-

Bipartisan legislation introduced Monday would permit loans made as part of the COVID-19 relief effort not to count against limits on member business lending.

March 2 -

Trade groups are still pushing for the industry's priorities, such as temporarily lifting the member business lending cap, as negotiations over the next round of aid continue.

August 10 -

Along with the assets-under-management milestone, Michigan Business Connection noted that its partner credit unions have financed more than 1,000 Paycheck Protection Program loans.

August 4 -

A letter from the National Taxpayers Union requested changes, such as requiring federal credit unions to fill out a certain IRS form for non-profits, before lawmakers considered easing member business lending limits.

July 22 -

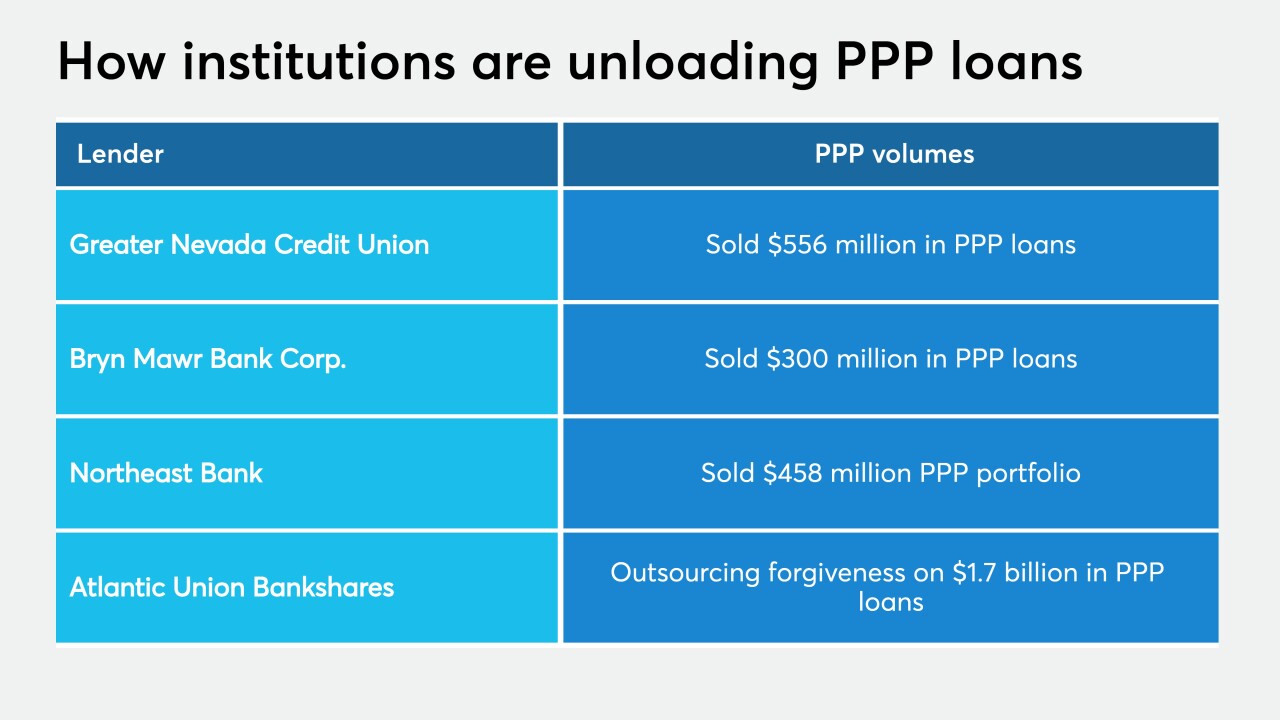

A growing number of lenders are unloading loans made through the Paycheck Protection Program.

July 15 -

For all banks' claims that credit unions pose a threat to their commercial lending market share, they've accounted for just 2% of volume in the Paycheck Protection Program.

July 13 -

Small businesses have been hard hit by the pandemic, meaning commercial lenders are considering how they can better manage risk in this portfolio and make other changes to help.

July 6 -

National Credit Union Administration Chairman Rodney Hood told a NAFCU audience now is the time to take action on the member business lending cap so credit unions can continue to help with the coronavirus recovery.

June 25 -

The industry granted about 21% of these loan applications after three months of record lows.

June 9 -

Bankers call credit unions’ latest efforts to ease limits on member business lending opportunistic. Credit unions say they're trying to help with the recovery effort.

May 18 -

The Independent Community Bankers of America would not rule out legal action if Congress doesn't address the National Credit Union Administration's recent decision expanding the low-income designation.

May 13 -

Rodney Hood, chairman of the National Credit Union Administration, will testify before the Senate Banking Committee about how the regulator and the industry have responded to the coronavirus pandemic.

May 11 -

A letter from Todd Harper, a member of the National Credit Union Administration board, called on lawmakers to make a variety of legislative changes to help credit unions and consumers weather the pandemic.

May 5 -

Bank trade groups from all 50 states have called on Congress not to lift restrictions on member business lending under the guise of aiding with coronavirus relief efforts.

April 23 -

Congress won’t be back to Washington for at least two weeks but credit unions already have a laundry list of requests for lawmakers to consider.

April 20 -

Legislation announced Wednesday would allow credit unions to make coronavirus relief loans to businesses without fear of bumping up against the member business lending cap.

April 16 -

Member business loans have been on a roller coaster over the last year and as the pandemic impacts the economy, executives will need to closely monitor these portfolios to catch any problematic credits.

March 24 -

Member business lending growth has fluctuated in recent years but growth overall is slowing even as balances continue to rise. The long run of success could prove to be a problem when the economy finally turns south.

November 14 -

A similar bill was introduced into the House earlier this year and both pieces of legislation have have bipartisan support.

November 13 -

The Unity, Maine-based institution, which should open in the fall, will provide member business loans and other products to local farmers.

August 23