-

For all banks' claims that credit unions pose a threat to their commercial lending market share, they've accounted for just 2% of volume in the Paycheck Protection Program.

July 10 -

After tech firms assisted community bankers in processing applications in the Paycheck Protection Program, small-business lenders are continuing to engage with cloud providers and other outside companies to automate the loan forgiveness process.

July 10 -

The Senate had passed the bill Tuesday, shortly before the Small Business Administration was to stop accepting new loan applications.

July 2 -

Lenders are selling their Paycheck Protection Program loans or hiring outside companies to navigate the process in an effort to reduce risk and avoid overloading their employees.

June 30 -

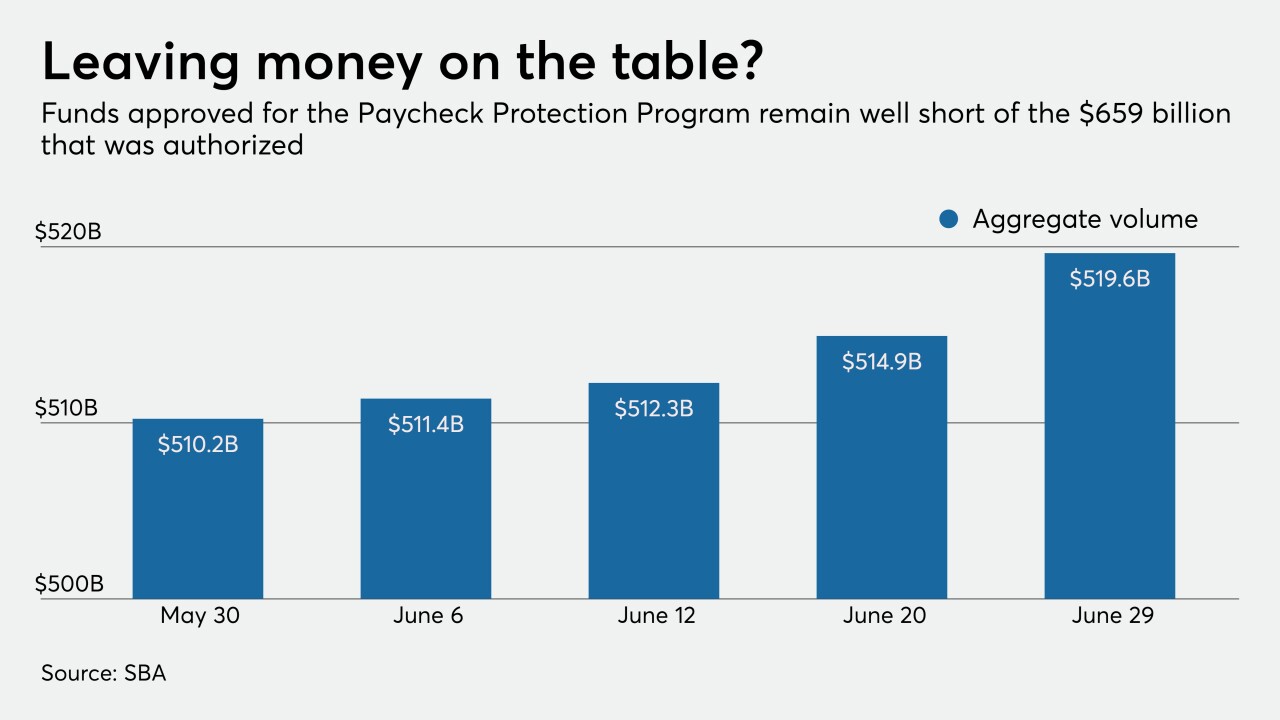

The Paycheck Protection Program had more than $100 billion in funding left as of last Saturday, with only days remaining until the Small Business Administration stops taking new applications on June 30.

June 25 -

Despite success lobbying for PPP inclusion and the elimination of Regulation D, the industry must continue to push for additional reforms.

June 25

-

The agencies said late Friday that they will provide information on small businesses that received $150,000 or more from the Paycheck Protection Program.

June 19 -

Activity in the Paycheck Protection Program has waned, but some argue that many small businesses, especially those owned by minorities, will miss out if the June 30 application deadline isn't extended.

June 19 -

In letters to administration officials and large banks, the lawmakers sought details about loan recipients following reports that financial institutions had favored their wealthiest clients.

June 15 -

Borrowers say getting the loans forgiven is just as complicated as obtaining the money; payment companies are holding some merchant funds in reserve as chargebacks spike.

June 15