-

The administration is prolonging a decision on a permanent director for the agency to keep the interim chief in place until year-end or longer.

May 8 -

Speaker Paul Ryan said the House will vote on Dodd-Frank reform legislation that originated in the Senate, but additional House reg relief measures are still on the table.

May 8 -

The lawmakers are calling on banks to follow the lead of Citigroup and Bank of America in limiting their business with firearms dealers in light of recent mass shootings.

May 2 -

Acting CFPB Director Mick Mulvaney told a group of bankers last week that he intends to end public access to complaints, but Sen. Elizabeth Warren and two other Democrats argue that would be a mistake.

April 30 -

The senior GOP lawmaker appeared to acknowledge concerns that expanding the bill could harm Democratic support.

April 26 -

On one hand, banks could face regulatory pressure to restrict services to the firearms industry. But banks that take a strong stand also risk the wrath of GOP lawmakers opposed to such restrictions.

April 26 -

The New York senator offers legislation to empower U.S. post offices to take deposits and make loans.

April 25 -

The American Bankers Association will fund TV ads for Sen. Jon Tester, D-Mont., and Rep. Ted Budd, R-N.C., the first of several candidates the group expects to actively promote during the midterms.

April 25 -

House Republicans are continuing to push the Senate to add more measures to a bill to give regulatory relief to community banks.

April 24 -

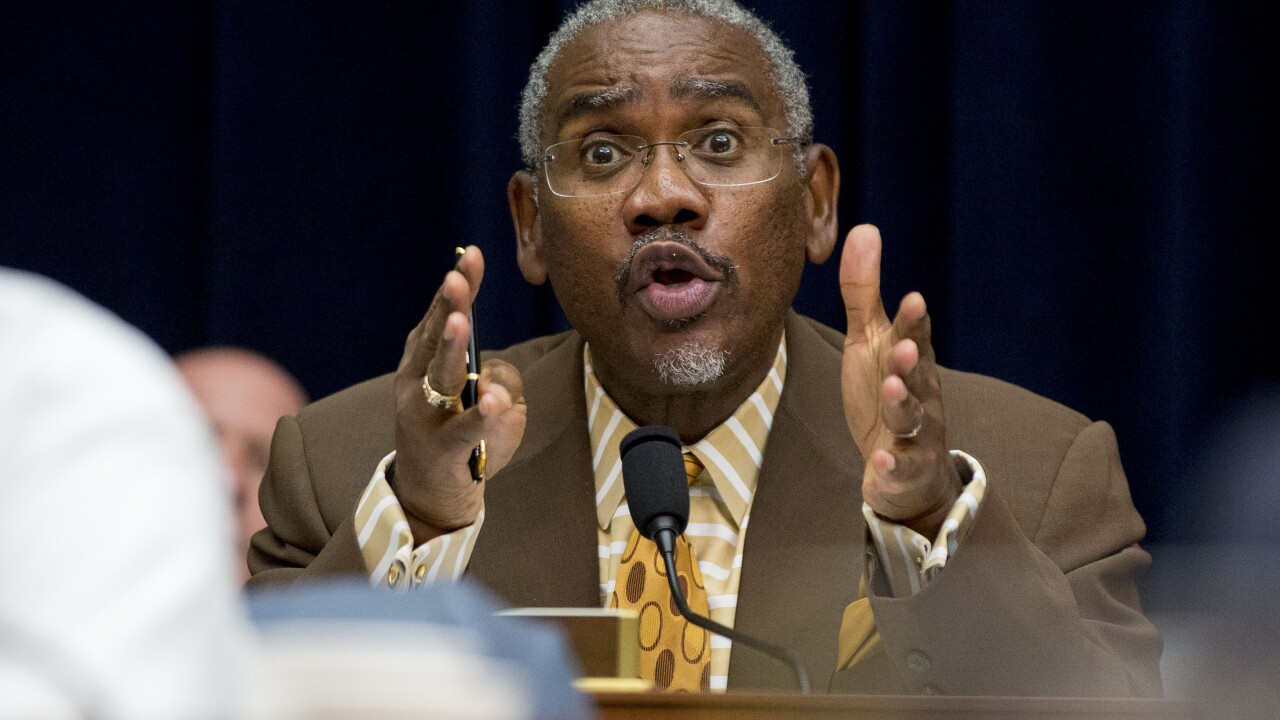

In his first of two Capitol Hill hearings this week, Democrats hammered the acting director of the Consumer Financial Protection Bureau for ignoring what they view as the agency's core purpose.

April 11 -

Small financial institutions are eager to see the Senate’s reform bill signed into law, but House efforts to amend the legislation risk stalling the effort.

April 6 America's Credit Unions

America's Credit Unions -

Small financial institutions are eager to see the Senate’s reform bill signed into law, but House efforts to amend the legislation risk stalling the effort.

April 6 America's Credit Unions

America's Credit Unions -

Momentum to overhaul the mortgage finance system had been slipping, and with Democrats divided over the Senate's banking relief bill there's virtually no chance more bipartisan deals can be worked out.

March 30 American Banker

American Banker -

Burdensome regulation has made it hard for community institutions to operate alongside bigger rivals, leaving consumers with less choice and more expensive banking options.

March 29 Sageworks

Sageworks -

One purpose of the Senate bill was for small banks to rein in skyrocketing costs, but some bankers question whether the changes will save them money, and adapting to the reforms may even increase spending.

March 28 -

The regulatory relief bill frees some regional banks from the tough supervision reserved for larger companies, but regulators still can subject them to onerous requirements.

March 23 -

With the Senate finishing its work on a regulatory relief package, a showdown in the House still looms while critics of Dodd-Frank weigh whether this is their last shot at unwinding it.

March 14 -

The Senate will resume discussions on S. 2155, while the House focuses on the TAILOR Act and other measures.

March 13 -

Former Rep. Barney Frank rejected concerns voiced by other Democrats that a Senate bill rolling back some provisions of the Dodd-Frank Act will fuel another financial crisis.

March 13 -

Unable to come to an agreement on which and how many amendments will be offered to a Dodd-Frank regulatory relief bill, the Senate will have to return next week before voting on the legislation.

March 8