Wells Fargo

Wells Fargo

Wells Fargo is one of the largest banks in the United States, with approximately $1.9 trillion in balance sheet assets. The company is split into four primary segments: consumer banking, commercial banking, corporate and investment banking, and wealth and investment management.

-

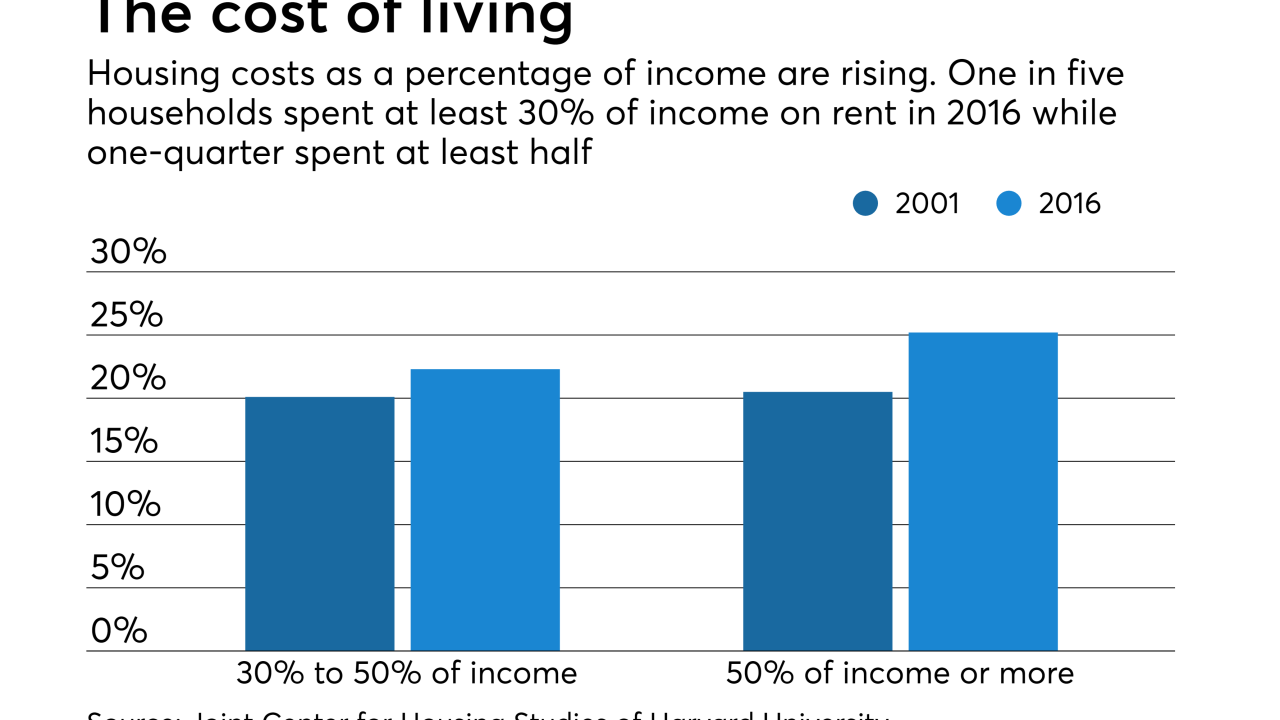

Advocates are seeking more federal funding for affordable housing. A federal investigation into the banks’ alleged manipulation of a popular tax-credit program can’t be helping their cause.

September 18 -

Speaking at an investor conference in New York, John Shrewsberry addressed a recent media report saying regulators had rejected Wells Fargo’s restitution plan for overcharged auto customers.

September 14 -

Four lenders, led by Sallie Mae, have long dominated the market for private student loans. But they could soon face new competition from Navient and Nelnet.

September 13 -

Delinquencies have held steady for a year, and observers are optimistic about upcoming third-quarter data. But the long-term question is whether solid underwriting can overcome higher vehicle prices and consumer debt burdens.

September 7 -

Agency’s first supervisory report under Mulvaney finds little change; the nonbank lender surpasses Citigroup and Bank of America in home loans.

September 7 -

Credit unions historically have focused on laws that directly pertain to them, but in a break with that tradition, NAFCU is calling on Congress to reintroduce efforts to break up big banks.

September 6 -

Investigators have sought more information from the bank in recent weeks about whether management pressured workers to improperly change documents in order to meet a regulatory deadline, according to a news report.

September 6 -

Just before the end of summer, several major banks have put new faces in key executive positions.

September 6 -

Wells Fargo said it thoroughly investigates all complaints of impropriety, after a report said the company is failing to treat some of its female employees fairly.

August 31 -

Women managers in the Well Fargo’s wealth management division say they are being passed up for promotions; TD Bank's U.S. retail division saw profit jump 27% in fiscal Q3.

August 31