-

The CFPB's practice of "regulation by enforcement" forces mortgage companies to develop compliance standards based on the mistakes of their peers, rather than clear guidance from the enforcement agency, said David Motley, the new chairman of the Mortgage Bankers Association.

October 23 -

Fed economists are suggesting a new mortgage product that would allow home buyers to build equity faster and give banks incentive to profitably hold the loans in portfolio.

September 13 -

The Consumer Financial Protection Bureau's final rule to formalize guidance on a number of TILA-RESPA Integrated Disclosures compliance points omits an originally proposed fix for the so-called black hole that's created when a mortgage closing is delayed.

July 7 -

The renewed debate on reforming Fannie Mae and Freddie Mac is focused on how small and midsize banks would be affected.

July 5 -

The Trump administration's Justice Department was expected to be less aggressive in its pursuit of False Claims Act cases against the mortgage industry. Instead, its focus has shifted to Federal Housing Administration-insured reverse mortgages.

July 3 -

From the largest banks to the smallest independents, policymakers want to hear the mortgage industry speak with one voice in the critical efforts to reform the government-sponsored enterprises.

July 3 Cunningham & Co.

Cunningham & Co. -

Both parties appear interested in a deal on housing finance reform, but tough fights are ahead.

June 29 -

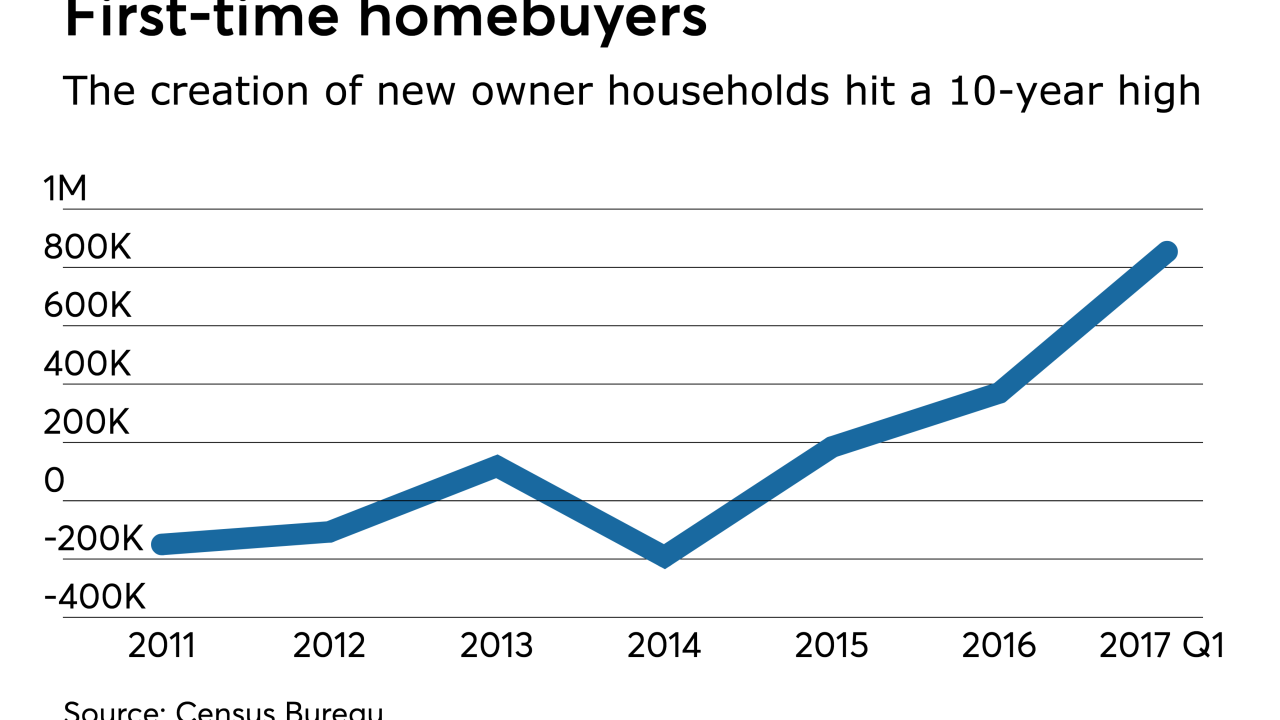

For the first time in a decade, new-owner households created in the first quarter were higher than the creation of renter households.

June 2 -

A new tariff on Canadian lumber threatens to further disrupt homebuilding at a time when lenders are increasingly concerned about a purchase mortgage resurgence that has failed to materialize.

June 1 -

Lawmakers from both political parties are increasingly interested in forcing lenders that offer loans to upgrade home heating and cooling systems to issue better disclosures, a prospect that has some in the industry nervous.

April 18