-

The panel shot down a proposed interim final rule regarding time limits for overdrafts, the first time in recent memory that an issue before the board did not have the votes to pass.

May 21 -

The credit union regulator has implemented a host of measures to help the industry manage the pandemic, but there may be only so much it can do without congressional action.

May 21 -

Four federal agencies offered guidance Wednesday on how to offer products that compete against payday loans without incurring Washington's wrath. The announcement could spark the rebirth of deposit advances, which were regulated out of existence during the Obama administration.

May 20 -

The regulator has formed the Culture, Diversity and Inclusion Council, which will conduct a survey of NCUA's culture to identify areas that need improvement.

May 19 -

The government's latest stimulus package cleared the House on Friday but a number of key credit union priorities didn't make the cut.

May 18 -

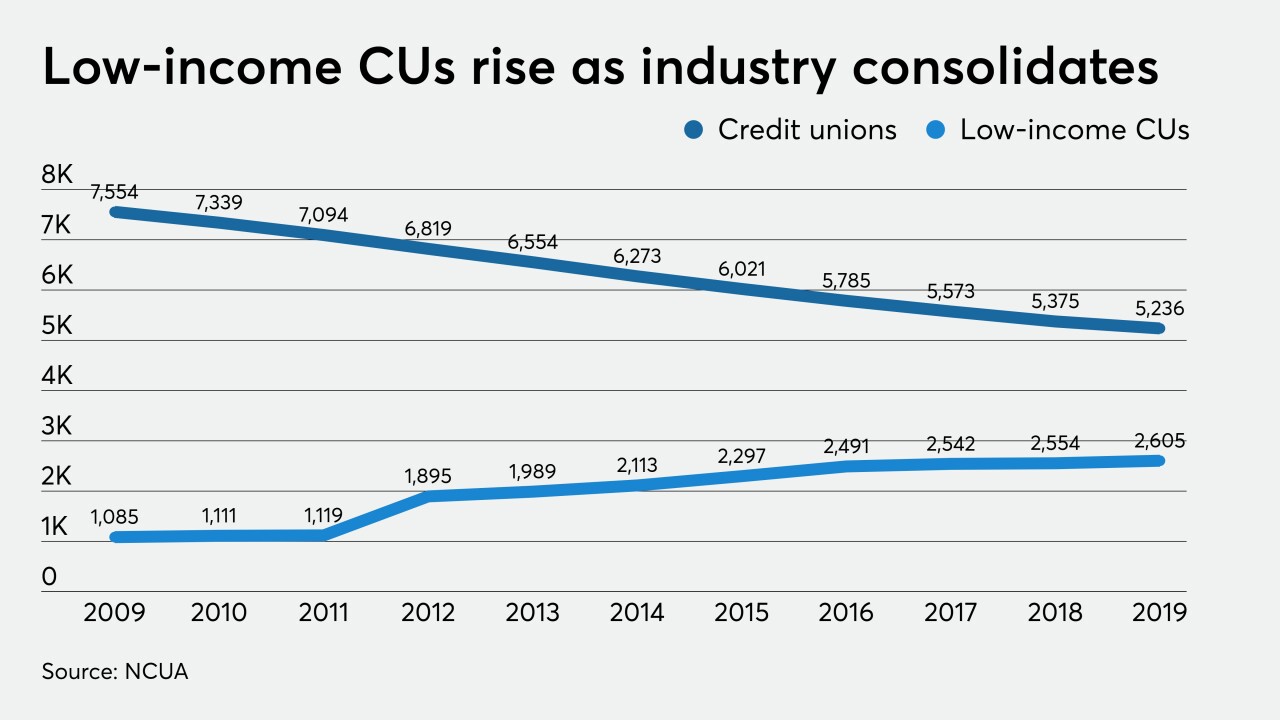

The Independent Community Bankers of America would not rule out legal action if Congress doesn't address the National Credit Union Administration's recent decision expanding the low-income designation.

May 13 -

The Ohio Democrat's criticism of Rodney Hood, chairman of the National Credit Union Administration, echoed complaints from bankers that the regulator was using the chaos from the pandemic to push through changes.

May 12 -

All 11 corporates have signed on as agent members of the CLF, boosting its borrowing authority by $13 billion.

May 11 -

Rodney Hood, chairman of the National Credit Union Administration, will testify before the Senate Banking Committee about how the regulator and the industry have responded to the coronavirus pandemic.

May 11 -

The Independent Community Bankers of America accused the National Credit Union Administration of using the coronavirus to usher in additional changes without the normal amount of scrutiny.

May 7