-

The heads of the biggest banks have a chance to tout the industry's community outreach during the pandemic. But they can also expect tough questions about the Paycheck Protection Program as well as what banks are doing to address climate change, racial inequities and other hot-button issues.

May 11 -

Critics say the regulation issued by the Office of the Comptroller Currency is a gift to predatory lenders. But the trade organizations warned lawmakers that invalidating it will make it difficult for the agency to create an improved framework in the future.

May 6 -

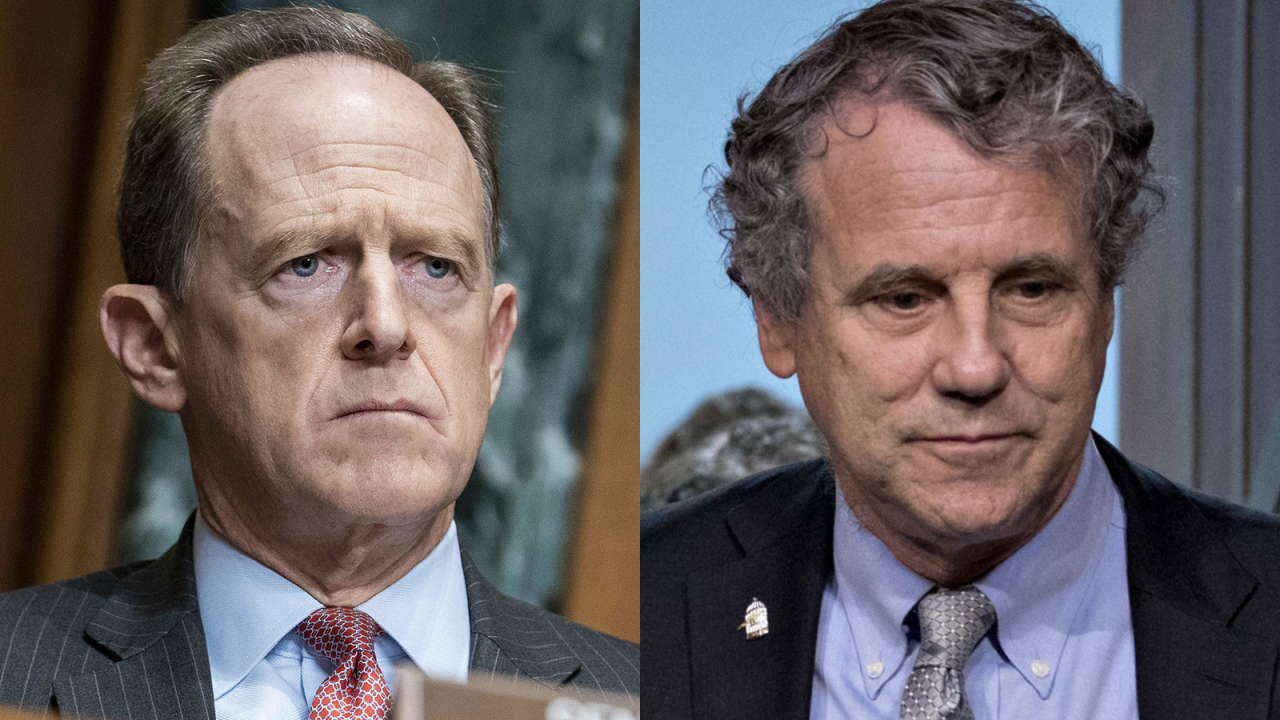

Democratic senators seek to block the "true lender" regulation, which they say lets national banks sell loans to lenders who then avoid state usury caps. Republicans say overturning the rule would restrict access to credit.

April 28 -

The 2020 elections buoyed hopes that Congress would finally make it easier for financial institutions to serve cannabis businesses. But Democrats’ push to decriminalize marijuana — a nonstarter for most Republicans — threatens the more targeted effort.

April 22 -

Federal standards “are apt to gum up the works,” says Sen. Cynthia Lummis.

April 18 -

Senate Banking Committee Chairman Sherrod Brown asked banks involved with Bill Hwang’s Archegos Capital Management to explain their role in the firm’s implosion.

April 8 -

The full Senate could deadlock on Rohit Chopra’s nomination as the Banking Committee did. If that happens, Vice President Kamala Harris is expected to cast the decisive vote in his favor.

March 30 -

Democrats have proposed a Congressional Review Act resolution to strike down the OCC rule, arguing it enables "rent-a-bank" schemes.

March 25 -

Democrats want regulators to actively protect the financial system from losses tied to extreme weather events, while Republicans say climate policy is "beyond the scope" of their mission.

March 18 -

The legislation easily passed the House in 2019 but was never considered in the Senate. Observers see a more promising path forward this time.

March 18