-

Expanding SBA funding and providing additional Community Reinvestment Act credit could help boost female entrepreneurs.

April 16 Invest in Women Entrepreneurs Initiative

Invest in Women Entrepreneurs Initiative -

A plan to bring in banks was created right after last summer’s hurricane devastation, but the magnitude of those storms, government dawdling on the issue and lenders’ reluctance to participate are key reasons zero loans have been made under the program.

April 11 -

OP Bancorp in Los Angeles aims to raise $20 million to fund organic growth and acquisitions.

March 6 -

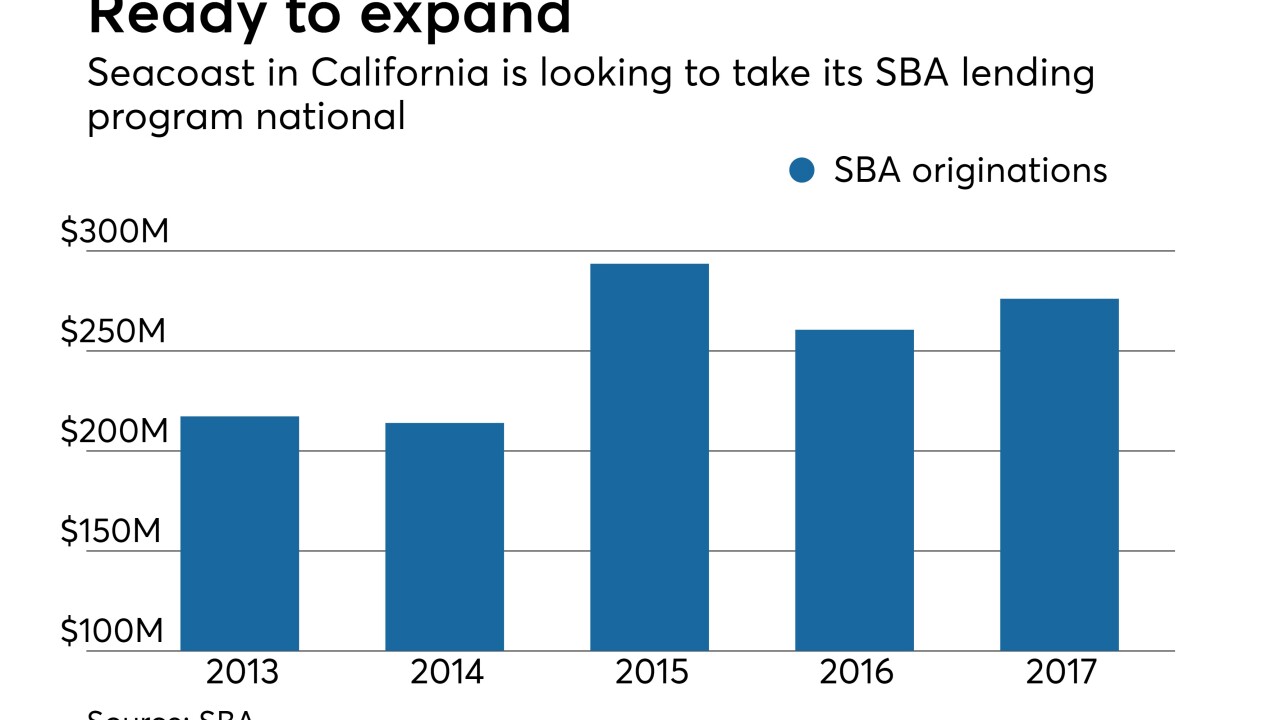

Seacoast Commerce is San Diego is already one of the biggest Small Business Administration lenders — half the loans on its books are tied to SBA programs. But will its underwriting hold up outside its traditional markets?

February 2 -

The credit union’s members want products to help with cash flow, working capital and business expansion

January 30 -

The proposed legislation would give the agency authority to increase funding for the 7(a) program — with several caveats designed to manage exposure.

January 26 -

The proposed legislation would give the agency authority to increase funding for the 7(a) program — with several caveats designed to manage exposure.

January 26 -

Women are not only less likely to be approved for loans than men, they are less inclined to apply for loans in the first place. Among the reasons: aversion to debt and fear of rejection, according to a new report.

December 6 -

Mary Anne Bradfield currently serves as chief of staff at the U.S. Small Business Administration.

December 1 -

The pilot could help the agency improve its image after past criticism of slow responses to catastrophes.

November 28