Wells Fargo

Wells Fargo

Wells Fargo is one of the largest banks in the United States, with approximately $1.9 trillion in balance sheet assets. The company is split into four primary segments: consumer banking, commercial banking, corporate and investment banking, and wealth and investment management.

-

The remote deposit capture tech at the center of the dispute is used by 6,500 institutions. That may mean other institutions will have to pay licensing fees to USAA.

November 18 -

The FDIC and the Fed have yet to sign on to the plan; this year’s managing director class includes fewer overall, but a higher percentage are women.

November 15 -

Allen Parker, who led Wells Fargo during its six-month search for a new chief executive, will leave the bank next year.

November 14 -

Tech giant takes will work with Citi; the bank reportedly asked IT providers to return some of the money it paid them in 2018.

November 13 -

The two previously worked at BNY Mellon in similar roles, Scharf as CEO and Daley as head of public affairs; Michael Johnson’s demotion follows the bank’s massive data breach in July.

November 8 -

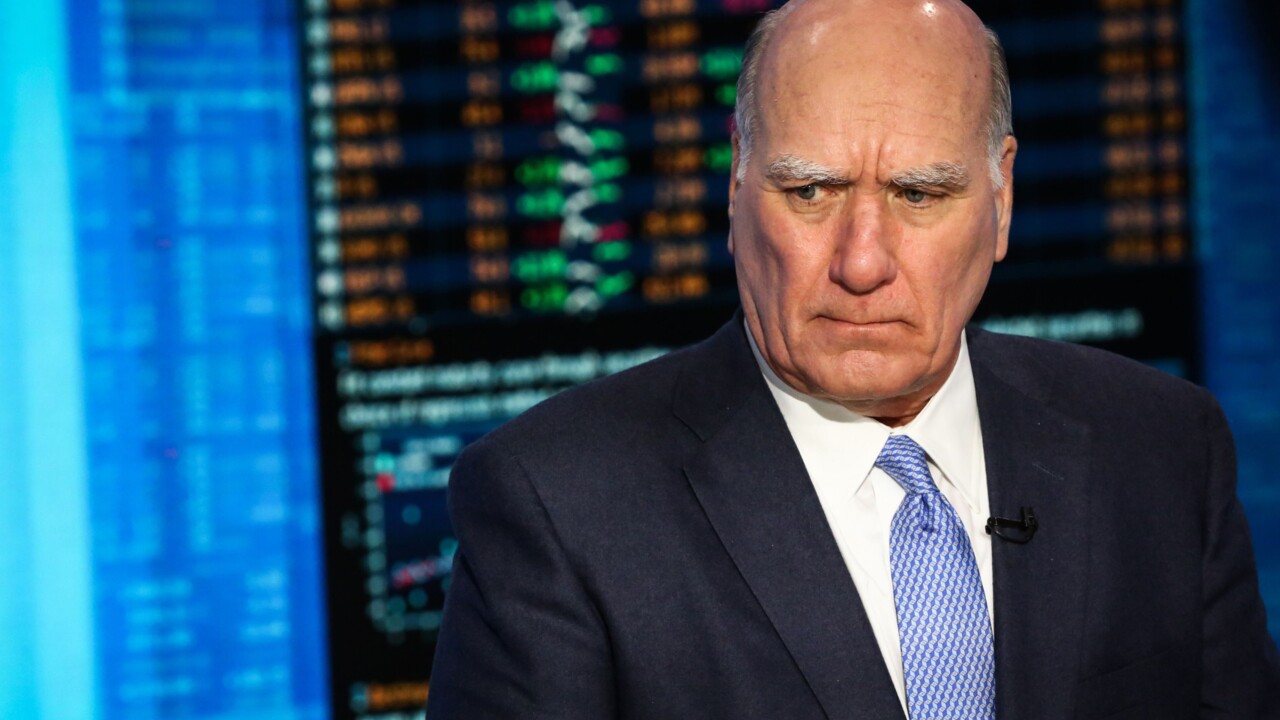

Chief Executive Officer Charlie Scharf plans to name Bill Daley, the former White House chief of staff, to a senior post to improve relations with authorities in Washington, according to people with knowledge of the plan.

November 7 -

Top officials at Bank of America and Wells Fargo said that commercial loan demand is weak, even as U.S. consumers show strength. Their comments echo recent findings by the Federal Reserve.

November 5 -

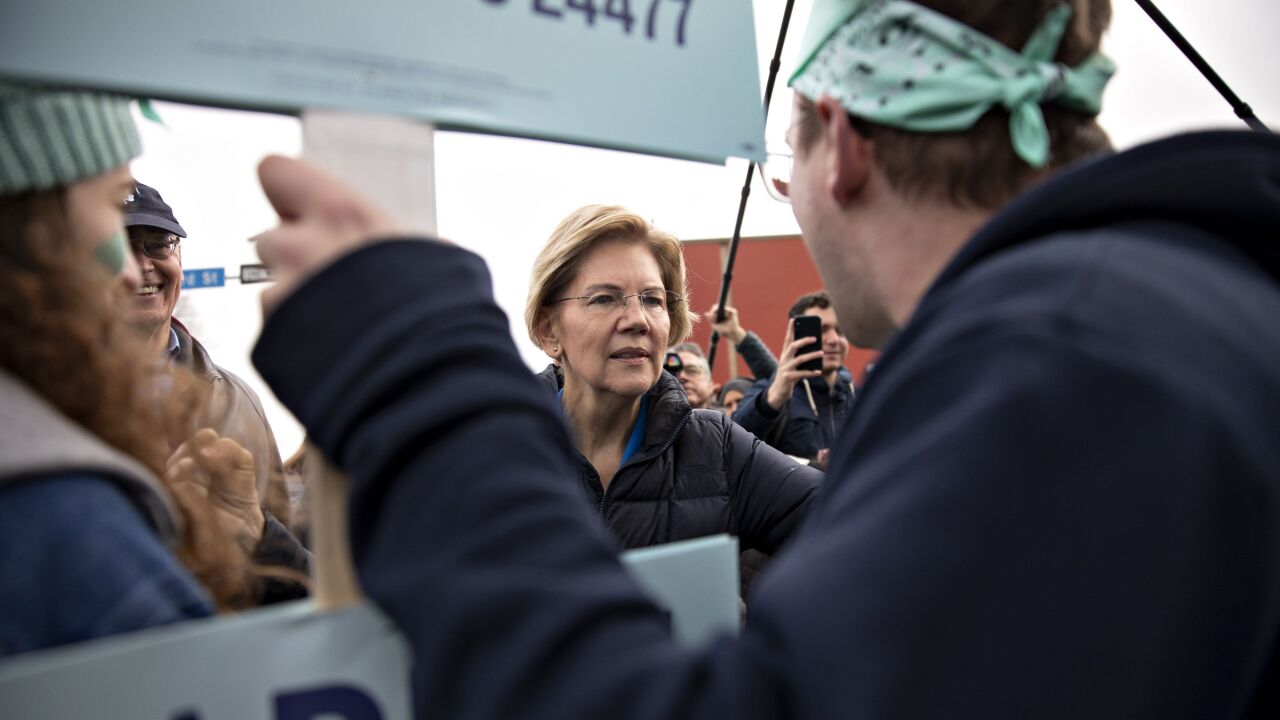

If elected president, Sen. Elizabeth Warren would charge large banks a fee to help pay for her Medicare-for-all plan.

November 4 -

CEO tells employees he wants them to be 'impatient' in fixing the bank’s woes; the new independent body would police banks’ compliance with AML regulations.

November 1 -

Rep. Ayanna Pressley, D-Mass., has proposed requiring annual testimony by the heads of the U.S. "global systemically important" banks.

October 31 -

The new CEO is the first outsider to head the scandal-ridden bank in decades; Facebook CEO faces the House Financial Services Committee on Wednesday to discuss Libra.

October 22 -

The legislation, sponsored by Rep. Cindy Axne of Iowa, aims to hold public companies accountable for moving jobs overseas. It won unanimous support from House Democrats but attracted only two votes from Republicans.

October 18 -

While demand is strong and loan performance generally remains solid, the prevalence of longer loan terms has sparked concern that losses will eventually spike.

October 16 -

They’ve long used their marketing muscle to wrest deposit share from smaller competitors. Now, amid growing concerns that the economy is weakening, they could be benefiting from consumers’ flight to safety.

October 16 -

Third quarter profits at JPM, Wells Fargo and Citigroup got a boost from consumer banking; the company tells Fed it will remain a passive investor.

October 16 -

Perhaps the biggest test that Charles Scharf will face when he starts next week will be how to control expenses while still trying to make the necessary investments in risk management to satisfy regulators.

October 15 -

Investors got a reminder that the bank isn’t past its problems even as it seeks a fresh start under a new leader.

October 15 -

Large banks will have less onerous capital rules and stress test requirements; the president’s main lender said it has other returns, but not the president’s.

October 11 -

Rather than homing in on specific methods to accommodate real-time payment processing, Wells Fargo realized a mix is the best bet to avoid inadvertently leaving parts of its client base in the dark.

October 8 -

The ‘Unsinkable Cathy Bessant’; Thasunda Duckett’s rising star takes center stage; the challenges facing Wells Fargo chief Charles Scharf; Fannie, Freddie to retain $45B in capital; and more from this week’s most-read stories.

October 4