-

Catch up on a deluge of sexual harassment disclosures from banks and regulators. Brace yourself — it gets ugly, with rape and strangulation among the lowlights. Then marvel at how one fintech CEO who fell early in the #MeToo era engineered a fast comeback. Plus valuable insight on anger.

August 1

-

The bank entangled in probe of Michael Cohen; Mayopoulos to leave at yearend, CFO Benson to become president.

July 24 -

Financial institutions are beginning to get on board with the global fight against climate change, but they are still trailing pension funds and insurance companies in putting these concerns into action.

July 11 -

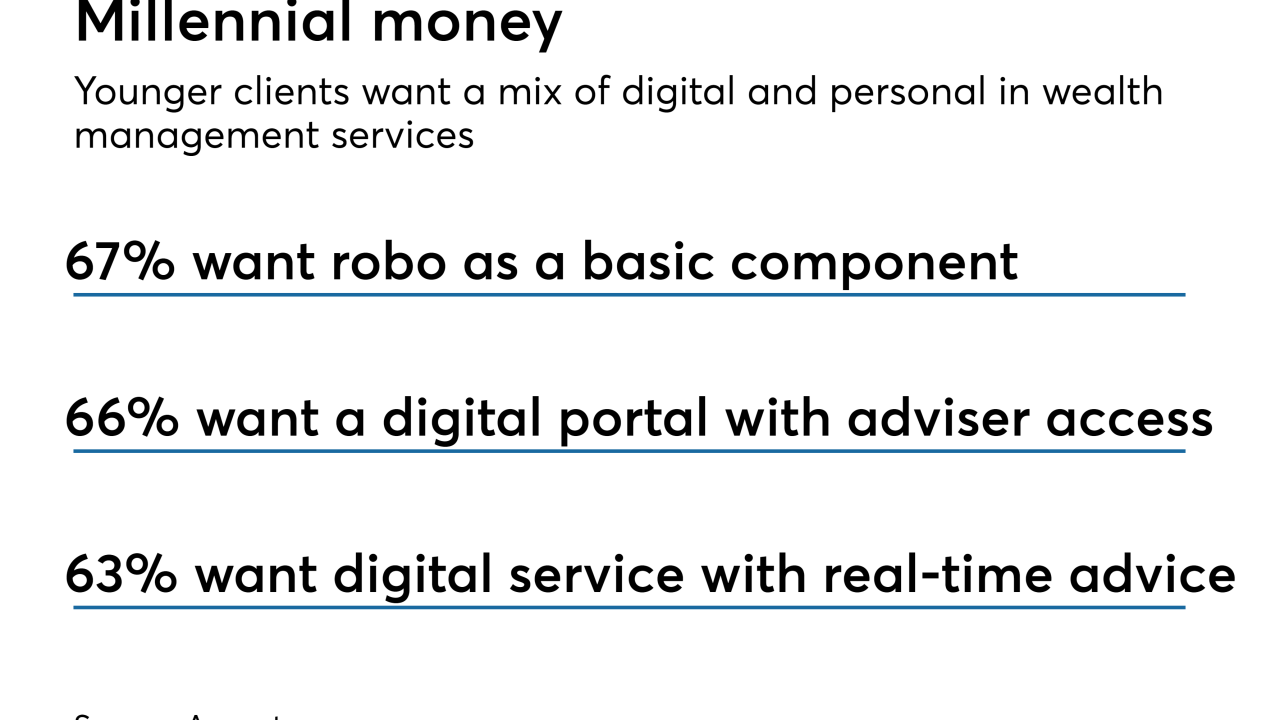

Needs of wealthy clients are "a lot more complex," says Kraleigh Woodford, managing director and head of digital client experience at UBS Wealth Management.

July 10 -

In an investor-backed power play, the robo tech firm wants banks to turn to it instead of traditional core software providers as they upgrade to digital-banking-friendly technology.

June 19 -

SigFig was among an early crop of digital advice firms that shifted their focus to serving wealth managers and banks. It has raised more than $100 million from a variety of investors.

June 19 -

Deputy Attorney General Rod Rosenstein thinks some companies are overpaying for their crimes, and he wants that to stop.

May 9 -

The banks contend distributed ledger technology (DLT) makes it easier to coordinate trade finance deals. And the use of smart contracts can help parties comply with contractual obligations such as staged payments.

May 9 -

John Chiang says the bank “reeks of betrayal” a day before the bank’s annual meeting; the former chair of the CFTC has doubts about cryptocurrencies.

April 24 -

BMO Wealth Management aims to modernize its investment service and give advisers better equipment. Others offering automated advice solutions include UBS, Wells Fargo and JPMorgan.

April 6 -

The holding company for Union Bank — itself a unit of the Japanese giant Mitsubishi UFJ Financial Group — is on a mission to double its size and become one of the nation's 10 largest banks. Under Steve Cummings, its first-ever American CEO, MUFG Americas has expanded middle-market lending and amassed $3 billion of consumer deposits through its new online bank. Is a splashy acquisition next?

March 26 -

UBS agreed to pay $230 million to resolve a New York state probe into the Swiss bank's marketing and sales of residential mortgage-backed securities before the financial crisis, boosting the state's recoveries in the investigation to almost $4 billion.

March 21 -

Anthony Noto may be SoFi’s next CEO; manager is quietly let go following an internal investigation into alleged sexual misconduct.

January 22 -

The Protocol for Broker Recruiting, signed in 2004, was designed to mitigate lawsuits when advisers left to join a competitor. Recent high-profile defections have raised concerns that the accord could unravel.

December 29 -

Former top commercial mortgage-backed securities strategist Trevor Murray accused the Swiss lender of illegally firing him in 2012 for blowing the whistle on attempts by traders to influence his research reports.

December 22 -

Rather than forming a consortium of peers to investigate blockchain technology, as many banks have done, one of the world's largest asset managers is acting on its own.

December 12 -

Jelena McWilliams, Fifth Third Bancorp’s chief legal officer, is the choice for FDIC chair; digital currencies pose too many risks.

December 1 -

A community bank gets taken to task by the Equal Employment Opportunity Commission. Tennis player Andy Murray makes his mom — and lots of other women — proud at Wimbledon. Also, the Bank of England's Charlotte Hogg and Morgan Stanley's Naureen Hassan.

July 13

-

When the U.S. withdrew from the Paris Agreement, business leaders across the country called on the private sector to step up their own efforts to reduce greenhouse gas emissions and ultimately limit global warming to 2 degrees Celsius. From new corporate governance practices to energy efficient upgrades, here’s a look at some of the ways the banking sector is combating climate change.

July 11 -

Regulator now has recovered nearly $4.8 billion in various suits related to the mortgage meltdown in 2008.

May 1