-

A legal memo conducted on behalf of the trade group says the agency’s policy goes beyond statutory intent and places undue restrictions on healthy banks.

March 4 -

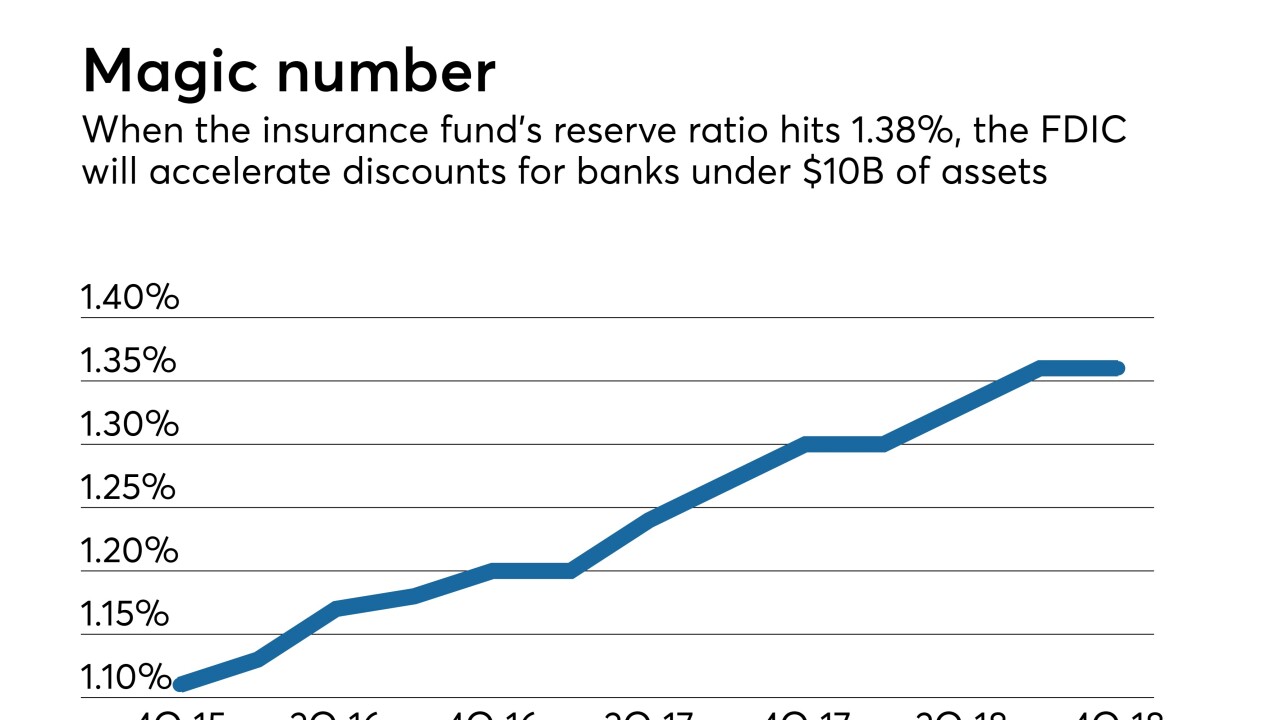

The FDIC reserve fund is nearing a threshold that will trigger a temporary reprieve on deposit insurance premiums for banks with less than $10 billion of assets.

February 28 -

By applying to become an industrial loan company, the fintech would be able to use insured deposit accounts as a cheap source of funding without having to comply with the tough rules banks face.

February 28 Calvert Advisors LLC

Calvert Advisors LLC -

With the two companies said to be still mulling which charter to seek, the various options each have possible advantages and drawbacks.

February 27 -

Lawmakers on the Senate Banking Committee pushed Federal Reserve Chair Jerome Powell for details about how he plans to review the proposed merger between the two regional banks.

February 26 -

The federal banking agencies will not hold a hearing on a proposal to reduce the number of residential real estate transactions that require an appraisal.

February 22 -

Readers weigh legislative proposals on pot banking, consider JPMorgan's new digital coin, debate the Federal Deposit Insurance Corp.'s brokered deposit rules and more.

February 21 -

Banks earned $59.1 billion in the fourth quarter, a 133% year-over-year increase, due to a one-time charge in the year-earlier quarter and a lower effective tax rate throughout 2018.

February 21 -

More than three dozen organizations are asking the FDIC to reject Square’s pending application to become an industrial loan company, according to a letter filed Tuesday.

February 20 -

The agency’s effort is a good first step to updating brokered deposit rules, but regulators excluded several important considerations in their advance notice of proposed rulemaking.

February 20 Jones Waldo Holbrook & McDonough

Jones Waldo Holbrook & McDonough -

Since the collapse of IndyMac in 2008, the agency has frequently helped to shield depositors over the $250,000 insurance limit from losses. But it’s a policy that was never formalized, and it remains to be seen whether the agency’s new head, Jelena McWilliams, will follow it.

February 14

-

The Federal Deposit Insurance Corp., BB&T’s primary regulator, has a history of going easy on the bank. The combined entity would be better supervised by the central bank, which already oversees SunTrust.

February 13 K.H. Thomas Associates

K.H. Thomas Associates -

The vast majority of comment letters to the FDIC support the fintech’s banking venture, in stark contrast to the public outcry over the pre-crisis ILC bids by large retailers.

February 12 -

The agency began seeking comments in December through a "request for information" on how to improve the agency's process for considering new deposit insurance applications.

February 12 -

Depository mortgage lenders are optimistic the final version of a regulation designed to open up the flood insurance market will make it easier for them to comply with a rule requiring them to accept private carrier policies.

February 11 -

The comptroller of the currency also addressed, in his role as acting FHFA head, whether Congress or the Trump administration will spearhead GSE reform.

February 7 -

Banks spend heavily on marketing to win deposits, push digital; Wells Fargo bends to critics in its latest response to scandals; FDIC review of brokered deposits has big implications for branches; and more from this week's most-read stories.

February 1 -

Federal Reserve Board Gov. Lael Brainard said public comments demonstrate a desire among stakeholders for reforms to be implemented consistently across the Fed, OCC and FDIC.

February 1 -

The lawmakers said the lack of someone with a state supervisory background among the agency's three inside board seats violates federal law.

January 31 -

The agency is exploring how to reopen small-dollar lending options for banks, but consumer groups are urging it to maintain pricing limits and other controls.

January 31