Goldman Sachs

Goldman Sachs

The Goldman Sachs Group Inc is a leading global investment banking firm whose activities are organized into investment banking (20% of net revenue), global markets (45%), asset management (20%), and consumer and wealth management (15%) segments. Approximately 60% of the company's net revenue is generated in the Americas, 15% in Asia, and 25% in Europe, the Middle East, and Africa.

-

Goldman’s consumer unit, Marcus, has so far lost $1.3 billion; big lenders like JPMorgan Chase and Amex are making loans for small-ticket items like clothes and cosmetics.

September 30 -

Building capital will help the mortgage agencies move toward the private sector; Virtual Wellness needs to assure banks it's safe to do business with them.

September 23 -

Goldman Sachs, Elevar Equity and QED Investors are among institutions financing Mexican lenders that fund SMEs.

September 17 -

The bank is adding senior tech executives from Amazon and Verizon as partners; bank allegedly inflated prices and overcharged investors for mortgage bonds.

September 13 -

Mnuchin hopes to strike a deal soon to recapitalize the two mortgage giants, a prelude to privatization; the bank’s focus on mid-tier corporations is starting to bear fruit.

September 10 -

Treasury Secretary Steven Mnuchin has told large U.S. financial institutions including Goldman Sachs and American Express they should do more to help black- and women-owned community banks win federal contracts.

September 6 -

About 15% of the bank’s partners are likely to leave this year to make room for new ones; the bank said it is looking into why it charges some customers even after their accounts are closed.

September 5 -

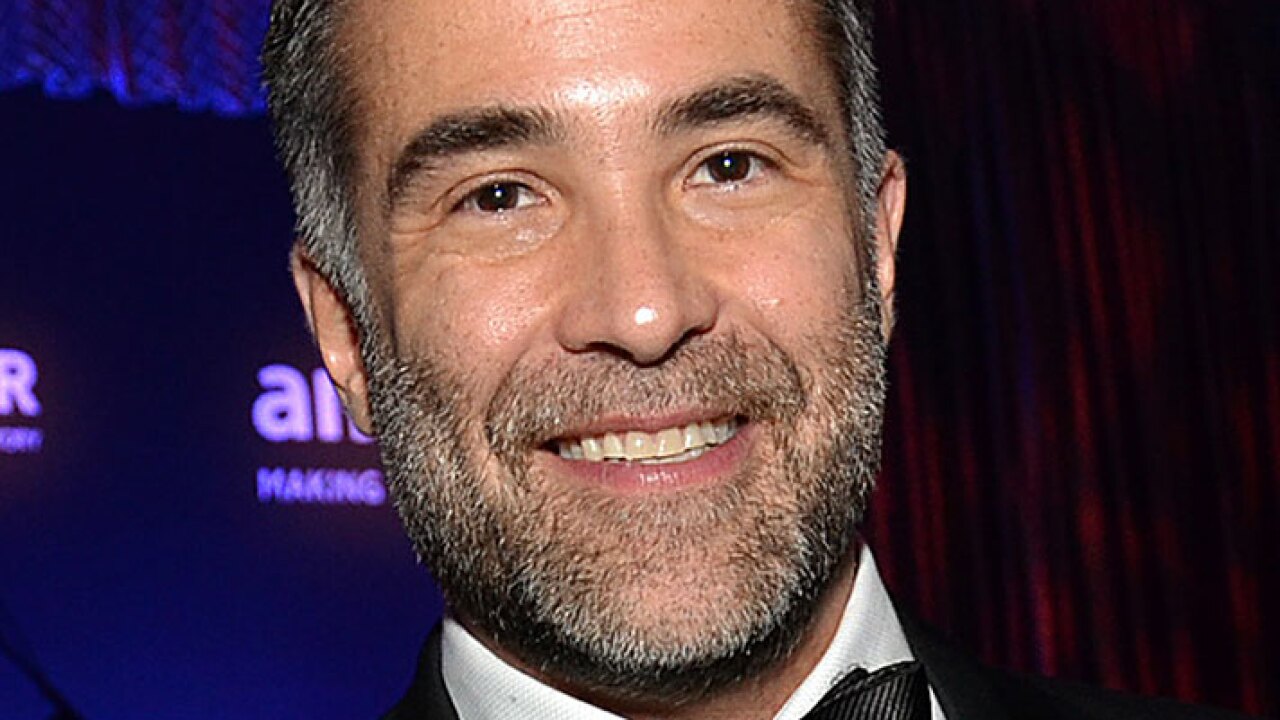

The co-head of the bank’s securities division, 55, was once seen as a possible CEO; the institutions are gobbling up small banks at a record pace, prompting pushback from banks.

September 4 -

Citigroup quietly boosted its minimum wage to $15 an hour in June, joining competitors in awarding raises to rank-and-file staff.

August 28 -

Apple's new credit card isn't just another virtual card in its virtual wallet. It borrows a lot of features from the most successful brands in payments and technology.

August 8 -

The card company is buying the corporate-services businesses of Danish payments provider Nets A/S; the online lender’s stock plunged after it missed second quarter earnings expectations.

August 7 -

The Atlanta fintech, whose shares have plummeted since it went public last year, also said it will stop providing financial guidance to its investors.

August 6 -

The firm joins $40 billion “technology megafund” sponsored by SoftBank Group; company says partnerships are taking longer than expected to bear fruit.

July 25 -

The eight "systemically important" banks currently file resolution plans annually, but a pending proposal would require them every two years.

July 23 -

Several wealth management firms, including Marcus by Goldman Sachs and Wealthfront, have launched banking products to complement their investment services.

July 23 -

Finance ministers call for tight regulation of cybercurrencies; Williams says the Fed must “act quickly to lower rates at the first sign of economic distress.”

July 19 -

Just a few months after leading a funding round for Berlin-based fintech company Elinvar, Goldman Sachs Group Inc. is backing another startup in the German capital.

July 16 -

The company revealed its pretax losses for its forays into consumer and other digital banking services, which began in 2016 with the launch of a consumer deposit franchise and an installment loan product.

July 16 -

Raisin, an online marketplace that aggregates high-yield savings accounts in Europe, aims to launch in the U.S. in the next nine to 12 months.

July 16 -

CEO David Solomon said that Goldman is “absolutely’’ looking at digital currencies and conducting “extensive research’’ on tokenization.

June 28