-

As government officials reconsider how best to wind down large financial institutions, they should ensure the banking agencies have flexibility to act without disrupting markets.

March 9

-

Banking and affordable housing advocates are encouraged by a provision in the tax reform legislation that could increase investment in underserved communities by allowing investors to defer capital gains taxes when they reinvest in federally chartered Opportunity Funds.

March 6 -

A top Treasury Department official on Monday said the administration's forthcoming report on regulating nonbanks will tackle questions around financial technology companies and whether they need to be regulated more like banks.

March 5 -

As Congress considers new rules for digital currencies, lawmakers should consider putting responsibility in the hands of the Treasury Department, given its role in handling traditional currency.

February 28

-

A recent report from the agency settles a long-running debate about whether bankruptcy should replace Dodd-Frank’s “orderly liquidation authority.” The financial system needs both.

February 28 Brookings Institution

Brookings Institution -

It’s unlikely a new chapter of the bankruptcy code for banks would be used in times of crisis or strengthen market discipline.

February 23 Georgetown University

Georgetown University -

The Treasury Department struck a middle ground in recommendations for Dodd-Frank Act wind-down powers, resisting calls to repeal those powers but still addressing concerns that they are too generous to large firms.

February 21 -

The Trump administration on Wednesday refrained from proposing the elimination of authority to clean up failed financial behemoths, but the Treasury Department still wants substantial reforms to the resolution powers.

February 21 -

The Supreme Court dealt hedge funds and other big investors a blow Tuesday by refusing to revive core parts of lawsuits that challenged the federal government’s capture of billions of dollars in profits generated by Fannie Mae and Freddie Mac.

February 20 -

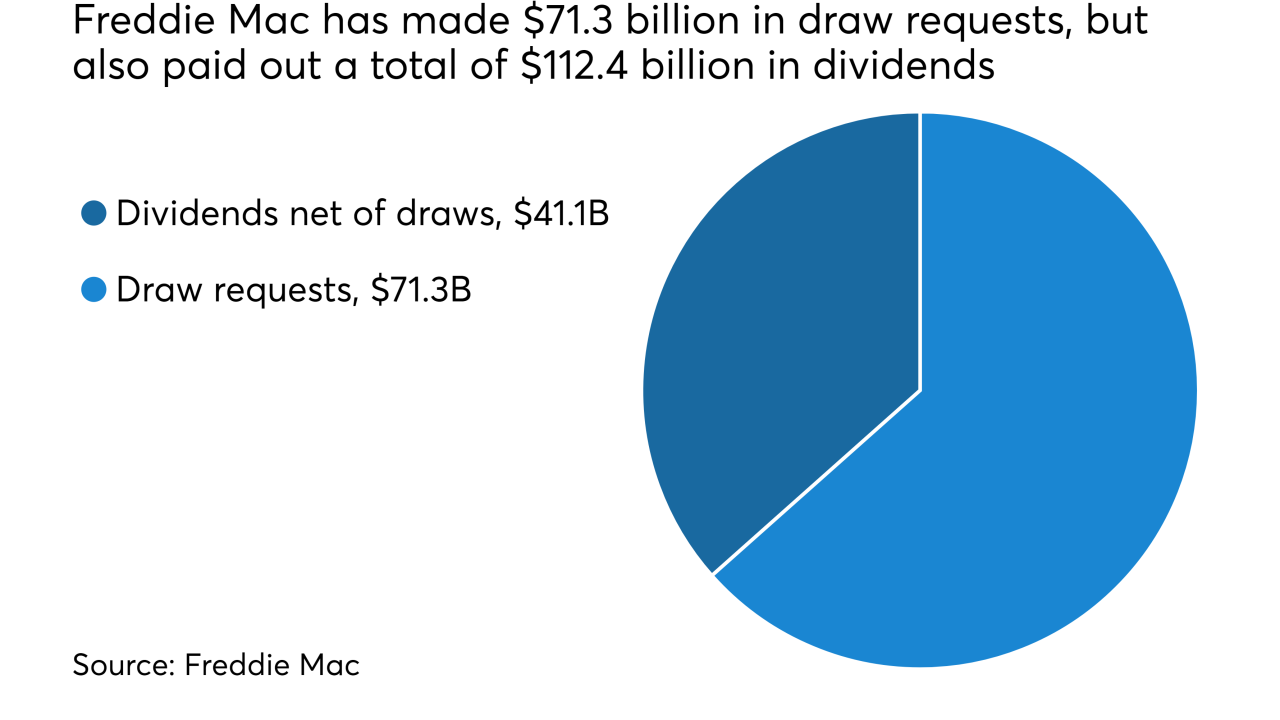

Freddie Mac posted a fourth-quarter net loss of $3.3 billion and will request $312 million from the Treasury after recent tax reform legislation forced it to write down the value of deferred tax assets.

February 15 -

Tax reform caused Fannie Mae to burn through retained earnings that had been approved just two months ago and to post a fourth-quarter loss. CEO Timothy Mayopoulos argued it was a one-time event that overshadowed strong fundamentals.

February 14 -

More than one-third of the Office of Financial Research’s staff could soon be laid off, but the agency seems to lack the political clout needed to block the move.

February 8 American Banker

American Banker -

As conservator, FHFA Director Mel Watt has substantial leeway to remake the government-sponsored enterprises without congressional input. Here's one way he might do so.

February 7 -

Problems with the IRS-managed Income Verification Express System, or IVES, have stoked concerns about delayed mortgage closings when volume picks up this spring.

February 2 -

The government must continue to provide support for the mortgage market in any new housing finance system, Treasury Secretary Steven Mnuchin said Tuesday.

January 30 -

The Financial Stability Oversight Council should ignore two recent Treasury Department recommendations regarding the labeling of systemically risky nonbanks.

January 29 Center for American Progress

Center for American Progress -

Financial firms have mostly shrugged off the government's budget woes, but Washington's gridlock might pose a bigger risk than they think.

January 22 -

Attorney General Jeff Sessions did not keep the rest of Washington apprised of his plan to rescind an Obama-era memo on pot. Now Fincen and other federal banking agencies are dealing with the backlash from that decision.

January 18 -

Craig Phillips, a top aide to Treasury Secretary Steven Mnuchin, said his department "broadly" agrees with the FHFA plan, which would return Fannie Mae and Freddie Mac to the private market and provide them an explicit government guarantee.

January 18 -

Treasury Secretary Steven Mnuchin on Friday warned traders and firms offering services related to cryptocurrencies like bitcoin that anti-money-laundering and know-your-customer rules apply to them — and regulators are watching closely.

January 12