-

Gulf Winds FCU immediatley assumed the failed credit union's members and deposits.

March 17 -

In January alone, before new field of membership rules took effect, NCUA approved nearly 25% of the number of charter expansions as in 2015 and 2016. Could that be just a taste of what’s to come?

March 9 -

The federal agency released data culled from fourth quarter 2016 call reports that showed the "great divide" between large and small credit unions continues to widen.

March 6 -

The regulator has banned a half dozen former credit union employees from participating in the affairs of any federally insured financial institution.

February 28 -

The industry had cause to celebrate when the regulator revamped its MBL and FOM regulations, but several fights are brewing.

February 24 -

At its February meeting, the NCUA Board approved a routine measure to reauthorize an 18% interest rate cap on loans, but suggested that it’s time for Congress to make some changes.

February 23 -

A month into the comment period, NCUA has yet to receive a single response to a proposal that could provide credit unions easier access to market capital. The issue is unusually complex, experts say.

February 21 -

The trade group says that by merging the Share Insurance Fund and Corporate Stabilization Fund to issue dividends now – instead of in 2020 – the regulator could avoid instituting new premiums to the NCUSIF.

February 13 -

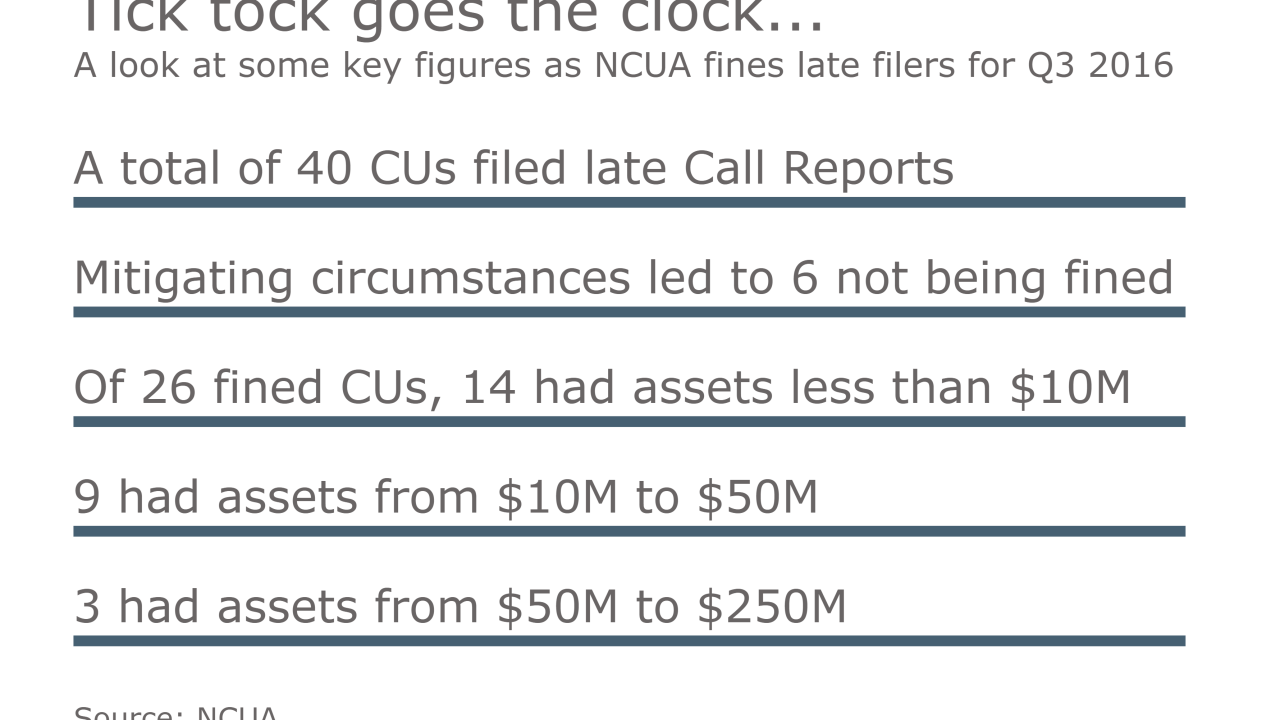

No CUs with assets of more than $250 million were subject to civil monetary penalties for filing late Call Reports.

February 8 -

The $12.8 million Employees First CU lost $2.8 million in 2016.

February 1