-

Regulators have made progress on revising stress tests, the Volcker Rule and other post-crisis measures. But some worry examiners still have too much latitude to punish banks for trivial matters.

November 19 -

Payday lenders argue that banks cut ties with their industry due to pressure from biased and hostile regulators. But the reality, in some cases, may be more nuanced.

November 16 American Banker

American Banker -

Federal and state regulators Thursday offered a slew of regulatory relief measures to banks and credit unions affected by the disastrous California wildfires.

November 15 -

The FDIC is seeking comment on how to encourage small-dollar lending at banks, signaling a course change from guidance it issued five years ago restricting such loans.

November 14 -

In a speech in Japan, the comptroller of the currency urged overseas institutions to consider a “single regulatory framework” instead of applying to multiple states.

November 14 -

While they won’t be in position to enact legislation, House Democrats could use their newfound power to spotlight issues that Republicans have largely ignored, including the exploding levels of corporate debt.

November 13 -

Top executives at Advance America acknowledged that anti-money-laundering concerns at banks were likely the cause of account terminations, even as they publicly blamed a stealth regulatory campaign.

November 12 -

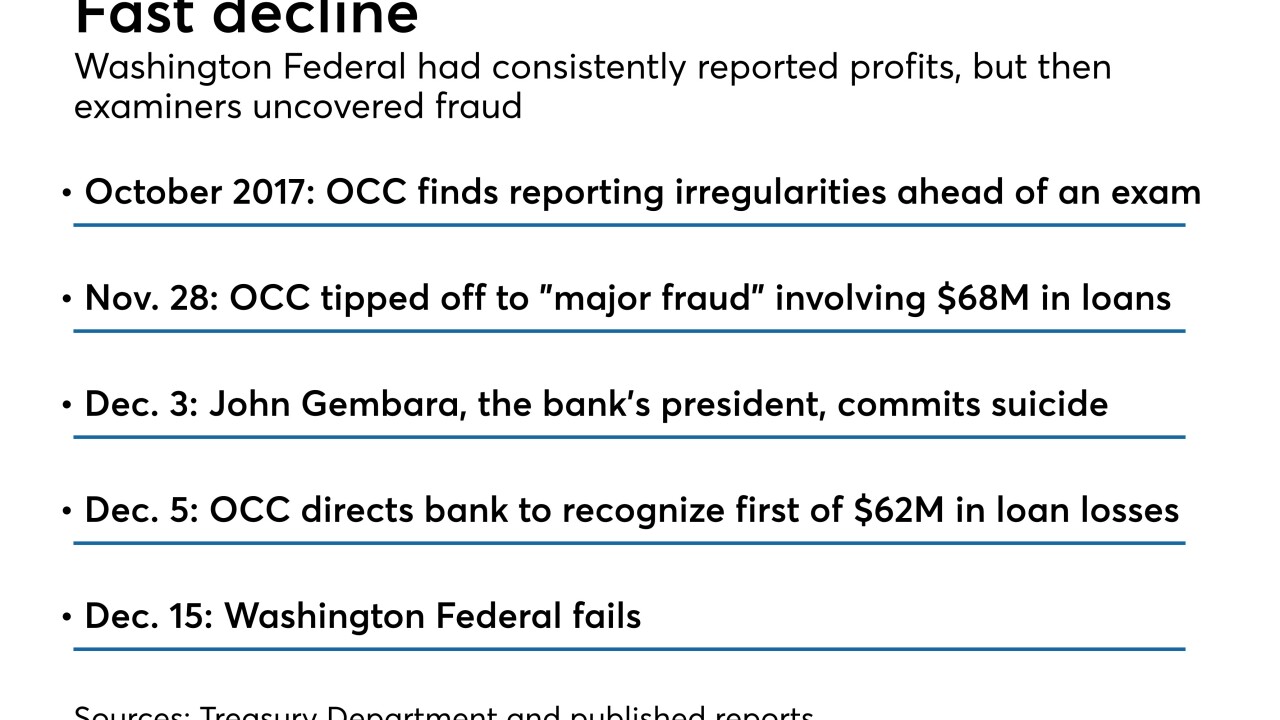

Examiners could have done more to minimize the brunt to the Deposit Insurance Fund from Washington Federal Bank for Savings, which hid fraudulent loans and will cost the fund more than $80 million, according to a report from the Treasury’s inspector general.

November 8 -

Payday lenders argue that banks cut ties with their industry due to pressure from biased and hostile regulators. But the reality, in some cases, may be more nuanced.

November 8 American Banker

American Banker -

The head of the Consumer Bankers Association lays out four industry priorities for the regulatory push to overhaul the Community Reinvestment Act.

November 8

-

The head of the agency developing the special-purpose federal license said the process is moving forward “independent” of legal challenges mounted by state regulators.

November 7 -

The federal agencies said in a recent statement that “guidance does not have the force and effect of law,” but two trade groups say that standard should be more binding.

November 6 -

John Dugan in January will succeed Mike O’Neill, who recently turned 72 and under Citigroup rules may not seek re-election to the board.

November 5 -

One of the biggest sticking points as regulators try to reform the Community Reinvestment Act is expanding the assessment footprint but ensuring banks continue to serve their direct communities.

November 1 -

In a highly anticipated proposal, the central bank outlined a new approach for its post-crisis supervisory program that divides banks into different tiers based on size.

October 31 -

The new approach would replace the "current exposure methodology" that banks typically use to calculate what they owe or are owed in swaps, futures or options contracts.

October 30 -

While there are ways to improve the Community Reinvestment Act for the modern era, steps must be taken to ensure the law is not weakened in the process.

October 30 K.H. Thomas Associates

K.H. Thomas Associates -

Under the Obama administration, the OCC quietly prevented JPMorgan Chase from opening branches in new states as punishment for violating banking rules, according to sources.

October 26 -

The money manager plans a big expansion in Atlanta; agency makes now rare determination that debt-collection practices were “abusive.”

October 26 -

The assessment is designed to get banks on the same page in combating cybersecurity and make it easier for institutions and regulators to assess their performance.

October 25