-

Lawmakers blasted an apparent decision by the OCC and FDIC to move forward with a proposal to reform the Community Reinvestment Act without the support of the Fed.

December 4 -

The ruling by a three-judge panel means the president will lose control of his long-secret business and personal records at the two banks unless the full court reconsiders or the U.S. Supreme Court blocks the decision.

December 3 -

House Democrats described the disparate impact standard as "the most important tool" for enforcing the Fair Housing Act.

November 22 -

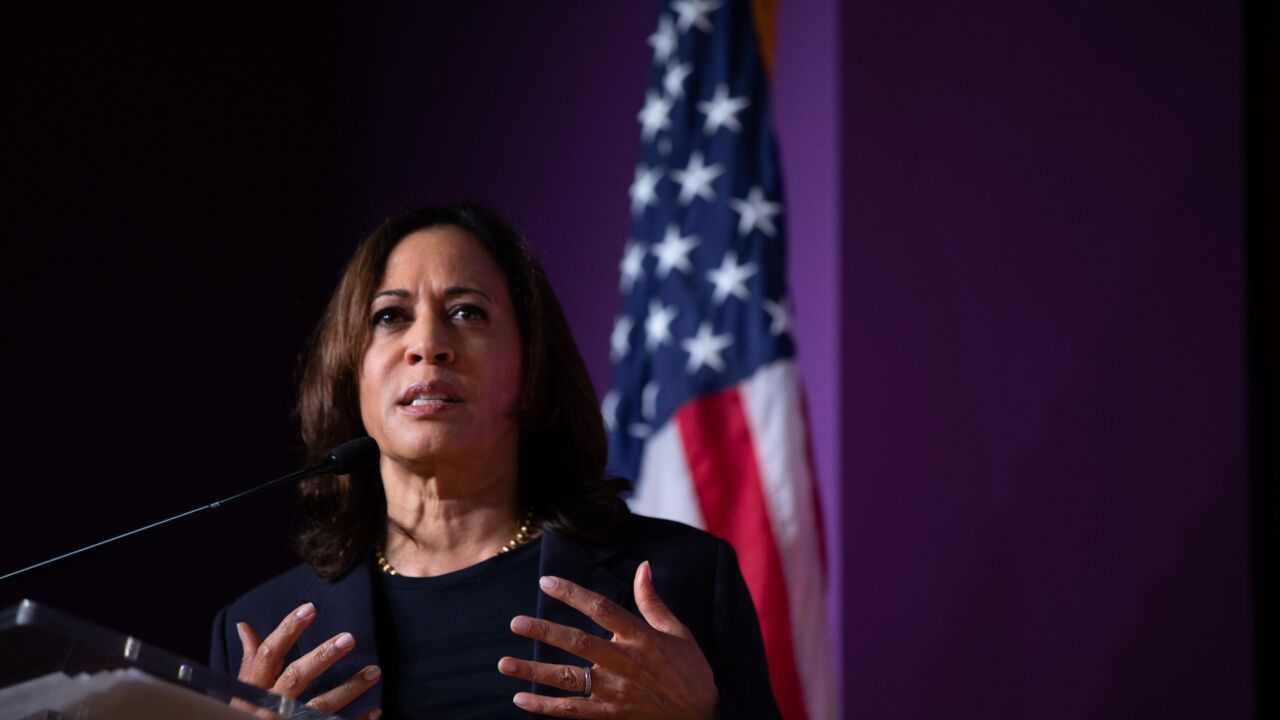

The House Financial Services chair is sponsoring a bill with one of the Democratic presidential contenders aimed at alleviating the public housing capital backlog.

November 21 -

Congress can help create a more uniform federal regulatory testing ground to foster innovation.

November 18 Milken Institute's Center for Financial Markets

Milken Institute's Center for Financial Markets -

Earnings hit could be avoided if BB&T and SunTrust complete deal by 2020; Fannie and Freddie will likely exit conservatorship by 2024, Calabria says; tired of paying 'ransom' to core vendors, two small banks fund new one; and more from this week's most-read stories.

November 15 -

Bankers had worried about Rep. Maxine Waters' control of the Financial Services Committee, but many now say the Democrat’s working relationship with the panel’s top Republican is refreshing.

November 14 -

Congress can help create a more uniform federal regulatory testing ground to foster innovation.

November 13 Milken Institute's Center for Financial Markets

Milken Institute's Center for Financial Markets -

The Veterans and Consumers Fair Credit Act would extend Military Lending Act protections to all consumers.

November 12 -

Fannie Mae and Freddie Mac’s exemption from the Qualified Mortgage rule is on borrowed time, but a House bill would allow lenders to use the mortgage giants’ guidelines for documenting borrower income.

November 12