KeyCorp

KeyCorp

With assets of over $170 billion, Ohio-based KeyCorp's bank footprint spans 16 states, but it is predominantly concentrated in its two largest markets: Ohio and New York. KeyCorp is primarily focused on serving middle-market commercial clients through a hybrid community/corporate bank model.

-

Bank-issued prepaid benefits cards were supposed to help state governments deliver these funds more efficiently. But the pandemic scrambled the economics of these programs.

April 7 -

Fourth-quarter profits rose 10% at the Cleveland company as investment banking income hit a record and nonperforming loans plummeted. Executives say charge-offs will probably start rising in late 2022 but that fee income from capital markets transactions will keep growing.

January 20 -

KeyCorp paid out bonuses to investment bankers of as much as $25,000 in June, according to people familiar with the matter, joining other financial firms that have boosted pay to retain talent.

August 2 -

The company, which is phasing out positions in areas including mainframe computing and lockbox operations, is offering employees 10 hours of instruction per quarter to learn how to manage bots and develop other new skills, Chief Information Officer Amy Brady says.

July 27 -

Commercial and industrial loans fell 14.3% in the second quarter. But CEO Chris Gorman says green shoots are emerging, pointing in particular to recent stability in credit line utilization rates.

July 20 -

Jennifer Eastes is tasked with spearheading and accelerating environmental, social and governance efforts at the Cleveland-based company.

July 8 -

Joe Skarda, who was previously managing director of JPMorgan Chase’s U.S. wealth management central division, will oversee a unit that houses Key’s private bank, family wealth and mass affluent business segments.

April 30 -

The Cleveland company is more than doubling an earlier commitment in order to support racial equity and environmental sustainability.

March 12 -

The Cleveland company will launch the service in March to broaden relationships its Laurel Road student loan refinancing unit has built with health care professionals.

January 21 -

Noninterest income has bolstered profits this year. But its growth is expected to slow over the next two years, making for a gloomy earnings outlook unless vaccine distributions and the economic recovery are relatively swift.

December 17 -

Executives from a half-dozen major financial institutions avoided detailed commercial lending forecasts and gave a mixed outlook on consumer credit at an industry conference. And they called on Washington to pass an aid package targeted at the most troubled business sectors as soon as it can.

November 5 -

The Cleveland company will exit indirect auto lending and close branches so it can devote more resources to mortgages, student loans and other relationship-driven, digital-friendly businesses.

October 21 -

Jane Fraser, who in February will become the first female CEO of a Wall Street bank, said during a Women in Banking event hosted by American Banker that she will be “the first of many, many more” to come.

October 8 -

Chris Gorman, the Cleveland company's chairman and CEO, said at an industry conference that an ongoing shift to digital channels provides an “opportunity to continue to ramp up" efforts to shutter physical locations.

September 14 -

Institutions large and small are either creating new positions or elevating existing diversity heads to C-suite roles. Will the moves help banks improve equality within their ranks and better serve their communities?

August 9 -

Other regionals set more aside for loan losses than the Cleveland bank did in the second quarter, and its ratio of reserves to total loans is slightly lower, too. But Key executives say the portfolio is balanced and holding up well despite the pandemic’s economic toll.

July 22 -

While elevated loan-loss provisions are expected to eat into all banks’ earnings, midsize banks could suffer more than their big-bank rivals because they have fewer revenue drivers. Meanwhile, investors will be watching closely for any signs of dividend cuts stemming from the Federal Reserve’s caps on payouts.

July 2 -

In an exit interview with American Banker, the former KeyCorp CEO reflected on a trailblazing career, shared her thoughts on leadership and described what it’s like to retire in the middle of a pandemic.

May 5 -

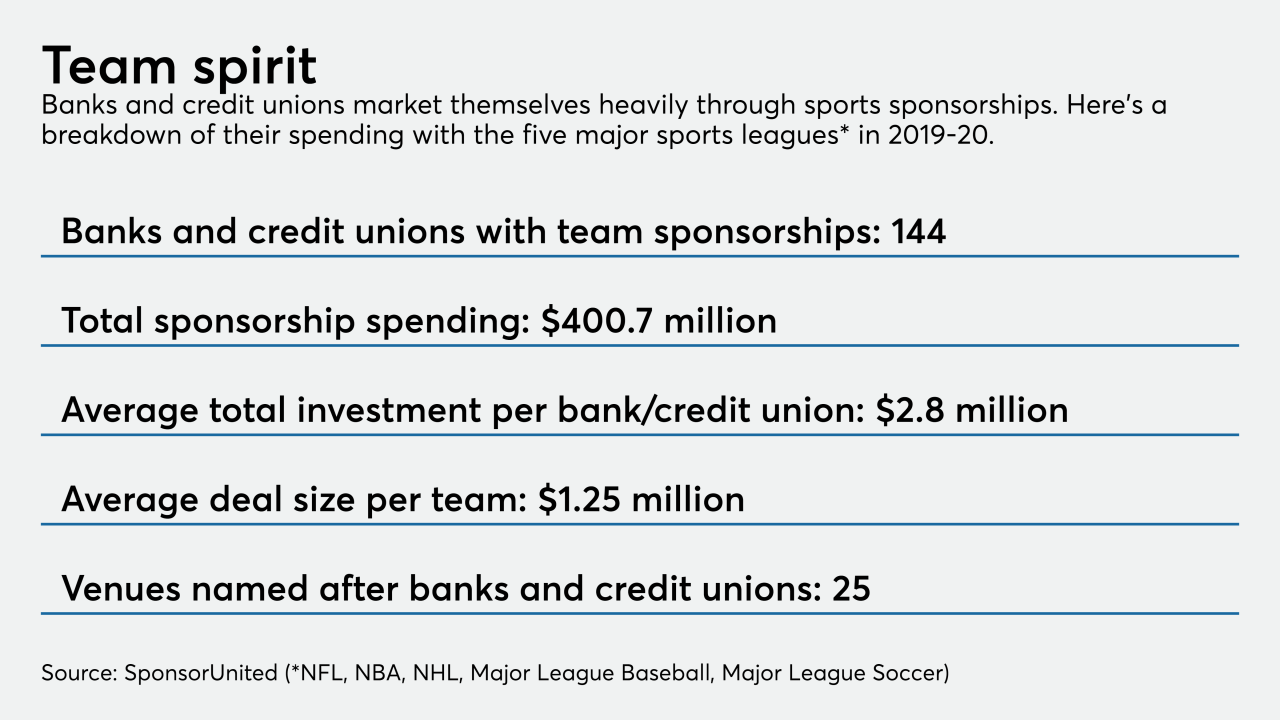

Many banks are slashing their spending. Others are changing their messaging strategies. And those banks that partner with pro sports teams are stuck in limbo, since it remains unclear when games will resume.

May 3 -

Consumers and businesses put more money in the bank as the pandemic worsened. How long the funds remain will depend on how quickly the economy recovers.

April 16