-

Democrats have proposed a Congressional Review Act resolution to strike down the OCC rule, arguing it enables "rent-a-bank" schemes.

March 25 -

Former Obama-era regulators Kara Stein and Sarah Bloom Raskin, as well as Atlanta Fed President Raphael Bostic, have joined the field of potential nominees to lead the Office of the Comptroller of the Currency, according to sources familiar with the process.

March 25 -

The agency's plan would strengthen requirements that banks use a minimum amount of their real estate for the business of banking, but three grade groups say banks need flexibility in the pandemic to manage occupancy.

March 23 -

Many in Washington have been in suspense about whether the Biden administration would favor a former Obama official or a financial inclusion advocate for comptroller of the currency. Mehrsa Baradaran, the candidate preferred by community activist groups, appears to have the edge.

March 10 -

Some nominees poised to take their agencies in a new direction appear headed for Senate confirmation while an intraparty squabble has delayed the administration’s choice to lead the Office of the Comptroller of the Currency. Here’s the roster update.

March 9 -

Michael Barr, an Obama-era Treasury Department official, is no longer expected to be nominated to lead a regulator that oversees Wall Street’s biggest banks, according to people familiar with the matter.

March 9 -

For the second time in three years, the Cleveland thrift has received a low score on its Community Reinvestment Act examination for making too few home loans in low-income communities.

March 2 -

The Boston-based bank said the Office of the Comptroller of the Currency gave it the highest grade possible on its most recent Community Reinvestment Act examination. Santander had received a “needs to improve” grade in 2017 and a “satisfactory” rating in 2018.

February 19 -

The former comptroller of the currency, who founded the consulting firm known for its roster of ex-regulators, will hand over leadership of day-to-day activities to an operating committee as he pursues other projects.

February 17 -

As the bureau writes data-sharing rules, the third-party firms that work with fintechs say oversight by the agency would be more efficient — and better for consumers — than being policed by their bank partners.

February 12 -

The jockeying over who President Biden should appoint to head the Office of the Comptroller of the Currency has focused attention on how to regulate the fintech sector, but the discussion has glossed over flaws in the agency's funding structure that have persisted across administrations.

February 10 American Banker

American Banker -

The next administration must halt the practice of allowing new entrants into the banking system to forgo a full Community Reinvestment Act exam.

February 9 K.H. Thomas Associates

K.H. Thomas Associates -

The Biden administration’s yet-to-be-named comptroller of the currency is widely expected to invalidate the GOP-backed measure that bars banks from shunning gun makers, fossil-fuel producers and the like. But another option is to recast it to promote investment in underserved communities.

February 8 -

Protego Trust Bank in Seattle will focus on providing custody services for investors that hold digital assets. The OCC decision comes weeks after the agency granted permission to a South Dakota trust company to offer crypto-related services.

February 5 -

A federal judge denied the Office of the Comptroller of the Currency's motion to have the case thrown out, saying concerns about the agency's rulemaking process to reform the Community Reinvestment Act have merit.

February 1 -

Several financial tech companies that applied to become national banks are seeking exemptions from many provisions of the Community Reinvestment Act. A consumer advocacy group and the American Bankers Association say the OCC mustn't allow this.

January 29 American Bankers Association

American Bankers Association -

The rule, finalized in the waning days of the Trump administration and scheduled to take effect in April, would have punished banks for denying services to certain firms without documented reasons for doing so.

January 28 -

The most likely picks for comptroller of the currency have pushed tech-driven approaches to financial inclusion and anti-money-laundering, and would bring new perspective to regulating cryptocurrencies.

January 27 -

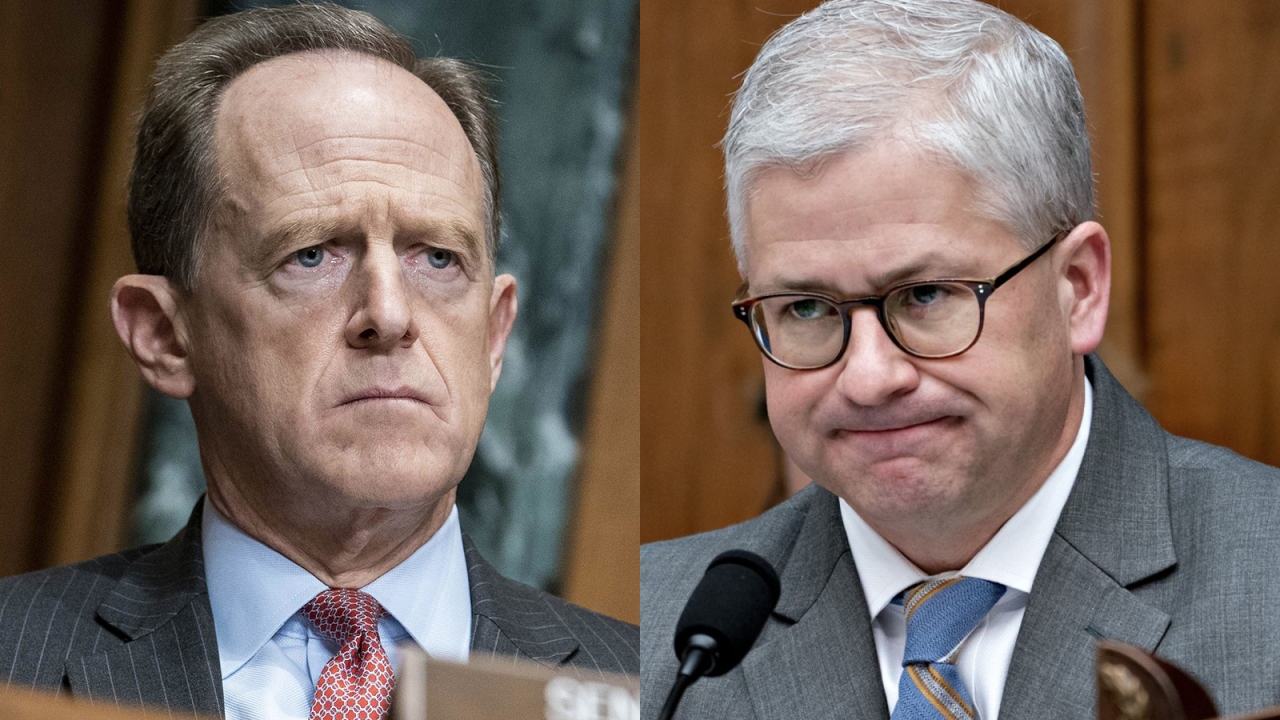

The Senate’s confirmation of Treasury Secretary Janet Yellen was notably bipartisan. But experts say congressional Republicans are poised to give nominees for the federal banking agencies heavier scrutiny.

January 27 -

The most likely picks for comptroller of the currency have pushed tech-driven approaches to financial inclusion and anti-money-laundering, and would bring new perspective to regulating cryptocurrencies.

January 27