-

Payday lenders argue that banks cut ties with their industry due to pressure from biased and hostile regulators. But the reality, in some cases, may be more nuanced.

November 16 American Banker

American Banker -

Federal and state regulators Thursday offered a slew of regulatory relief measures to banks and credit unions affected by the disastrous California wildfires.

November 15 -

The FDIC is seeking comment on how to encourage small-dollar lending at banks, signaling a course change from guidance it issued five years ago restricting such loans.

November 14 -

In a speech in Japan, the comptroller of the currency urged overseas institutions to consider a “single regulatory framework” instead of applying to multiple states.

November 14 -

While they won’t be in position to enact legislation, House Democrats could use their newfound power to spotlight issues that Republicans have largely ignored, including the exploding levels of corporate debt.

November 13 -

Top executives at Advance America acknowledged that anti-money-laundering concerns at banks were likely the cause of account terminations, even as they publicly blamed a stealth regulatory campaign.

November 12 -

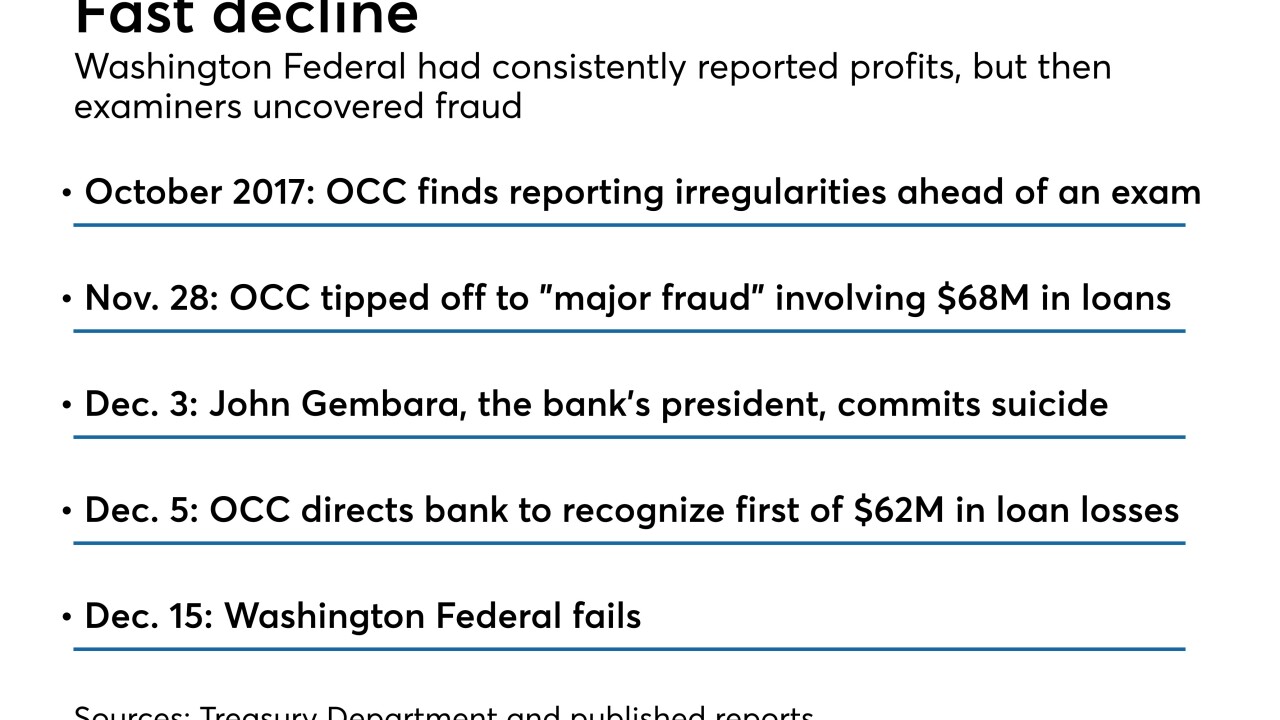

Examiners could have done more to minimize the brunt to the Deposit Insurance Fund from Washington Federal Bank for Savings, which hid fraudulent loans and will cost the fund more than $80 million, according to a report from the Treasury’s inspector general.

November 8 -

Payday lenders argue that banks cut ties with their industry due to pressure from biased and hostile regulators. But the reality, in some cases, may be more nuanced.

November 8 American Banker

American Banker -

The head of the Consumer Bankers Association lays out four industry priorities for the regulatory push to overhaul the Community Reinvestment Act.

November 8

-

The head of the agency developing the special-purpose federal license said the process is moving forward “independent” of legal challenges mounted by state regulators.

November 7