-sharing agreements become more popular. Wintrust has landed several deals brokered by the Federal Deposit Insurance Corp., but its management has largely resisted doing any without a safety net.

Millsaps says Wintrust could ramp up acquisitions. "Wintrust is probably the most bullish of the Chicago banks," he says.

Wehmer "is taking what the market is giving him, which is a lot of cheap" deals, Millsaps said. "It is hard to speak about the timing of deals, but they could probably do one a quarter at this size."