-

The Boston-based cryptocurrency firm says it would welcome the tough oversight that comes with being a bank. Yet Biden-era regulators have shown apprehension about granting approvals to digital-asset firms.

August 10 -

The San Francisco company says it will "modify and strengthen" its filings with the Federal Deposit Insurance Corp. and Utah officials and "resubmit at a later date." It's the latest fintech to encounter such a setback, though some later secured approval.

August 6 -

The industry reported a net release of reserves, helping to make up for a record-low net interest margin and the first year-over-year decline in loan balances in nearly a decade, the FDIC says in its latest Quarterly Banking Profile.

May 26 -

After much anticipation, the Federal Reserve last year finally joined the Network for Greening the Financial System, which develops regulatory best practices for combating climate risks. But all U.S. banking regulators must participate for the effort to succeed, some observers argue.

May 18 -

The agency issued a request for information to gather feedback about how institutions facilitate use of cryptocurrencies and other kinds of assets, and what factors regulators should weigh as they develop supervisory policies.

May 17 -

Financial institutions said they needed more time to weigh in on issues such as how they use artificial intelligence for fraud prevention and underwriting.

May 17 -

In letters to regulators and lawmakers, bankers and their trade groups argued that deals like Vystar Credit Union's proposed acquisition of a small Georgia bank could result in less community development lending and declines in federal tax receipts.

May 14 -

Chairman Jelena McWilliams said the agency will issue a request for information "to learn more about what banks are doing, what banks are considering doing and what, if anything, the FDIC should be doing in this space.”

May 11 -

The FDIC said Financial Pacific Leasing, a subsidiary of the Oregon bank, charged undisclosed fees to borrowers, made excessive collection calls and disclosed information about customer debts to third parties.

May 10 -

The industry has raised concerns about nontraditional bank owners, and some lawmakers have backed limits for industrial loan companies and cryptocurrency firms. But members of the House and Senate have been unable to reach a consensus on legislation.

May 4 -

The FDIC issued a prohibition order against Mark Wong, who was ordered to pay nearly $220,000 in restitution as part of a guilty plea in January.

April 30 -

In a speech, Federal Deposit Insurance Corp. Chair Jelena McWilliams zeroed in on the potential for outdated technology to impede the banking industry and even threaten the sector’s resilience.

April 14 -

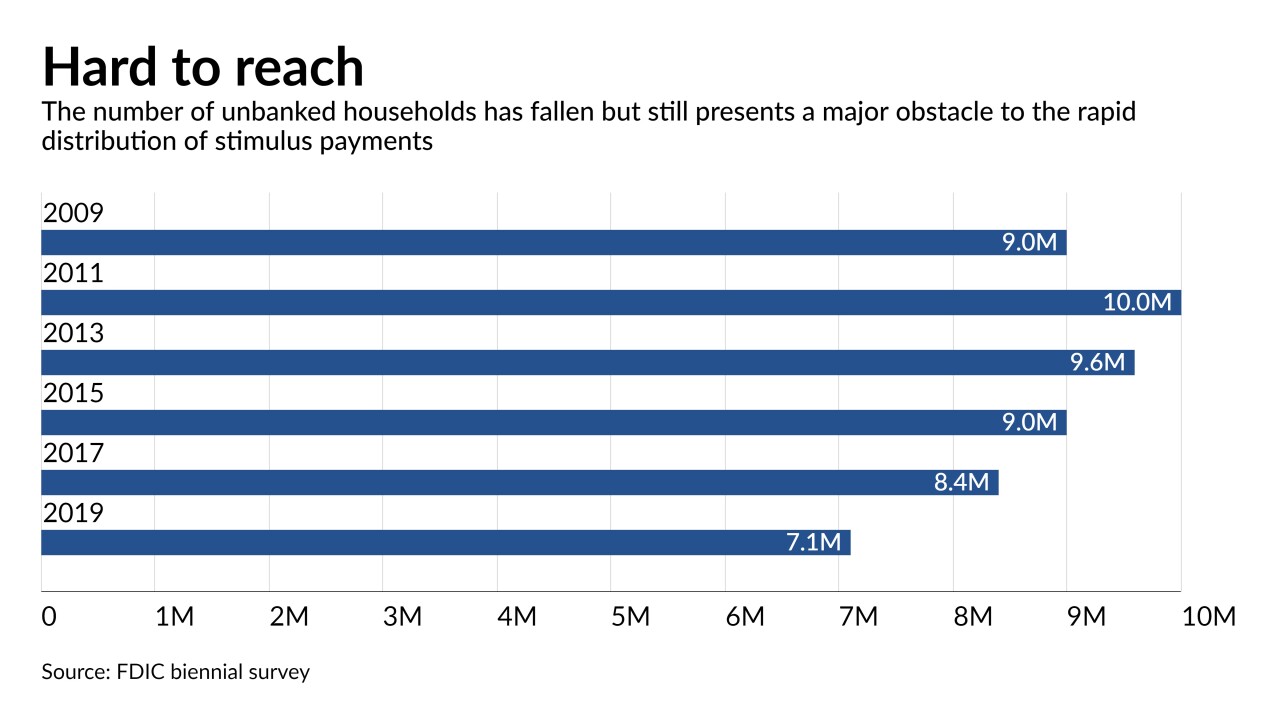

The agency has stepped up efforts to encourage those lacking banking relationships to choose an affordable account option for their pandemic relief funds. It will have to overcome distrust of financial institutions in communities of color.

April 11 -

Regulators are likely to scrap the Office of the Comptroller of the Currency’s divisive rule and instead pursue an interagency framework. But stakeholders commenting on a Federal Reserve draft plan say several aspects of the OCC regulation are worth keeping.

April 4 -

The federal banking and credit union agencies want input about how financial institutions use artificial intelligence for credit underwriting and other purposes, and about whether additional regulatory guidance is needed.

March 29 -

Jelena McWilliams, a Trump appointee, pushed back Wednesday on reports that an incoming Democratic majority may be able to enact policy at the Federal Deposit Insurance Corp. without her support. "The chairman really controls the board agenda," she said.

March 17 -

The IRS, FDIC and more than 70 banks and credit unions are urging consumers to open affordable accounts so they can receive their Economic Impact Payments quickly and safely. Many people have signed up, but millions lack accounts and will be harder to serve.

March 17 -

Community banks with meager tech budgets need help identifying the right systems for institutions their size and finding good partners, says Sultan Meghji, who recently joined the Federal Deposit Insurance Corp. in this newly created role.

March 9 -

The comments by Federal Deposit Insurance Corp. Chair Jelena McWilliams published in Politico reinforce optimism that the banking agencies could settle years of disagreement about modernizing the Community Reinvestment Act.

March 8 -

Banks lowered their loss provisions at the end of 2020, a sign they feel better about this year than last year, according to data from the FDIC. But loan balances fell for the second straight quarter and the annual loan growth rate was the lowest in seven years.

February 23