Citizens Financial

Citizens Financial

Citizens Financial Group is a retail bank holding company operating primarily in the New England, Mid-Atlantic, and Midwest regions of the United States. The bank operates through two segments: consumer and commercial banking.

-

Unlike online lenders, banks are focusing primarily on consumers with solid credit scores. But unsecured loans to prime borrowers have a limited track record, so it’s hard to predict how they’ll perform when the economy inevitably weakens.

November 22 -

On paper, conditions would seem favorable for regional banks to pursue acquisitions in order to overcome organic growth challenges. But executives have poured cold water on that idea in recent days.

October 19 -

Hamlin caught the attention of the bank's senior leaders when she oversaw the successful launch of a checking product. Now she sits at the center of every major marketing initiative.

September 26 -

At Beth Johnson's insistence, the bank built an analytics platform that can anticipate customers' needs. It's an investment that is paying off in big ways.

September 26 -

Four lenders, led by Sallie Mae, have long dominated the market for private student loans. But they could soon face new competition from Navient and Nelnet.

September 13 -

Some are relying on a national, digital strategy. Others say the right balance of costs and growth comes from more traditional means such as targeted branch openings and out-of-market expansion.

September 12 -

Delinquencies have held steady for a year, and observers are optimistic about upcoming third-quarter data. But the long-term question is whether solid underwriting can overcome higher vehicle prices and consumer debt burdens.

September 7 -

Good old-fashioned commercial credit analysts are a dying breed, David Nicholson says. Community banks need them to stay competitive in C&I, but training courses have been cut back. So he’s on a mission to teach as many students as he can.

August 9 -

Despite some green shoots in key credit segments, total loan growth was light at many banks last quarter. Rate hikes are threatened, and deposits will get pricier — where will the earnings come from?

July 20 -

That helped push total lending growth to 4% and contributed to strong second-quarter earnings at the Providence, R.I., company.

July 20 -

Turnover of chief risk officers is on the rise as CEOs look to add executives whose experience goes far beyond assessing credit risk. Sometimes they are promoting from within, but often they are poaching talent from rival banks.

July 2 -

Commercial real estate is their bread and butter, but many banks are scaling back in this vital loan category. Here’s why.

June 29 -

The recent string of positive news for the banking industry, from lower corporate taxes to less regulation, is starting to feel like a distant memory.

June 27 -

With plenty of cash on hand, many commercial firms have had little need to tap existing credit lines.

June 14 -

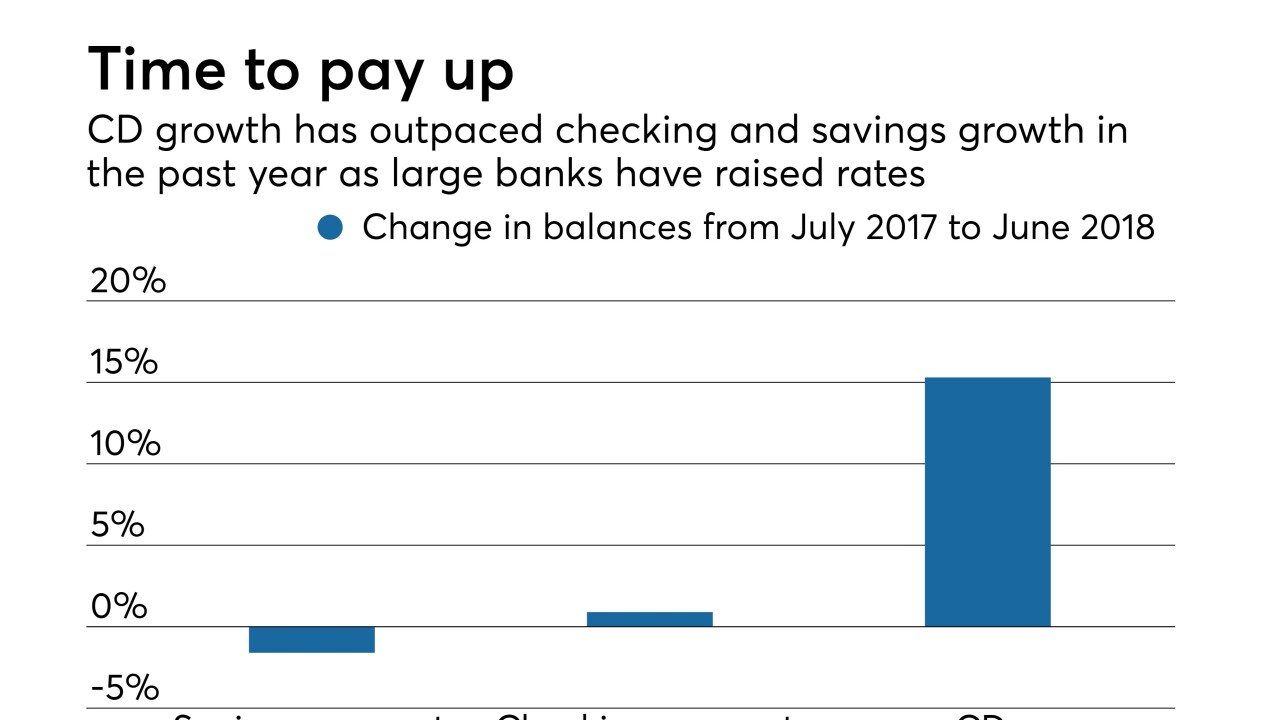

Competition for deposits is heating up as summer approaches, and banks are responding in all sorts of ways — from launching digital-only platforms to raising CD rates to reviving debit rewards. But rising interest rates could weaken demand for loans, especially mortgages.

June 14 -

Citizens Financial Group is partnering with IBM to develop a virtual career coach that will use artificial intelligence to help employees set career goals and determine what kind of training they need to develop new skills.

June 6 -

As other banks de-emphasize mortgage lending, Citizens is spending half a billion dollars to buy a large originator with a big servicing portfolio.

May 31 -

Customers at the Providence, R.I., company were unable to access their accounts, due to what a spokesman described as a "technical issue."

May 30 -

The Providence, R.I., company said that Citizens Access will open for business nationwide next quarter.

May 14 -

Citizens Financial Group plans to merge its two banking charters into a single national bank. The move would make the OCC the bank's primary regulator and eliminate the costs of dealing with the FDIC and state officials.

May 10