-

Democrats want regulators to actively protect the financial system from losses tied to extreme weather events, while Republicans say climate policy is "beyond the scope" of their mission.

March 18 -

The legislation easily passed the House in 2019 but was never considered in the Senate. Observers see a more promising path forward this time.

March 18 -

The Ohio Democrat and chairman of the Senate Banking Committee told a virtual gathering of the American Bankers Association that FedAccounts, a plan opposed by industry trade groups, will lead to more bank customers.

March 17 -

The Senate Banking Committee is questioning whether Goldman Sachs Group paid dividends at the expense of lending to businesses and households during the pandemic as lawmakers take a broad look at the support big banks offered clients to get through the economic slump.

March 15 -

With a steady stream of Senate hearings held on the racial wealth gap and inequities in the financial system, the new chairman has set a consumer-focused agenda that leans further left than even past Democratic chairs.

March 15 -

The nomination of Gary Gensler as chairman of Securities and Exchange Commission will now be voted on by the full Senate, but Rohit Chopra's nomination to head the Consumer Financial Protection Bureau remains held up in the Senate Banking Committee.

March 10 -

Chair Jerome Powell told a congressional panel that the Federal Reserve is weighing whether to extend temporary relief from the “supplementary leverage ratio” — meant to help banks lend more during the pandemic — beyond March 31.

February 23 -

The Banking Committee will hold a confirmation hearing on March 2 for Rohit Chopra and Gary Gensler. They are the administration's picks, respectively, to lead the Consumer Financial Protection Bureau and the Securities and Exchange Commission.

February 22 -

Sen. Richard Shelby. R-Ala., served two stints as head of the committee. He announced Monday that he will not run for reelection when his term expires.

February 8 -

Steve Daines of Montana, Bill Hagerty of Tennessee and Cynthia Lummis of Wyoming are joining the panel for the 117th Congress.

February 4 -

Democrats Raphael Warnock and Jon Ossoff, who won runoff elections to flip party control of the Senate, were assigned to sit on the panel for the 117th Congress.

February 2 -

Marcia Fudge told senators that her first priority as secretary would be to assist renters and homeowners struggling financially due to the COVID-19 pandemic.

January 28 -

The Senate’s confirmation of Treasury Secretary Janet Yellen was notably bipartisan. But experts say congressional Republicans are poised to give nominees for the federal banking agencies heavier scrutiny.

January 27 -

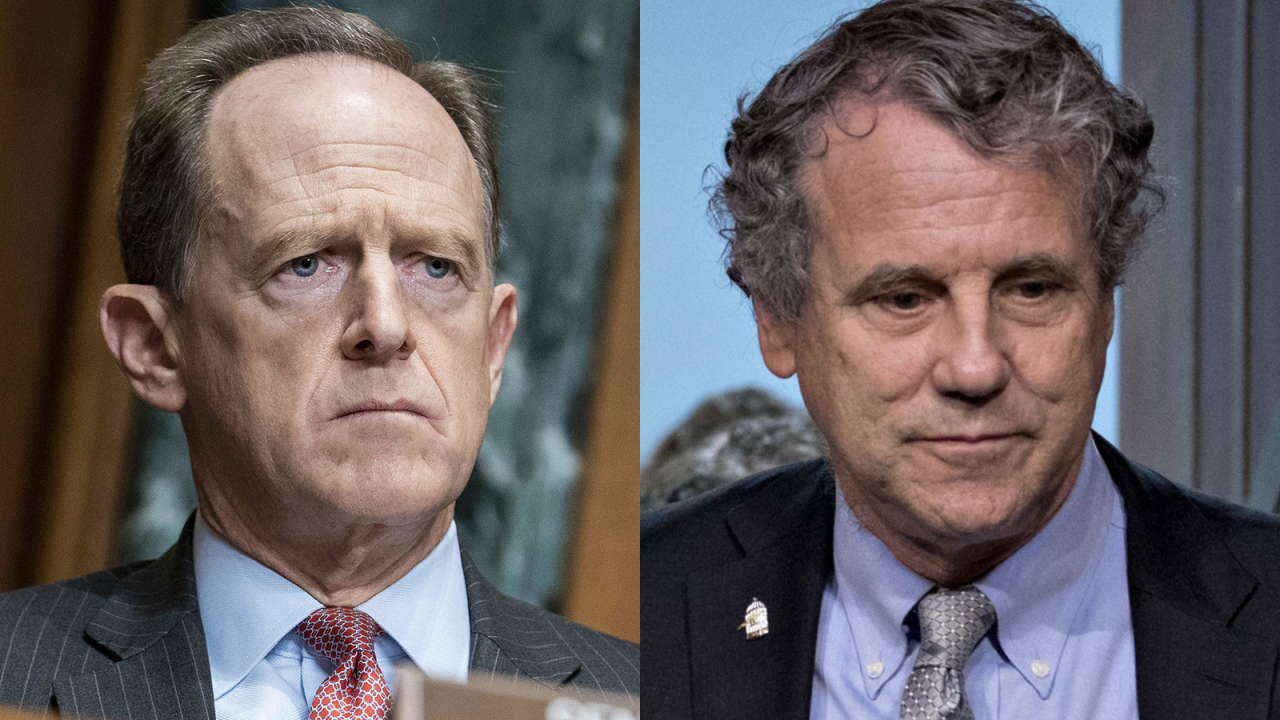

Sen. Sherrod Brown, D-Ohio, said elevating affordable housing issues, examining the financial system through a climate and racial justice "lens" and holding banks accountable for their impact on consumers will be among his priorities.

January 12 -

Sen. Sherrod Brown of Ohio signaled a change in direction for the Banking Committee under Democratic control, on the same day he called for President Trump's ouster after the U.S. Capitol riot.

January 7 -

The defense spending bill includes language requiring businesses to report their owners to Fincen.

December 11 -

The Maryland Democrat served five terms in the U.S. Senate, a 30-year tenure in which he was chairman of the Senate Banking Committee when it responded to a rash of accounting scandals. He didn’t seek a sixth term and retired on Jan. 3, 2007.

December 7 -

Banking trade organizations are usually cautious about making endorsements. But with Democrats winning the White House and control of Congress on the line in the two races, some groups are pouring in cash for the GOP candidates.

December 6 -

Tuesday's hearing on the CARES Act was dominated by bickering over Treasury's decision to shut down the Fed's emergency lending facilities, drowning out pleas from some lawmakers for more aid.

December 1 -

If Congress speeds through Brian Brooks’ confirmation in the waning days of the Trump administration, it could make it harder for President-elect Biden to quickly put his stamp on banking policy.

November 19