-

Federal regulators normally hesitate even to name specific institutions, but the Office of the Comptroller of the Currency appears to be taking a different tack with Wells.

March 15 -

Recounting her family’s financial struggles, Jelena McWilliams said regulatory policy should address the plight of the underbanked.

March 14 -

Community bankers and state regulators want the FDIC and other agencies to rethink their approach to a simplified capital ratio for smaller institutions.

March 14 -

If there is renewed interest in a proposal to restrict incentive-based plans, that isn’t enough to overcome obstacles that have hindered the rulemaking for so long.

March 13 American Banker

American Banker -

The combined bank would be chartered in North Carolina, with the FDIC serving as its lead federal regulator, N.C. Banking Commissioner Ray Grace says. The merger partners had other options, including the Fed and the OCC.

March 12 -

While the OCC has led the charge on modernizing the Community Reinvestment Act, Gov. Lael Brainard gave a rundown of new ideas under discussion — from updating assessment boundaries to a comprehensive community development test.

March 12 -

Comptroller of the Currency Joseph Otting and Federal Deposit Insurance Corp. Chairman Jelena McWilliams acknowledged industry concerns with the proposal meant to improve how banks comply with the trading ban.

March 11 -

John Quill, a former deputy comptroller, had a key role deciding which banks could participate in the Troubled Asset Relief Program.

March 7 -

U.S. regulators are poised to scrap their proposal for revising Volcker Rule restrictions on banks' trading in favor of a newer version as they respond to a misstep that drew fire from Wall Street lobbyists, according to people familiar with the effort.

March 6 -

With the two companies said to be still mulling which charter to seek, the various options each have possible advantages and drawbacks.

February 27 -

Lawmakers on the Senate Banking Committee pushed Federal Reserve Chair Jerome Powell for details about how he plans to review the proposed merger between the two regional banks.

February 26 -

A report identified gaps in documentation and other weaknesses that the watchdog said heighten the risk of agency officials being too cozy with the institutions they supervise.

February 25 -

The OCC said that branches in New York, Los Angeles and Chicago will be required to take certain corrective actions, but it did not hit the Japanese-owned bank with any financial penalties.

February 22 -

The federal banking agencies will not hold a hearing on a proposal to reduce the number of residential real estate transactions that require an appraisal.

February 22 -

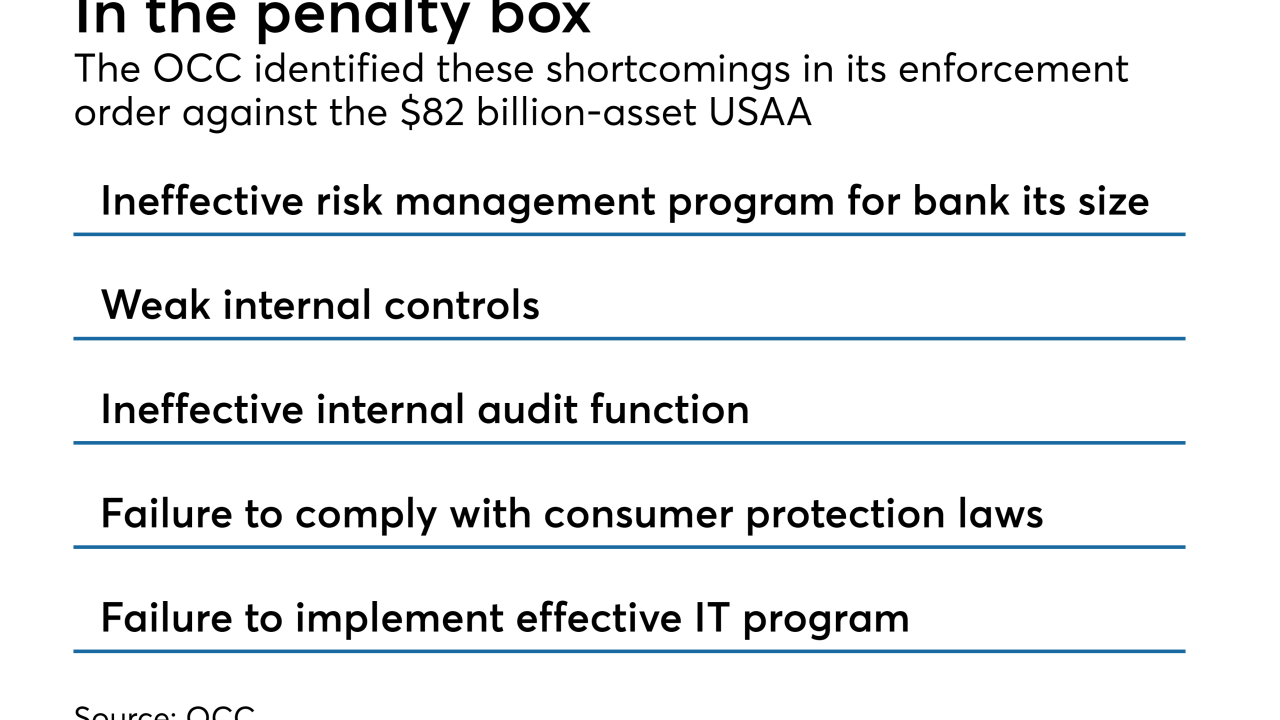

The enforcement action from the OCC comes on the heels of a CFPB consent order that said USAA reopened customers' accounts without consent and neglected stop-payment requests.

February 15 -

The comptroller of the currency also addressed, in his role as acting FHFA head, whether Congress or the Trump administration will spearhead GSE reform.

February 7 -

Federal Reserve Board Gov. Lael Brainard said public comments demonstrate a desire among stakeholders for reforms to be implemented consistently across the Fed, OCC and FDIC.

February 1 -

The agency is exploring how to reopen small-dollar lending options for banks, but consumer groups are urging it to maintain pricing limits and other controls.

January 31 -

Banks say regulatory relief efforts should go even further, while public interest groups — and even one of the Fed’s regional offices — say the proposals to roll back supervisory standards go too far.

January 29 -

The lawmakers want U.S. banking agencies to join their international peers in ensuring the financial system is resilient to climate-related risks.

January 28