-

A report from the trade group shows that state-chartered credit unions saw greater first-quarter membership gains than their federal counterparts and posted lower rates of consolidation.

July 8 -

Jim Nussle, CEO of the Credit Union National Association, recently argued that Congress should do away entirely with FOM requirements. Such a move would further favor credit unions over banks.

July 8 Sound Financial

Sound Financial -

More than 70% of the industry now has access to the emergency liquidity source, according to the regulator.

July 6 -

The credit union regulator has not yet announced an agenda, but the meeting could potentially include mattes related to field of membership and risk-based net worth.

July 1 -

The regulator banned a former CU employee from working in financial services on the basis of allegations that he misused funds when working at an Indiana credit union.

June 30 -

Credit unions won the day as the Supreme Court rejected an appeal that would have limited consumers' access to financial services. Now Congress must act to remove those field-of-membership restrictions entirely.

June 30 America's Credit Unions

America's Credit Unions -

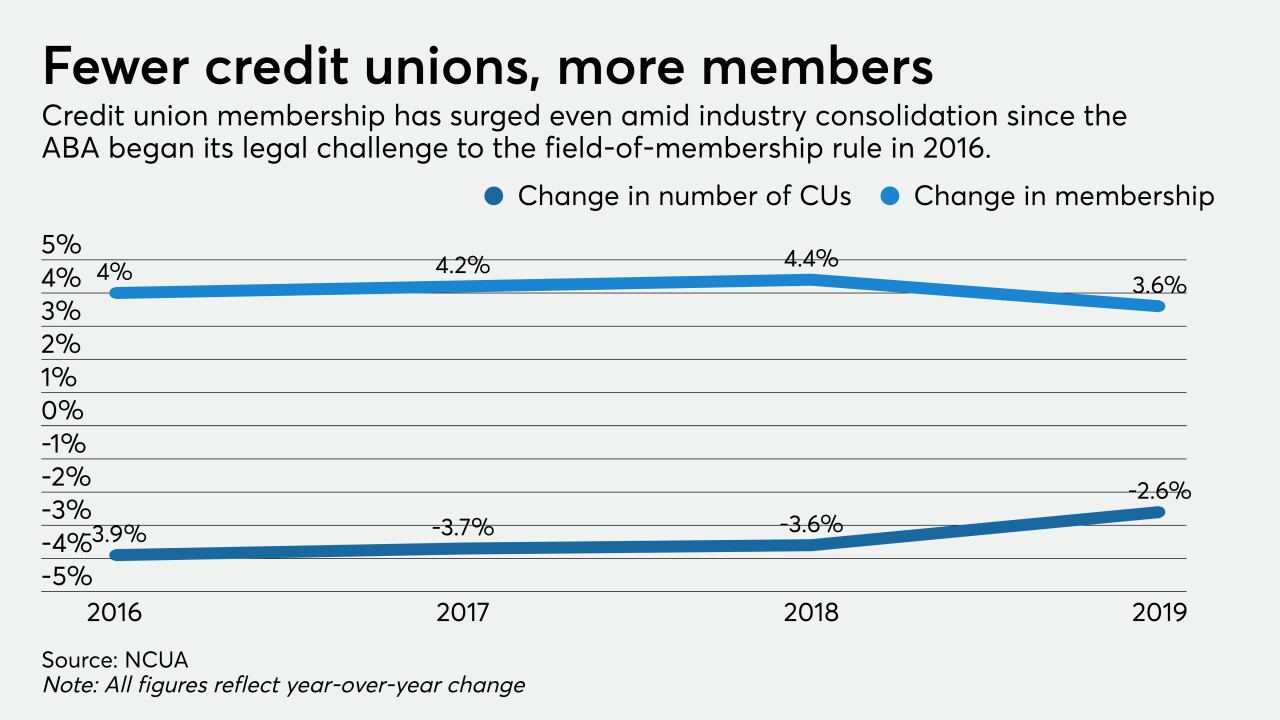

The industry claimed victory over banks as the Supreme Court elected not to hear a challenge to a controversial 2016 rule, but the landscape has shifted dramatically since NCUA approved the measure.

June 30 -

The Supreme Court ruled the Consumer Financial Protection Bureau's leadership structure is unconstitutional and refused to hear a lawsuit over the NCUA's field of membership rule. Credit unions are watching to see what happens now.

June 29 -

The court's decision not to consider an appeal from the American Bankers Association is likely to be the last step in a legal saga dating back to 2016.

June 29 -

Nearly 900 institutions are set to receive a payout related to the demise of Southwest Corporate FCU, but the agency could ultimately return as much as $2.5 billion tied to the corporate credit union failures of 2009 and 2010.

June 25