U.S. Bancorp

U.S. Bancorp

U.S. Bancorp with nearly 70000 employees and $554 billion in assets as of December 31 2020 is the parent company of U.S. Bank National Association the fifth-largest commercial bank in the United States. The Minneapolis-based bank blends its relationship teams branches and ATM network with digital tools that allow customers to bank when where and how they prefer.

-

Big-bank execs downplayed gloomy economic forecasts and said a commercial lending rally, niche M&A and smart tech spending will drive growth in 2019.

December 4 -

Quicken and U.S. Bank are launching a co-branded contactless credit card that will integrate with Quicken's personal finance software and mobile app.

November 29 -

The card is being launched in partnership with U.S. Bancorp, which will handle the underwriting and provide the credit.

November 28 -

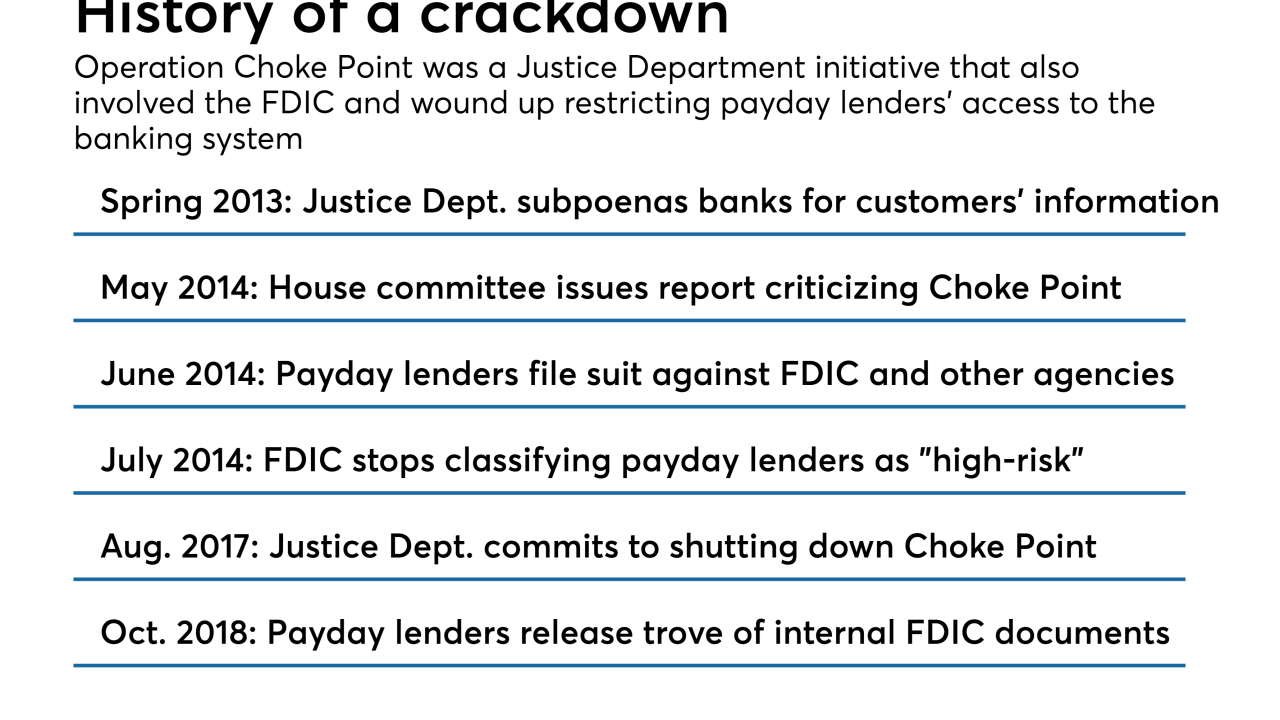

Payday lenders argue that banks cut ties with their industry due to pressure from biased and hostile regulators. But the reality, in some cases, may be more nuanced.

November 16 -

Berkshire Hathaway plowed $13 billion into bank stocks in the third quarter that included new investments in JPMorgan and PNC and additional investments in Bank of America and Goldman Sachs.

November 15 -

Payday lenders argue that banks cut ties with their industry due to pressure from biased and hostile regulators. But the reality, in some cases, may be more nuanced.

November 8 -

Wells Fargo puts two top execs on leave as scandal's reach grows; regional banks freed from SIFI label lobbying regulators hard for more relief; FDIC to launch innovation office to help banks compete with fintechs; and more from this week's most-read stories.

October 26 -

The Minneapolis company said in an email to American Banker that it would reduce its headcount by approximately 1%, or about 740 positions, across the company.

October 24 -

The appointment comes nearly two years after Davis said he was stepping down from the Minneapolis bank to pursue "another calling."

October 17 -

Executives are reluctant to pull back on their big investments in technology, arguing they must stay competitive and that they have flexibility in other areas to trim costs if growth begins to stagnate.

October 17 -

The Minneapolis company, which reported strong profits but 1% loan growth, is hiring middle-market bankers in New York and launching a digital lending platform aimed at small businesses.

October 17 -

The two megabanks face different problems, as Bank of America customers are frustrated over fees and customer service while Wells customers are alarmed about the bank's recent scandals.

October 10 -

Big banks are expected to report that commercial lending weakened in the third quarter thanks to tax cuts, nonbank competition and seasonal factors. It raises questions about whether the second-quarter rally was an anomaly and if an overall economic slowdown is edging closer.

October 9 -

The nation's largest bank overtook PNC Bank to snag the top spot in an annual study that evaluates satisfaction levels at the nation's six largest retail banks.

September 27 -

The mass retirement of baby boomers and the growing affluence of women are the biggest disruptive forces in the industry, says Gunjan Kedia. Here's how she's dealing with them.

September 24 -

In five years, Moy has built from scratch a thriving business unit that is focused solely on developing easy-to-use, customer-facing technology for U.S. Bancorp's wealth management clients.

September 24 -

Gunjan Kedia left a big job at State Street for an opportunity to have more direct impact on the lives of individual investors.

September 23 -

The Minneapolis bank is betting that it has the heft — and the brand recognition — to compete for deposits in states where its biggest rivals already dominate.

September 13 -

The nation's fifth-largest bank on Monday rolled out a three-month consumer loan that is far less expensive than the typical payday loan. The move comes as regulators are encouraging banks to reach out to the subprime market, which they largely abandoned.

September 10 -

Just before the end of summer, several major banks have put new faces in key executive positions.

September 6