While several federal regulatory agencies are working to finalize proposals on climate-related financial risk management that purportedly target the nation's largest financial institutions, the proposals would inevitably subject community banks to new and expensive regulatory burdens. Rather than rush to impose new standards on community banks, the agencies must ensure their climate risk regulatory efforts mitigate the downstream costs their proposals will impose on community banks and the communities they serve.

Recently proposed climate risk regulations would require some community bank customers to collect and disclose greenhouse gas emissions data as a condition of banking. The proposals also would require community banks to pay myriad expenses to comply with climate risk management frameworks — including hiring subject matter experts and compliance specialists to implement these complicated frameworks.

Ultimately, these proposals would cut off local communities from the community banks that best understand and best serve local environments.

Community banks have decades of experience managing concentration risks and responding to extreme weather events and natural disasters in their communities — meaning new, onerous and expensive climate risk management frameworks are counterproductive.

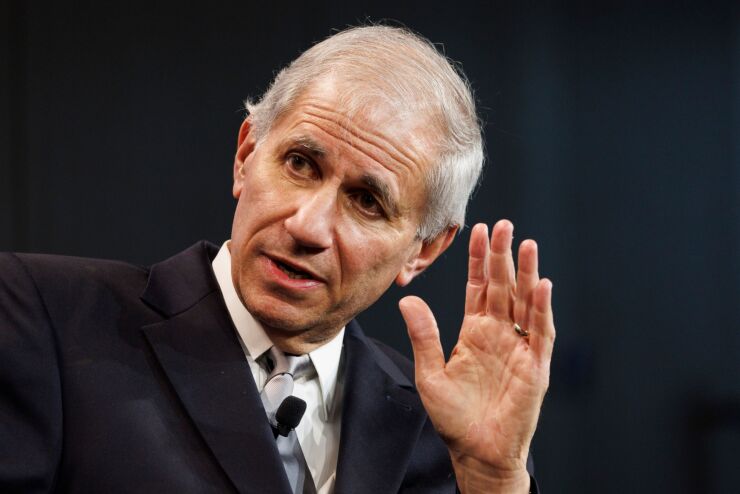

Martin Gruenberg, chairman of the Federal Deposit Insurance Corp.,

For instance, the New York State Department of Financial Services recently

While separate climate risk management

Regulators should not impose climate risk regulations on community banks for the following reasons.

First, current risk management practices protect community banks from climate-related financial risks, as evidenced by the absence of community bank failures following severe weather events.

As Gruenberg noted, community banks have employed a range of risk management strategies for generations and know their communities and loan portfolios better than anyone else. Rather than impose new climate-related guidelines on community banks, regulators should continue to utilize existing and effective risk management supervision practices, which will avoid duplicating requirements and introducing new regulatory burdens.

Second, before contemplating new policies, the agencies should first conduct studies and gather empirical data to determine the extent to which climate-related financial risks affect the safety, soundness and stability of community banks and the financial system.

The FDIC, OCC, Fed and SEC published their proposals without any independent studies to demonstrate climate risk is a threat to bank safety and soundness, raising questions about the validity of their assumptions. But a Federal Reserve Bank of New York

The lack of empirical data points to the third key concern with these proposals — that the government's ultimate motive is to choke off legal but disfavored businesses and industries from the financial system.

While community banks typically are not the primary source of financing for large energy-producing companies, they do provide the majority of small-business credit in communities in which energy production, refinement, agriculture and transportation businesses exist.

Reintroducing the

Resiliency is central to community banks' business model, with their longstanding underwriting and insurance practices addressing the impact of severe weather events and natural disasters since the early 19th century. When local environments flourish, community banks flourish.

But subjecting community banks to mandatory climate risk regulation or enhanced climate-disclosure requirements is unnecessary and would only restrict their ability to meet their communities' needs. Regulators should reconsider their climate risk proposals and their adverse effects on local communities.